Commercial SatCom’s Role in New U.S. Administration

With a new U.S. Presidential administration only weeks away from taking office, Datapath’s recent contract win to provide support for the Army’s Global Tactical Advanced Communications Systems is a trend likely to continue as part of ongoing streamlining and optimization of U.S. Government satcom systems. While there will always be a place for government-owned and -run networks, the role of commercial providers for remote connectivity to U.S. Government and military user groups is likely to be closer to center stage than before.

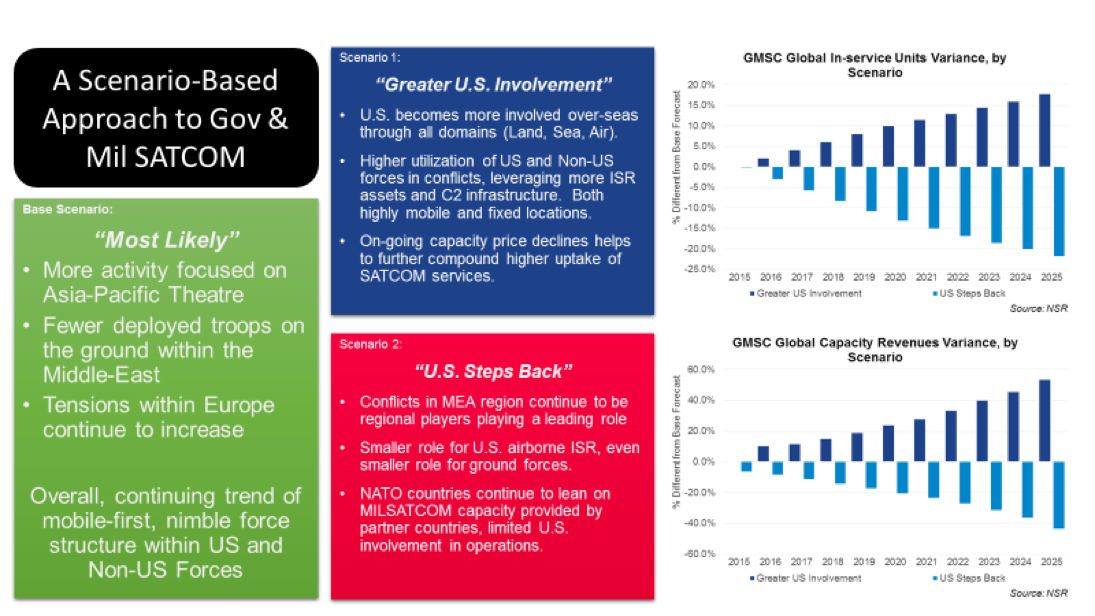

In NSR’s Government and Military Satellite Communications, 13th Edition study, NSR explored some of the macro-level impacts on changing U.S. foreign and military policy on the commercial opportunities for satellite services. Within our base scenario, it was assumed there is a continuation of a longer-trend towards a nimble, mobile-first force. Regardless of the foreign policy objectives of the incoming administration, NSR continues to expect developments such as the Datapath contract, which gives tighter integration of commercial providers into providing and supporting remote connectivity. NSR thus forecasts in-service units to nearly double between 2015 – 2025 across all capacity levels. Driven by manned and unmanned aeronautical applications and land-mobile services across the spectrum, the ‘most likely’ viewpoint gives positive signs of growth on the horizon.

More importantly, the analysis points towards one of the core trends NSR studied extensively over the past years: growth outside U.S. Government purchases is only going to accelerate. While comments during a general election do not necessarily translate to the complex realities of international relations, the SATCOM industry should expect to see a greater emphasis on sourcing domestic capabilities for non-U.S. markets across the globe. Although they are unlikely to surpass the U.S. in terms of raw size on an individual basis, they will continue to be a key source of growth and new opportunities.

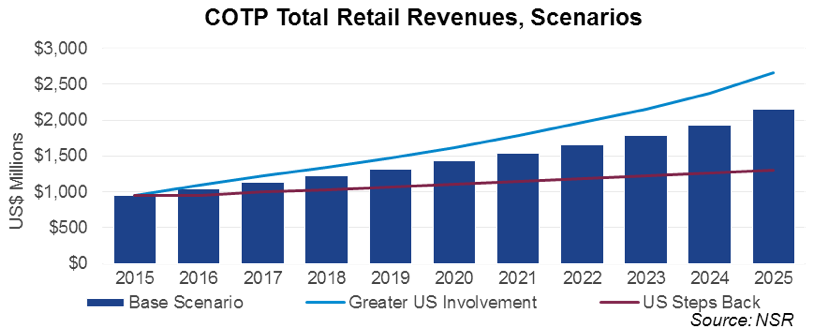

However, one of the three major scenario’s NSR continues to explore is the ‘what-if’ the U.S. lowers its involvement overseas. Within that “U.S. Steps Back” scenario, we could expect to see up to 20% fewer In-service Units by 2025. For capacity revenues, we can expect a difference of more than 40% from our base scenario forecast. Under this lower U.S. involvement scenario, fewer forward deployed troops in fewer locations have a two-fold impact: first, lower overall numbers of troops and machinery to connect; second, higher concentrations of activity increase competition from terrestrial and military-owned connectivity mediums. One of the area’s hit hardest under this scenario is the Comms-on-the-pause (COTP) market – which essentially assumes an almost zero-growth rate for retail revenues between 2015 – 2025. While all scenarios assume a decreasing cost for satellite communications services on a per Mbps basis, the lower involvement of U.S. forces abroad act as a compounding factor.

Under this “U.S. Steps Back” scenario, Comms-on-the-move (COTM) markets such as aeronautical and maritime will see lesser impacts. As there is significant interest to acquire and deploy COTM SATCOM services in non-U.S. Markets, and if the U.S. decreases overseas involvement, it will only slightly impact the number of planes or ships the United States deploys abroad. Ground-based and troop-centric markets will bear the burden of a ‘lesser involved’ U.S.

Although a U.S. foreign policy that promotes less involvement overseas remains a potential policy objective of the new administration, “greater U.S. involvement” through direct and indirect action provides the upside potential for SATCOM players. Taking many shapes, the key aspects for satcom players are higher utilization of U.S. and non-U.S. intelligence, surveillance and reconnaissance (ISR) assets, greater number of forward deployed forces and equipment, and more operational locations. Add in lower per Mbps cost the satellite communications sector is seeing across all verticals, and there is a perfect storm brewing for more revenues for all levels of the value-chain. Looking just at the COTM market, where ‘less involved’ had little negative impact, ‘more involved’ has almost double the amount of HTS as well as appreciable growth for FSS capacity demand.

Bottom Line

Regardless of the policy objectives of the in-coming U.S. administration, there are sectors and segments of the government and military satcom market which will continue to provide growth opportunities. Just as in commercial markets, satcom players approaching the Government & Military markets with a mobile-centric value proposition will likely see fewer impacts and remain on stage even if the new Executive decides that the U.S. should be less involved in world affairs.