|

According to the GSM Association (GSMA), mobile penetration in the Asia Pacific will reach a landmark three billion connections in Q1 2012, nearly two years earlier than projected. More importantly, by 2015, the region is expected to reach 4.1 billion connections, growing at twice the rate of Europe and North America, and will account for 40% of mobile data traffic worldwide.

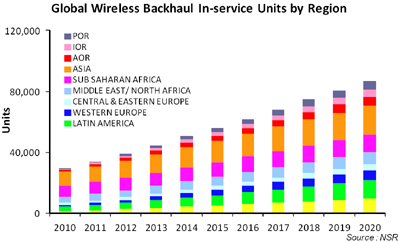

NSR’s findings are certainly consistent with the GSMA’s projections. For satellite-based backhaul, the Asia Pacific is expected to account for the largest share of in-service units and revenues until 2020. The rate of growth should lead to more than a doubling of installed satellite BTS units in Asia, indicating that while BTS installations in developed country markets are showing signs of saturation, satellite backhaul demand in the Asia Pacific is not foreseen to taper anytime soon.

Two key markets will drive growth in the region – China and India. Today, China alone has 940 million mobile connections, which exceeds the combined connections in Europe and the U.S. Moreover, even as Asia’s growth has been on a blistering pace, China and India have penetration levels at just 60%, which means that one billion people are still without a mobile connection.

The opportunity for the satellite industry in Asia is certainly promising, and it is worth noting that the region’s dynamic growth is coming at a time of severe financial pressure around the globe. Many economists have argued that the engine of growth will likely rest with Asia, and this appears certainly true in the mobile industry.

However, tapping or cashing in on the Asian opportunity is easier said than done due to a number of reasons:

- Access to key markets, notably China and India, may be hindered by regulatory factors such as preferential treatment, which may be afforded to national operators and suppliers.

- The rate of urbanization is expected to be high over time, limiting the addressable market for satellite backhaul as the value proposition rests in rural markets.

- Although wealth has grown substantially, the higher costs associated with satellite backhaul compared to terrestrial alternatives will be a challenge in the economic structure of rural markets.

Bottom Line

If the GSMA is correct in its projections of adding one billion connections in Asia, rural markets will have to account for a relatively large share of the pie given population demographics. Yes, urbanization is on the rise, but a large base will remain in rural areas. Satellite backhaul cost structures will have to address rural dynamics, and here, NSR projects those players with the most compelling cost structures both on the CAPEX and OPEX side stand to gain a better foothold. Solutions that target mobile data, particularly broadband mobile data, should likewise prosper over time.

|