|

|

Southeast Asia

DTH: ASEAN to Behold

Sep 3rd, 2014

by

Alan Crisp, NSR

The Indian

DTH market justifiably

captures a hugely

disproportionate number

of headlines when

discussing ‘growth

drivers’ for

Direct-to-Home (DTH)

subscribers and

revenues. India recently

became the largest DTH

market in the world by

subscribers, and every

month it seems some

major press release or

development comes from

the subcontinent.

However, often what is

lost in all of this

excitement is the

relatively smaller, but

arguably even better

positioned, growth

market to India’s East –

Southeast Asia.

According

to NSR’s

Global Direct-to-Home

(DTH) Markets, 7th

Edition,

Southeast Asia is

readied for exceptional

DTH growth moving

forward for a number of

reasons.

Firstly, the total

addressable market, in

terms of TV households,

is expected to increase

by 36% to 2023,

with the region adding

50M new TV households.

These households will

come from

fast-developing

countries such as

Indonesia, Thailand,

Philippines, and Vietnam

– all of which have

higher per-capita GDPs

than India. This will

lead to higher ARPUs on

average than the

subcontinent moving

forward.

According

to a recent study by

Media Partners Asia,

India already has an 80%

Pay TV penetration rate,

amongst TV households.

By comparison,

Indonesia, the

Philippines, and

Thailand have

penetration rates of 9%,

11%, and 28%,

respectively.

Clearly, there is

significant room for

growth of Pay TV amongst

existing TV households

in Southeast Asia, which

will complement the

overall increase in Pay

TV households in the

region moving forward.

Looking at

the largest country by

far in the region –

Indonesia – DTH

platforms have seen

explosive subscriber

growth. For example,

Indovision, the largest

DTH platform in

Indonesia, has seen

subscribers

increase from

approximately 600,000 in

2009 to nearly 2.5

million in March 2014.

In addition, countries

like Indonesia, due to

geographical

limitations, have seen

DTH take a huge share of

the total Pay TV market

– 2013’s breakdown of

Pay TV is estimated to

be 84% for DTH, 13% for

cable, and 3% for IPTV

in Indonesia.

Similar

geographic tendencies

could lead to similar

breakdowns in countries

like the Philippines in

the medium-term as it

continues to develop.

This is especially the

case as fiber will

remain prohibitively

expensive to lay over a

country that contains

several thousand

islands. It should also

be noted that the

population of the

Philippines is expected

to cross 100M sometime

during 2014, if this has

not occurred already.

Therefore, when

combining Indonesia, the

Philippines, Vietnam,

and Thailand (all

emerging markets and all

with low Pay TV

penetration rates) one

is looking at a market

of over 500

million people.

Add in relatively

developed and high-ARPU

Malaysia, frontier

markets Myanmar, Laos,

and Cambodia, and cash

cow niches like

Australia and New

Zealand, and clearly

there is a real business

case to be made in the

DTH market of SEA.

Bottom Line

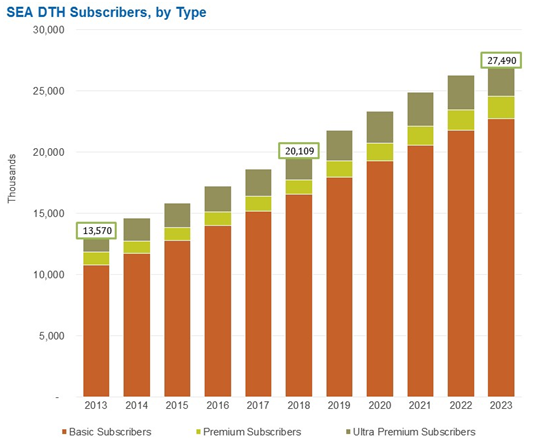

Bottom

Line, NSR expects DTH

subscribers in Southeast

Asia to increase at a

rate of over 7% to 2023,

more than doubling from

around 13.5M today to

around 27.5M by 2023.

Revenues will increase

from around $6.5B today

to $10.2B by 2023. While

its neighbor to the

west, South Asia, tends

to grab all the

headlines, Southeast

Asia remains an El

Dorado of sorts for the

DTH industry. With a

perfect storm of

geography, a huge

population with

increasing purchasing

power, and an

unquenchable thirst for

television content

powering the region to

the forefront of the DTH

growth picture to 2023

and beyond, all combined

this leads NSR to

classify the Southeast

Asian DTH market as a

region poised for solid

growth.

|

|

|