IFC in Asia:

A Market for the

Long-Haul

May 18th,

2015

by

Claude

Rousseau,

NSR

Facebook

Tweet

LinkedIn

Email

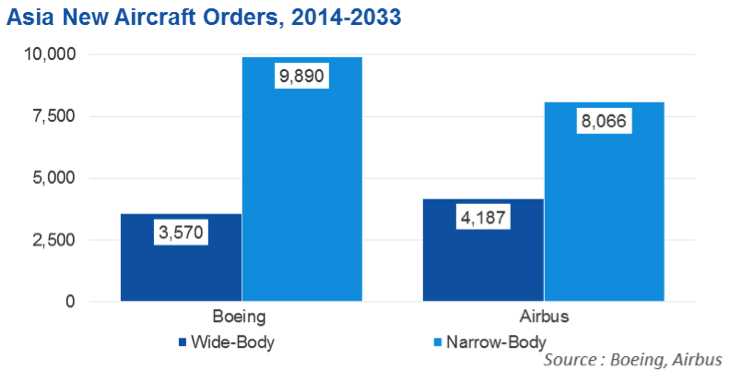

A few months ago,

both Boeing and

Airbus indicated

they raised their

forecast for new

aircraft deliveries

in large part due to

Asian orders.

It is no secret the

region is set to

become the biggest

market for

commercial passenger

aircraft as GDP

rises. The recent

Panasonic deal to

equip Xiamen

Airlines for its new

fleet of Boeing

B787s with

connectivity may

give a hint as to

what lies ahead for

IFC in Asia: more

in-flight

connectivity demand

for wide-body

airframes.

According to the

ICAO, Asia is

considered to hold

robust growth rates

in passenger traffic

despite the recent

woes of the Chinese

economy, with on

average more than

7.4% passenger

growth on commercial

aircraft in the next

three years.

Both Airbus and

Boeing are looking

much farther into

the future and

forecast approx.

12,800 aircraft will

be purchased by

Asian carriers by

2033, a total close

to 40% of global new

deliveries.

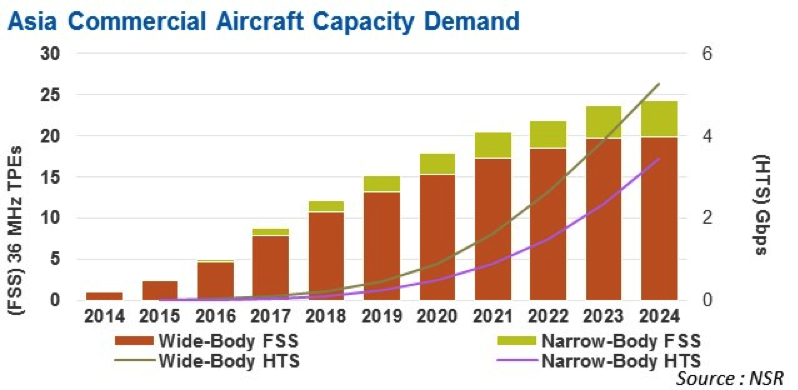

In its recently

released

Aeronautical Satcom

Markets, 3rd

Edition, NSR

forecasts the

Asia

addressable

commercial aircraft

market for satellite

connectivity will

reach more than

11,000 wide-body and

narrow-body planes

by the end of 2024.

This is not only

new aircraft, but it

is clear that by the

end of the next

decade, if only half

of the new

deliveries expected

from Airbus and

Boeing are made

(roughly 6,400 new

planes), it

is a prime market to

outfit with

connectivity right

on the production

line.

But what is more

important is the

majority of the

recent connectivity

deals in the region

(like the Panasonic

deal) have a

strong focus on

wide-body airframes:

China Eastern

Airlines, Garuda

Indonesia, JAL,

Singapore Airlines,

ANA, Cebu Pacific,

Philippine Airlines

are set to outfit

satcom services on

more than 250

wide-bodies, many of

them new aircraft

like the one for

Xiamen. And if we

look at their

connectivity

requirements,

long-haul

flights on wide-body

airframes is where

most of the demand

will originate even

if they represent a

smaller number of

airframes.

According to both

aircraft

manufacturers, the

majority of airline

traffic growth in

Asia is set to take

place inside

China,

which is not

optimal for the

deployment of costly

satellite services

by airlines,

compared to longer

duration flights.

Boeing even stated

in their forecast

that “approximately

65% of growth will

be within China”.

Airbus goes even

farther stating that

“nearly 80% of the

Chinese population

and economy is

within a range of

about 2,000 km”, or

about 2 hours of

flight, notably in

the Eastern part of

the country. As

such, they expect

domestic air travel

will be 60% larger

than the U.S. market

today.

This large growth

in numbers is

certainly enticing

but the flight

durations are not

because over the

same time horizon,

if we look only at

China’s growth in

traffic to Europe,

North America,

Africa and to other

Asian countries, it

is expected to see

on average a 7%

growth. And

this is the driver

for the Asian IFC

market, where the

wide-body is king

and represents

the main

target for

satellite-based

passenger

connectivity.

Bottom

Line

Even if the

volume of

narrow-body aircraft

to be delivered in

Asia in the next 20

years will outnumber

wide-bodies by a

factor of up to 3,

the flight patterns

in the region are

impacting in-flight

connectivity in a

different manner. As

passenger traffic

grows within but

also outside the

region,

satellite-based IFC

in Asia will

primarily grow from

passenger demand on

intercontinental

flights,

those where the main

airframes are

wide-body

aircraft.

And those are in for

the long-haul.