|

|

Asia & the Age of High Throughput PrideSats

Oct 9th, 2017 by

Blaine Curcio, NSR

The Asian satellite telecom market has for some time been relatively

fragmented. Several countries with comparatively small populations, or

comparatively small economies, or both, have launched their own

satellites, with these programs having varying levels of commercial

motivation. However, due to spectrum rights and legacy of the Big Four,

among others, these national players have historically represented a

relatively small piece of overall capacity supply in the region.

Moving forward, however, this will change. As discussed in NSR’s

Global Satellite Capacity Supply & Demand, 14th Edition,

APAC in particular finds itself on the cusp of a sizeable increase in

the number of nationally-owned satellites, which, in the age of closing

of markets and increasing nationalism, could cause increased

challenges for foreign operators attempting to enter fast-growing Asian

markets.

Recent Impacts on Supply

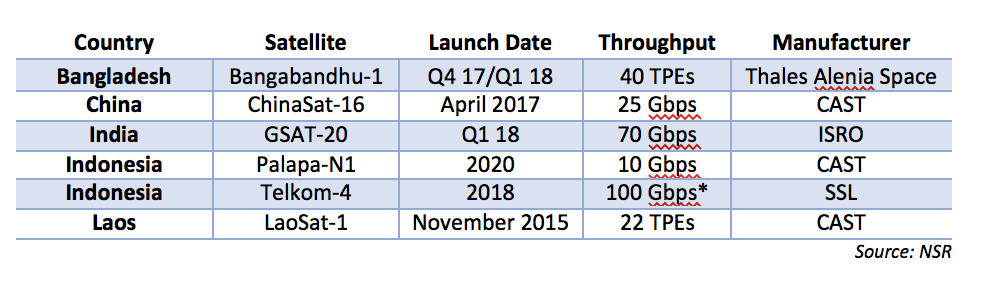

Overall, 2017 has been, and 2018-2020 will be crucial years for the

advancements of several countries’ national space programs. A growing

number of countries are procuring their own satellites, either through

national governments or through telcos that are themselves owned by

governmental agencies. The coming few years will see satellites launched

for IndoSat and PT Telkom in Indonesia (the state owns large stakes in

both companies, though in the case of IndoSat, the government of Qatar

maintains the largest stake) and the government of Bangladesh. Beyond

this, China and India have been rapidly developing capabilities to

manufacture HTS indigenously, with ChinaSat-16 having been launched in

early 2017, and GSAT-20 to be launched next year.

The ability of China and India to manufacture HTS is expected to have

implications beyond these two countries. In an age of increasing

nationalism and rising impetus for countries to be “self-sufficient”,

particularly in key industries such as telecoms and national security,

the ability to procure satellites that can address broadband/backhaul

requirements becomes increasingly attractive.

The Impact on Demand

Despite a potential avalanche of HTS supply coming into the market,

this does not necessarily spell the end for commercial operators

in the region. Up to this point, larger amounts of capacity in

Asia have meant highly elastic demand. Indeed, operators such as O3b

(now a part of SES Networks) have seen Gbps of demand coming from APAC

in verticals such as backhaul.

Moving forward, NSR expects the above-mentioned satellite programs—in

particular those procured by Telkom and IndoSat—to be integrated into

wireless networks. Ultimately, it could be a net benefit that

telcos are procuring HTS—since this will, almost by definition,

force the hand of these telcos to adapt their technological development

towards integrating HTS capacity into their backhaul networks. With this

in mind, operators trying to address these verticals are likely to see

spillover demand from telcos that are filling gaps in their wireless

networks with existing capacity.

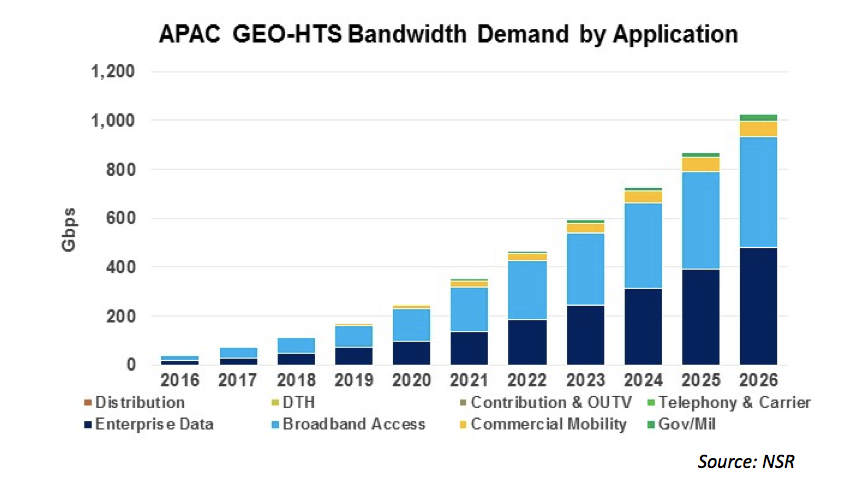

NSR expects total GEO-HTS demand in APAC to exceed 1 Tbps by 2026,

with the majority of demand being driven by enterprise data (of which

the largest component is cellular backhaul) and consumer broadband.

Despite capacity being sold at a significantly lower price point due to

more purchases in bulk, NSR sees total APAC GEO-HTS revenues rising to

nearly $4 billion annually by 2026, with broadband access and enterprise

data representing around $1.5 billion each. Recently, the business case

for consumer broadband in middle-income markets has been, to an extent,

validated by players such as Hughes in Brazil, which has seen ~70,000

subscriber additions within the first year of operations. Moving

forward, as more HTS capacity is launched over APAC, the region’s

upper-middle class is expected to provide a significant opportunity for

consumer broadband services.

Another market of note includes commercial mobility. Driven by

in-flight connectivity, the market is expected to grow to ~$600M in

annual revenues by 2026. A recent forecast by Boeing for airplane demand

in the Chinese market indicated that airplane demand expectations have

increased over the past year, and the expectation remains that air

travel in APAC will continue to flourish over the coming decade. Despite

regulatory hurdles to be overcome in some markets (India, China), it is

seen as a matter of when, rather than if, the IFC market sees an

explosion in demand in APAC. In particular, commercial mobility/IFC are

not expected to be as addressable by the above-mentioned national

satellite programs, due to the fact that these satellites tend to be

country-focused or at best, regional-focused, whereas mobility demands

tend to be more global, or at least multi-regional in nature.

Bottom Line

The next several years will see an increase in domestic

satellite programs in APAC. The region’s three most populous

countries—China, India, and Indonesia- are leading a charge of procuring

satellites for domestic companies to address domestic demand, and this

is expected to make life more difficult for foreign operators in these

countries.

However, as more supply comes online and is integrated into telco

networks, NSR expects the general applicability of satellite for

several demand verticals to increase. One of the main

challenges for satellite today is educating end consumers that the price

of capacity is no longer necessarily prohibitively expensive, and by

having telcos launch their own HTS payloads, it is expected that

satellite will see a bigger role to play in the greater telco

infrastructure in APAC.

-

|

|