A Missing Piece in Asia’s

Wireless Backhaul Industry

Aug

8th, 2013 by

Jose

Del Rosario, NSR

In its recently launched Wireless

Backhaul via Satellite, 7th

Edition report, NSR found the largest

market potential unquestionably lies in

Asia; however, the private sector (i.e.

mobile service providers) have had

difficulty justifying rural area

investments due to narrow margins or

achieving profitable return on

investment (ROI). In essence, although

the market potential is huge for Asia,

ROI considerations have prevented the

potential from being fully realized.

Indeed, the entire satellite industry

has been hampered by ROI in provisioning

wireless backhaul services while

governments have mandated Universal

Service Obligations (USO) in order to

bridge the ever widening digital divide.

Basically, governments want to

equalize telecom services in rural and

urban areas, while the private sector

wants to profit from the government

initiative. Somehow there is

something missing in the equation.

Universal Service Funds (USF) may be

the answer. Indeed, the case of

Australia where the government issued a

request for proposal for a satellite

broadband program, could serve as an

example of how to best serve large

geographic areas, in particular those

not reached and likely will not be

reached by terrestrial technologies. NBN

Co Limited is the company established by

the government to design, build and

operate NBN, which will roll out the

network and sell wholesale capacity at a

uniform price to service providers, who

in turn, will offer retail services to

end users. The model is envisioned to be

applied for fixed broadband access, but

it could easily be applied to wireless

backhaul services as well.

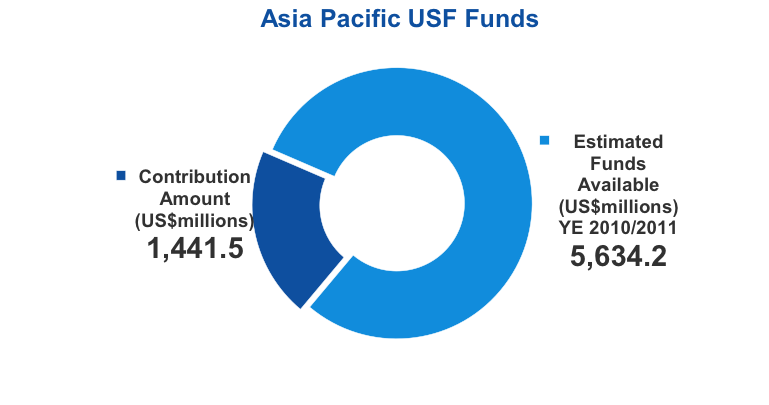

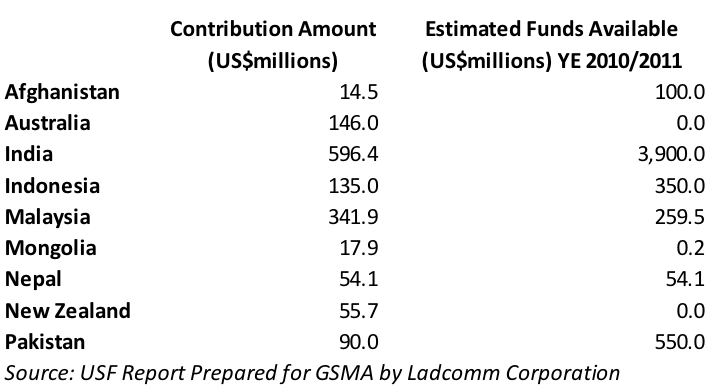

However, a recent report released by

the GSMA found that most USF remain

inefficient and ineffective. Of those

funds studied, many have not disbursed

any money (such as India, which has

accumulated $3.9 billion in unused

funds). In total, Asia has over

$5.6 billion in USF funds that are idle.

Australia (and New Zealand) noticeably

had $0 unused funds.

The problem is basically legal and

administrative rather than technological

or having much to do with basic ROI

metrics. The GSMA report found that the

underlying legal framework for many

funds were not well conceived from the

outset (e.g., not technology-neutral or

service-flexible, excessively

bureaucratic, insufficient oversight,

inadequate or ambiguous authorization to

manage the Fund) as well as

poorly-conceived legal frameworks.

In NSR’s report, the Asian market is

forecast to reach close to $500 million

by 2022 using a mix of technologies and

solutions, notably a shift from

traditional FSS to next-generation

systems such as HTS and MEO-HTS (O3b)

that offer better ROI. Indeed, the

entire forecast was based purely on a

sustainable ROI model where NSR believes

that private initiatives rather than

government programs will drive growth.

Yet, it is certainly worth taking a

close look at USF given that the Asian

market for 2012 based on NSR’s research

stood at a little over $200 million or

3.5% of the estimated funds available

via USF. India of course

influences the market significantly, but

taking out India’s $3.9 billion idle

funds still leaves more than $1.7

billion of unused USF. NSR’s 2012

estimated wireless backhaul satcom

market for Asia translates to just 11.5%

of the unused $1.7 billion USF.

Bottom Line

There is a large disconnect among

ROI, USO and USF considerations. For

USF, the problem primarily lies in

administrative and legal frameworks.

Governments of course need to resolve

these issues internally, and the

transparency laid out by the GSMA is a

step in the right direction in getting

the problem resolved.

On the satellite industry’s side, it

is already coming up with innovative and

cost-effective solutions to address ROI

considerations. However, it needs to do

more in terms of getting USF to be spent

on their technologies and services in

order to fulfil the large market

potential in the Asian region and other

key regions of the globe, notably Africa

and Latin America.

NSR does not have the answer in

addressing government inefficiency and

how the satellite industry can correct

this. However, it does see opportunities

on two fronts:

-

Funding: Governments are

beginning to dedicate funds for

broadband access services, which

could provide satellite service

providers with cost advantages over

terrestrial solutions and thus

enlarge the satellite market base;

-

Partnerships:

-

Satellite providers could

partner with wireless, wireline

or fixed wireless carriers to

develop a comprehensive

broadband service towards

fulfilling USO obligations;

-

Satellite providers can partner

with governments in establishing

entities ala-NBN Co for

provisioning broadband and

mobile access to remote and

underserved areas.

|