|

NSR has often spoken of the "indi"osyncracies of satellite capacity supply in the Indian market – be it the role of ISRO/Antrix as a gatekeeper, glass ceilings on capacity prices or the preferential allotment to the domestic INSAT fleet. No efforts were spared to keep the country’s six Pay TV DTH operators on Indian transponders. But a combination of power anomalies, increasing backlog, spectrum controversies and (more importantly) unmet demand have allowed “foreign” transponders to trickle into the country’s DTH market – one 3-5 year contract at a time.

Dish TV, Reliance Big TV, Sun Direct and Videocon d2H are already beaming their 200+ channels via transponders from SES, AsiaSat, Measat and SingTel. When tallied at 36MHz equivalents, this translates into 40 Ku-band TPEs from a DTH universe of 60 at end-2010 that are served by operators headquartered outside the sub-continent.

Will this be as "open" as India’s skies will ever get?

INSAT-4CR’s extra in-orbit manoeuvre post-launch in 2007 and the vulnerability of INSAT-4A as the single point of failure for Tata Sky are expected to tilt the 40:20 balance even further. Almost as a side effect, the DTH industry is serious about backup capacity for the first time – due no less to the loss of a few million subscribers for Sun Direct following INSAT-4B’s power anomaly. NSR expects that very soon every Pay TV DTH operator will have some foreign capacity, and any more failures for ISRO/Antrix may cause permanent damage to both revenues and reputation. Even planned INSAT launches may come as "too little too late" as re-pointing millions of dishes to the domestic fleet, merely out of compulsion, will not go down well with the industry.

And what should the satellite industry expect from India?

These numbers and trends are undoubtedly backing the financial models behind SES-7, SES-8, ST-2 and Measat-3B – just a few of the many satellites looking to carry the next wave of SD and HD channels into this market. The long-standing pricing benchmark of $1M to $1.5M per transponder per year is already being breached. Open skies may bring aggressive pricing, but it also leaves rates to the mercy of market forces of supply and demand – and the supply in the hands of foreign companies. The supply situation is matched by DTH’s demand dilemma of having to drop (carriage paying) less popular SD channels to accommodate bandwidth hungry HD channels. NSR believes that this impasse can only end in a win-win if more bandwidth is made available irrespective of whether it is domestic or international.

Bottom Line

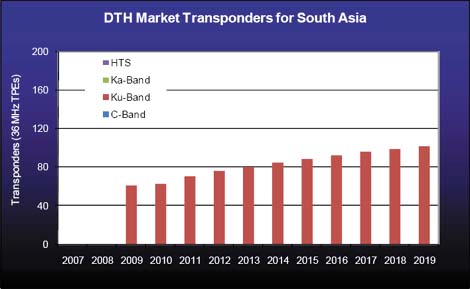

International and regional satellite operators eyeing growth cannot ignore India’s "indi"sputable DTH demand of an additional 40 TPEs over the next 10 years. While some are willing to offset profits in other geographies against low prices in-country, others are still unsure about whether the 3-5 year contracts will go down well with their business planners. Nonetheless, the industry has gone from being a closed door, transponder overflows market to today’s battlefield in the sky with the incumbent losing ground.

NSR expects ISRO to clear the air post a successful GSAT launch and would not be surprised if there was a policy change before the end of 2011. However, DTH companies can be just as cost-conscious as their viewers, and competition is always ready to lower the price point. NSR believes that while the skies may be overcast with supply, it will take the heat of an Indian summer before the revenues begin to pour.

|