|

X-(Band) Marks the Spot in Asia-Pacific

Feb 2nd, 2017 by

Brad Grady, NSR

On the footsteps of the successful launch of Japan’s DCN-2

satellite with its X-band payload (Japan’s first dedicated MILSATCOM

satellite), a new resurgence of MILSATCOM capabilities is on the

horizon. While NSR already covered some of the challenges

in larger proprietary military satellite constellation replenishments

such as “WGS 2.0” and “Skynet 6”,

new ‘players’ are entering the market looking to provide their own

capabilities.

Japan’s DCN program is one such example of nation-states

looking to provide their own capabilities. While the DCN

program uses a Public Finance Initiative (PFI) model in the same vein as

the UK’s Airbus D&S owned and operated Skynet-5 constellation, the

primary customer for the DCN program is the Japanese Self Defense

Forces. Focused on delivering capacity over the Asia-Pacific

and Indian Ocean regions (where Japanese Forces operate the most),

the capacity will help provide additional throughput in an

increasingly tense region. Just as China is expanding

their ‘blue water’ operations in the South China Sea, increasing force

projection capabilities through their new aircraft carrier, building new

relationships with traditional U.S.-allies such as the Philippines, and

on-going tensions between the U.S.-China – a serious question should be

on the minds of all players in the military and government satellite

markets: Are we finally going to see a ‘pivot to Asia’?

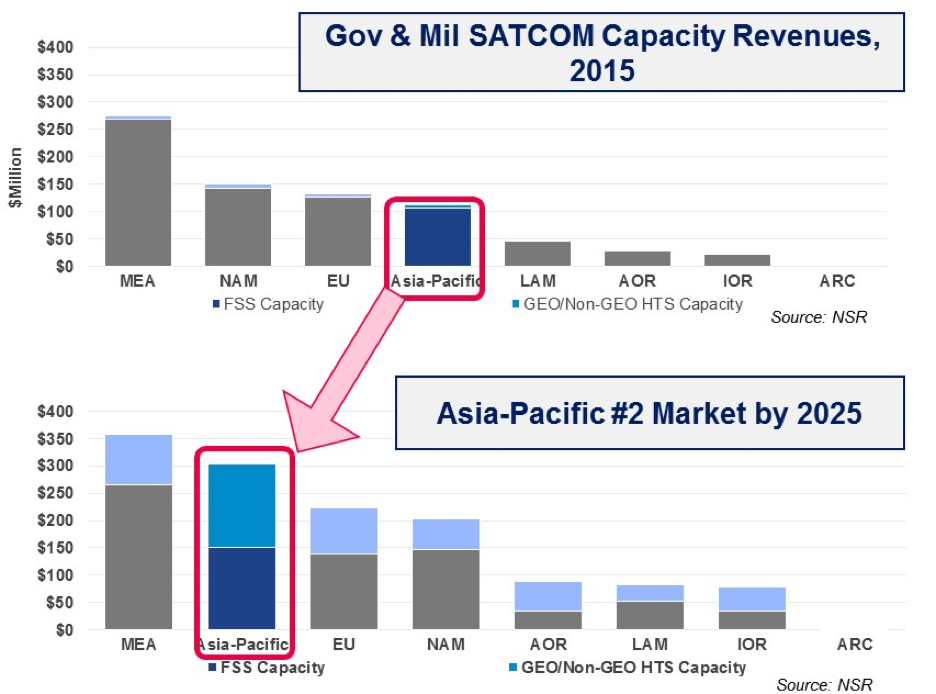

The “short answer” is that the Middle East & Africa will

remain a core-market for the vast majority of military and

government satellite communications demand, and the most significant

source for capacity revenues from 2015 – 2025.

According to NSR’s Government and Military Satellite

Communications, 13th Edition, despite changing dynamics

on the ground – from troop draw-downs to changing capacity pricing – the

Middle East & Africa generated almost $275 Million in capacity revenues

in 2015, and will increase to $360 Million annually by 2025. Yet,

the growth story for capacity revenues from Gov & Mil markets will be

within Asia-Pacific.

Looking at Asia-Pacific, capacity revenues between 2015 – 2025 will

increase by more than $190M – greater than both Europe and Middle East &

Africa. Why do we see such growth from Asia-Pacific?

Just as we have seen with the Japanese launch of the DSN

dedicated military satcom system, ongoing and increasing tension within

the region is spurring the deployment of airborne, maritime, and other

Gov & Mil assets into the region. Driven by the need for ISR and

C2-type applications, which capacities and which markets will help drive

growth in Asia Pacific?

For FSS capacity, X-band will be the ‘growth story’ for

Asia-Pacific, with bulk leasing applications – where

governments lease ‘raw capacity’ to support their own networks – leading

the charge for growth. The growth comes at the expense of a

shifting preference from FSS C-band capacity and FSS Ku-band capacity

towards HTS, FSS Ka-band, and FSS X-band. As more focus is given

towards operating in a ‘contested’ environment and allied

interoperability, FSS X-band represents a strong value

proposition within Asia-Pacific.

Just as nation-States invest in increasing X-band capacity in the

region like Japan’s DSN, the system joins other X-band capacity from the

UK’s Skynet and the USA’s WGS constellations. Although within the

Gov & Mil FSS markets there is a clear growth story for X-band, the

impact from GEO and Non-GEO HTS is not to be underestimated.

With a net-growth of almost 28 Gbps from HTS capacity between 2015 –

2025, HTS capacity revenues and FSS Capacity revenues will be

nearly equal by 2025. Unlike the FSS X-band story where

bulk leasing plays a significant role, HTS capacity demand comes from

managed services – providing ‘end-to-end’ networks to maritime, UAS and

manned aero platforms operating within the region. With 9 Gbps of

demand on GEO-HTS Ka-band capacity, of which some will use terminals

that are compatible with other military systems such as WGS,

there is a clear sign that designing commercial systems to work

alongside proprietary military systems is a winning combination.

Bottom Line

With compatibility with a growing number of proprietary military

satellite systems covering Asia-Pacific today and over the next ten

years, there is clear demand for designing and deploying systems

compatible with these networks. Although Ku-band in FSS and HTS for

Asia Pacific will be a significant source of capacity demand and

revenues, FSS X-band offers this compatibility, and it should be on the

spot for Asia-Pacific growth in the coming decade.

|