Consumer IoT: Hype or Reality for Satellite?

Up to this point, the core focus of M2M via satellite has been its industrial applications – most notably land transport, aviation and maritime. However, a lot of buzz has been generated recently about the potential for satellite to address consumer based IoT applications. Thus, NSR’s M2M and IoT via Satellite, 7th Edition report, includes analysis and forecasts the consumer IoT segments.

Cisco expects to see 50 billion Internet connected devices in 2020, which looks conservative compared to Intel’s forecast of 200 billion devices in 2020. Although this includes smartphones and personal computers, the majority of these devices will be IoT devices. While satellite operators may dream of addressing light switches and thermostats, the consumer market is really split into two segments – location tracking devices, and backhaul for Low Power Wide Area (LPWA) Networks.

The first segment - location tracking devices - consists mostly of land mobile consumer handheld form factors, most notably Globalstar SPOT, DeLorme InReach, and new competitors and products that will come along in the future. One of the primary functions of these devices is location tracking for consumers, even though other functions such as social media usage is typically included, especially with future generations of products. The target market for such devices is outdoor enthusiasts, hikers, emergency backup and usage in private vessels, which are expected to be used in regions where there is no terrestrial network coverage, such as in mountainous terrain, in remote regions, and in offshore waters.

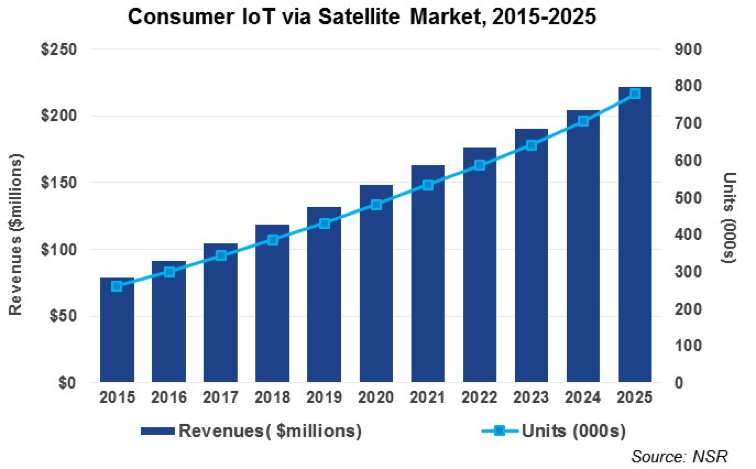

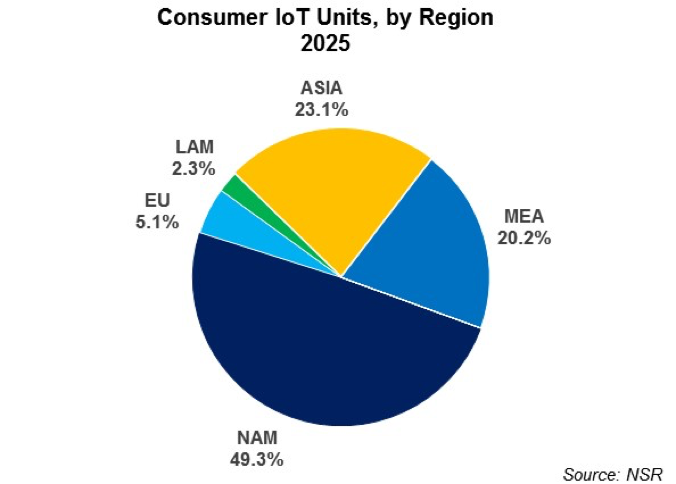

In M2M and IoT via satellite, 7th Edition, NSR projects there will be over 770,000 active location tracking IoT units in 2025, which corresponds to annual retail revenues of over $220 million. While as of 2016, 62% of units will be in located in North America, NSR expects the Asia Pacific region to have the largest growth, as the likes of Globalstar and others will make a further push in the region, taking advantage of greater levels of disposable income as well as shifting trends in terms of growth in levels of travel and greater utilisation and dependence of social media.

With a compelling value proposition, NSR expects new devices and players to enter the market, with new form factors to drive additional unit sales and revenues driven by new features and higher bandwidth requirements. New levels of connectivity such as Globalstar’s second generation network will provide a further boost to IoT demand. Churn nevertheless remains an issue for operators, with aggressive promotions in recent years driving up usage but increasing levels of churn, ultimately benefiting the end consumer but harming the operator.

For other true non-backhauled consumer IoT devices, such as thermostats and light switches, the business case will be extremely difficult to close. Here, NSR expects all but the most niche use cases to be carried on terrestrial networks. For the most part, these will be on fixed home connections through Wi-Fi, cellular networks, or increasingly in the future, Low Power Wide Area (LPWA) Networks. This is due to the higher costs of satellite connectivity in a generally price sensitive consumer market. Some upcoming smallsat constellations intend to address this market; however, once again the main target market will be industrial M2M applications over consumer IoT devices.

The backhaul of LPWA Networks will bring additional revenue streams for satellite operators, but the overall market of general backhaul will be limited to ~$5 million by 2025 in retail revenues. This will be economical on both Ku-band and MSS, due to the very small bandwidth requirements on LPWA networks (typically in the order of 10 bytes). However large numbers of IoT devices will be required to turn a profit, considering the ~$1 per month, or even lower ARPU, on LPWA networks. However, NSR recommends operators enter the market earlier to get a first mover advantage on backhaul networks - some are already doing so.

The consumer IoT, with its billions of devices, for the most part will remain on cellular connections. Only a very small portion of these devices will have data routed through satellite connectivity. Cost is by far the most important factor driving this, with most households already having Wi-Fi connectivity that is used to connect IoT devices to the Internet. Alternatively, an embedded GSM SIM can be used for low cost, or connected to networks such as Sigfox for $1 per month or less per device, which will always remain more price competitive than satellite. Further, the smaller terminal size and long battery life of LPWA networks providers further technical advantages, especially when integrating with ever smaller IoT devices. Both of these factors are key to limiting the growth of IoT on satellite networks.

However, niche opportunities exist in both location tracking devices, and to a lesser extent IoT backhaul over LPWA networks. The challenge for satellite operators and service providers will be reaching price points and form factors palatable to casual outdoor enthusiasts, without reducing ARPU from existing higher value customers. This involves limiting feature sets to consumers such as basic location tracking and social media, while avoiding high level data analytics. Nonetheless, consumer IoT applications remain a niche market when compared to the much larger enterprise M2M satellite market, and it is these enterprise applications that should be the primary focus for operators and service providers alike.

Bottom Line

Is the consumer IoT via satellite more hype than reality? The 480,000 consumer IoT in-service units NSR expects in 2020 is orders of magnitude lower than what we see on the terrestrial side of the business. Taking Cisco’s number, this means that in 2020 the proportion of satellite connected IoT devices will remain at 0.00096% of the global market, and less than 0.00025% if using Intel’s figures. This small share reflects the lower costs that terrestrial solutions are able to bring to consumers, and the easier integration with OEM devices through cellular, Wi-Fi, Bluetooth and LPWA networks. If entities within the satellite industry are touting numbers in the billions or tens of millions of devices, then this is hype. The reality is far lower.