Satellite Video Markets in State of Flux

Video broadcast for both DTH and Video Distribution has historically been the mainstay of FSS demand, with long term contracts and stable capacity demand growth ever continuing. However, with significant changes in consumer entertainment markets over the last number of years, including OTT and expanding terrestrial Internet speeds, what will be the impact to the satellite leasing markets for video?

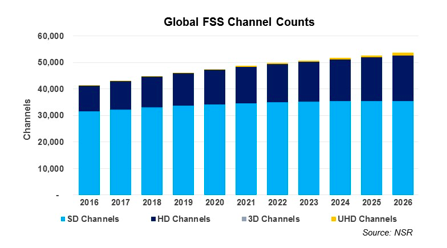

NSR’s recently released Linear TV via Satellite, 9th Edition report found that an additional 12,200 new channels will be broadcast in 2026 over 2016 levels on both DTH and Video Distribution. However, growth will not be spread evenly across the regions, with significant variation in changes in channel counts between developed and under-developed regions; i.e. mature vs non-mature video markets.

Growth over the past year has been driven by a handful of new platforms being broadcast in the developing world, with countries such as Myanmar and Indonesia showing particularly strong growth. When looking at the less developed markets of Latin America, Middle East, Africa, South and Southeast Asia for leased Ku-band DTH channels, NSR forecasts channel counts will increase from 8,644 today to approx. 12,400 over the next decade, representing a massive ~50% increase.

New platforms will continue to drive growth in the short to medium term, with economies in many developing regions growing alongside increases in disposable incomes. Overall purchasing power will result in greater subscriber numbers for Pay TV in such regions, growing the market pie. For DTH platforms to become profitable, however, costs will need to be minimized to drive growth with large numbers of subscribers at low ARPUs in these regions; both content acquisition and leasing capacity costs must be minimized. The result of this demand growth is increasing capacity requirements required from satellite operators in developing regions. However, rapidly growing video capacity demand will remain a thing of the past, with growth at less dynamic levels than has been seen historically at a global level.

In contrast, North America and Western Europe together on leased Ku-band DTH (excluding dedicated satellites for Dish and DirecTV) will see channel growth to be significantly lower, increasing from 3,740 in 2016 to approx. 4,130 in 2026. This low growth rate reflects the maturity of such markets, and the impact of OTT. There does remain room for growth coming from the upgrading of channel quality in the developed world, where platforms place increased focus on exclusive content to OTT’s impact. UltraHD content, while small in number, is on the rise in Western Europe with platforms such as Viasat, Sky Deutschland, Tivusat, and Rai all adding UltraHD channels in the past year. HD content is also becoming common even for niche channels, which have traditionally remained in the domain of SD – a trend which is similar in North America.

Despite the rapid growth of OTT options and services, especially in North America and Western Europe, channel line-ups will not see significant declines. Any declines in channel line-ups will likely accelerate cord cutting, and thus any costs saved from reduced channel counts will be offset up an even larger decline in subscription revenues – a silver lining for satellite operators.

The greater impact from OTT will be some level of cord cutting for DTH platforms, cutting into subscriber revenues; mitigations will be required such as bundling OTT into DTH platforms to stem potential subscriber declines. In more developing regions, OTT is having an impact; however, the effect is significantly smaller. In such markets where Internet penetration and connectivity speeds are low, DTH and satellite video distribution are the most effective way to reach audiences with significantly lower cost with point to multipoint benefits. This is the key way to reach new subscribers at low ARPUs with ‘instant infrastructure’ compared to rolling out high cost ground infrastructure. Consequently, stable channel counts in North America and Western Europe are contrasted with stronger growth in more developing regions.

Bottom Line

Satellite operators in more developing regions will have an advantage as DTH and video distribution capacity demand continues to grow, driven by consumer trends and economic growth. This will be advantageous to operators in those regions as sustained video demand with longer contract leases will continue to boost fill rates as demand from other, data-centric applications moves to HTS capacity.

Nonetheless, in all regions Linear TV markets will remain the bread and butter of the satellite industry for some time, although the very high growth rates of the past decades are over. The world’s largest markets by number of subscribers - especially India, United States, and various Western European countries - are either saturated or stagnating. However, there is still some room in developed regions for enhanced content quality and ethnic programing in diverse parts of the world.