Commercial UAS – Down but Not Out

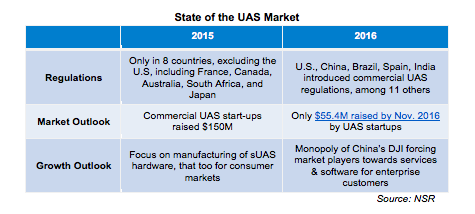

The year 2016 will go down as a forgetful one in the short history of the commercial UAS industry. Yet, it will be etched in memories because of several ‘industry-defining’ changes that took place.

From DJI knocking out its competition globally in the consumer drone business, the market failure of the U.S.’s biggest drone startup 3DR, Trimble selling off its Gatewing drone business, and Parrot laying off employees, 2016 was an eventful year when the commercial UAS industry’s focus turned on services and software, and some important M&As happened – which NSR had predicted would occur in its previous research on UAS.

Before analyzing the path ahead for the commercial UAS imaging industry, one must take a step back and realize what went wrong or what forces were at play in the first place. First and foremost were the over-optimistic growth projections that are so common in Silicon Valley, leading to large scale mismatch on the demand and supply side of the market, because of incorrect understanding of the business unit economics. Secondly, the gross underestimation of threats from competition, be it from within the industry or outside of it, such as the rapid development in small satellite imaging and analytics, which inflicted wounds to many upcoming companies that either shut down or are on the verge of it.

However, all is not gloomy for the commercial UAS imaging industry, as these setbacks have helped the strategy evolve towards new business models like franchising and focusing more on enterprise customers.

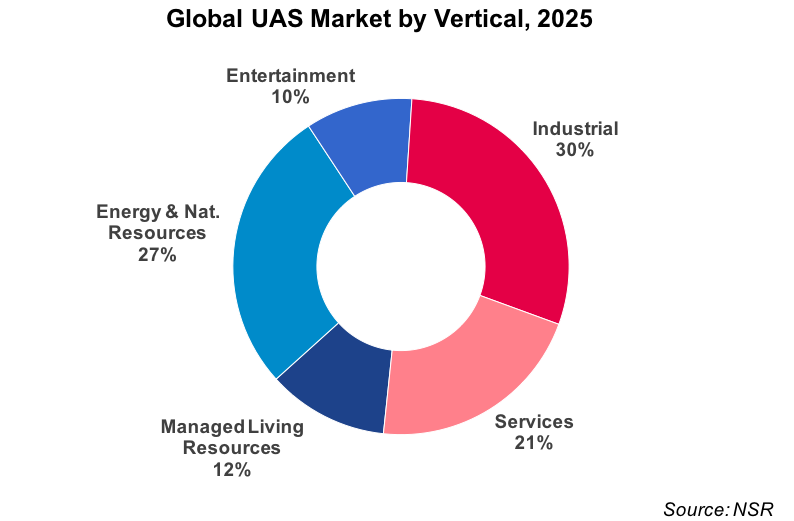

Nevertheless, NSR continues to believe that imaging services, with an analytics layer on top of it, delivered by sUAS platforms will continue to add value to many industry verticals and generate growth in revenues for operators and service providers. The market prospects of UAS imaging-as-a-service were analyzed in NSR’s UAS – Satcom & Imaging Markets, 3rd Edition report as part of larger market forecasted to generate more than $4 billion between 2015 – 2025, due to annual global revenues reaching over $550 million by 2025. NSR expects this growth to be primarily driven by three vertical markets – Energy & Natural Resources, Industrial, and Services, which together will constitute 78% of the revenues brought by UAS imaging services, by the year 2025.

The size of the commercial UAS imaging industry may be smaller than satellite imaging and its entire value chain, but public agencies like the European Union and the Canadian Space Agency are betting on these commercial UAS platforms to expand the range of geospatial services, especially with advances in computing leading the industry towards the age of geospatial Big Data. Despite the lowering of investor confidence in the commercial UAS business, there are success stories like Measure, DroneDepoly, Airware, DelairTech, and Precision Hawk, to name a few. NSR expects the UAS market consolidation to continue and expand its footprint in this new and emerging industry, and include involvement of software giants such as Intel, Google, and IBM, whose Watson IoT technology entered the commercial UAS market using hardware from Netherlands-based Aerialtronics (and having a queue of 4,000 billable clients in waiting), is an indication of a bright future for this industry.

Bottom Line

The commercial UAS industry may be down, but not out. The gradual integration of image analytics into business intelligence processes, used by platform agnostic customers in non-traditional Earth Observation markets will thin the walls between satellite and UAS imaging, as both will co-exist and complement each other. The world is in the midst of a sensor revolution, and UAS are clearly an important part of it. However, caution must be exercised by the industry stakeholders to evaluate the capabilities and limitations of UAS platforms, and get the business economics right.