|

A Tale of Two Cities: Beijing vs. Washington’s Space Policy

April 3rd, 2018 by

Jose Del Rosario , NSR

Space is both a frontier to conquer and an

arena where superpowers collide. The space economy has commercial

implications that boost a country’s global standing as well as

military interests that provide key strategic advantages. China has

entered or has ushered in a new space race, pitting itself against

the United States. How are the two contenders battling it out?

Beijing’s Thrust

Simply put, China is planning and directing its space industry

through state-sponsorship with the full backing of the government

and its state-owned entities - the China Great Wall Industry

Corporation (CGWIC) and the China Development Bank (CDB). At the

core of this campaign is the ruling party’s 5-year plan, which sets

specific goals for China’s aerospace industry.

China has also established space partnerships around the globe and

Beijing appears to be stepping up its efforts within the “One Belt

One Road” (OBOR) footprint as well as in other regions of the globe

including Africa and Latin America. Deals with Nigeria,

Argentina, Bolivia, Brazil and Nicaragua (among others) feature

projects that have largely been financed through direct investments

by the Chinese government coursed through the CDB. Beijing

reportedly covers up to 70% of the cost, and the partner country

covers the remaining 30%. In cases where the government cannot

pay the 30% or financial payments are difficult, Beijing can be

re-payed partially by oil exports as in the case of Venezuela.

The end result if we look at 2017 is that

China clocked in at third place for number of launches with 18

behind the United States’ 29, Russia’s 18, and well ahead of the EU

or India, at 11 and 5, respectively. The year 2016 was even better

where China and the United States tied for most orbital launches at

22, ahead of Russia’s 19 and well ahead of the European Union’s 9.

Washington’s Policy

In stark contrast, the United States believes in the free market and

avoids heavy government backing. Washington does leverage the EX-IM

Bank for financial support as well as NASA and DARPA for technology

incubation and partnership building. The current

administration does plan to increase funding by encouraging

public-private partnerships and the USG as a client is a tremendous

boost to commercial entities. For the most part, however, the

U.S. relies on the commercial sector for satellite manufacturing and

launch services. More importantly, it relies on the financial

markets, private equity and other commercial investment instruments

in developing, boosting and making its satellite, launch and space

industries competitive.

So, Which Policy is More Effective?

On the one hand, the satellite, launch and space industries have

thrived over the past 50 years via the free market approach. There

is a solid track record of success in favor of U.S.-style or

Western-style capitalism. Programs that do fail via bankruptcy or

projects that simply do not get off the ground due to investors not

backing the ventures financially, can once again be credited to the

wisdom of the marketplace.

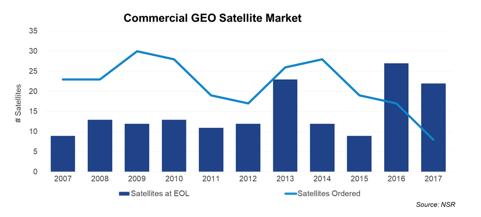

On the other hand, when we look at the number of satellites ordered

in the recent past coupled with the revenue performance of the “Big

Four” satellite operators, there seems to be something happening in

the free market, and it’s not looking good.

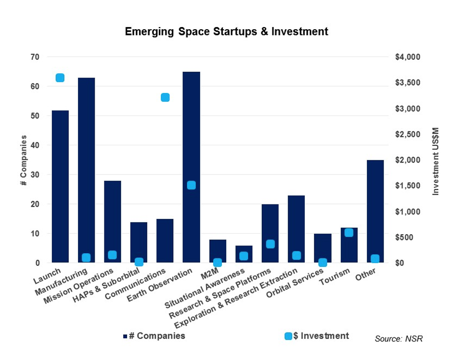

It’s all a bit concerning but not yet time to push the panic button.

Indeed, the commercial industry in the West is alive and well given

the number of companies engaged in “New Space” and the level of

funding that these companies have received. One can argue that

the space industry may be in transition where large GEO satellite

orders from the “Big Four” are transitioning to smaller start-ups

that are ordering smaller satellites for specific use cases and for

new market offerings that have not existed over the past 50 years

(tourism and orbital services for example).

But questions and the way forward have to be considered if the U.S.

and other Western nations hope to remain competitive and pertinent

within the industry they built. The obvious questions are:

Should government have a stronger hand in partnership building

and technology incubation?

-

More importantly, should government engage more fully in

financing the industry in order to close deals and boost its

local satellite, launch and space industries?

-

And if the answers to the above questions are “yes,” how much

should Western governments pour into their space programs, and

which specific parts of the ecosystem should be funded?

Bottom Line

Picking winners within the space industry (or any industry for that

matter) is a tricky thing. Judging which system to pick winners –

state-sponsored, free market or a combination of both - is the right

one is trickier still. The last space race between the U.S. and

Russia provides hindsight; however, the conditions and dynamics were

different compared to today’s campaign.

The jury is still out on whether Chinese-style go-to-market

strategies will be successful and only time will tell if their

strategy proves to be better than that of the West. In 20

years, we will know who won the new space race that emerged today by

the number of satellites “owned” by the Chinese and the West, who

got to Mars first, who’s mining the moon and other tangible

benchmarks.

The industry or governments in the West today need to respond and

not just react to Beijing’s initiatives as the free market may not

be able to withstand the onslaught that will surely be coming from

Beijing, the CGWIC and the CDB.

|