Grounding

Smallsat

Expansion

Nov 9th,

2016

by

Carolyn

Belle, NSR

Suitable launch

access has long been

a concern for

smallsat operators,

a challenge

intensified since

2014 due to a

series of

launch failures and

delayed manifests.

India’s announcement

last month of an

83-satellite

PSLV launch planned

for early 2017,

its largest yet,

highlighted once

again the growing

demand for a route

to orbit. Despite

efforts at

facilitating higher

volume launch

opportunities, the

market-wide launch

bottleneck will not

be alleviated in the

near term –

obstructing market

development and

opening the door to

market contraction.

Pinching Demand

Interest in

smallsats continues

to outpace

opportunities to

launch, leading to

long waiting lists

for slots or an

inability to reach

the desired orbit.

Diverse technology

development missions

and budding

commercial

constellations have

been left wanting.

Delays in

space-testing new

platforms,

components, and

operations reduces

the availability of

advanced capability

technologies. Such

technologies include

those that might

improve current

applications (e.g. a

higher resolution

camera) or enable

entirely new

applications and

sub-markets (e.g.

formation flying). The

longer today’s

budding companies

wait for launches

and postpone the

start of full

operations, the more

challenging it

becomes to deliver a

compelling customer

experience, convince

new industries to

rely on novel

satellite services,

and maintain

cashflow following a

capital-intensive

build phase. The

potential failure by

an early market

entrant due to an

inability to deploy

all satellites on

schedule

could

reverberate across

the industry,

frustrating future

funding efforts and

leading to a market

contraction.

Until the launch

access challenge is

resolved, market

exits will commence,

enthusiasm for new

smallsat based

ventures will

falter, and new

players will not as

readily emerge to

fill the vacuums.

Evolving Solutions

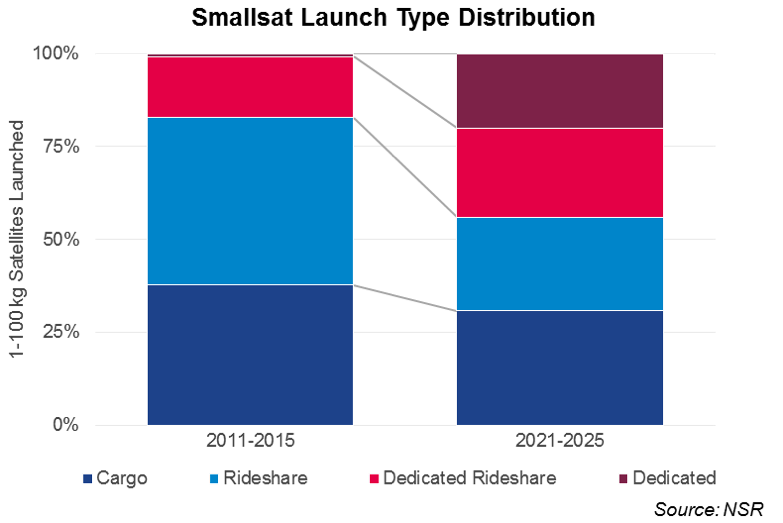

NSR’s Small

Satellite Markets, 3rd

Edition found

that even

with evolving launch

practices and

solutions, the

launch bottleneck

will not be

alleviated until the

early 2020s.

While the market has

been primarily

served by

opportunistic

rideshare and ISS

resupply missions,

launch type

distribution will

diversify in coming

years to include a

growing

share of dedicated

and dedicated

rideshare missions

leading to a

nearly

four-fold

increase in the

5-year launch rate

between

2021-2025 compared

to 2011-2015.

The growth by

type of launches

will unfold as

follows:

- Cargo

launches will

generate a

fairly

consistent share

of launch

opportunities.

ISS will

continue to

benefit from

Dragon, Cygnus,

and HTV upmass,

with higher

upmass

allocations

after the more

capable

DreamChaser

becomes

operational in

2019/2020. Plans

to install a

commercial

airlock will

also increase

annual

deployment

capacity. Yet

Cargo will

remain a

less attractive

launch option

for the low,

fixed orbit,

schedule

constraints, and

human-rated

environment

requirements.

- As records

for successful

rideshare

missions have

grown, the

initial

hesitancy of

primary payload

owners to

support a

secondary

payload(s) has

abated.

Likewise, launch

providers are

implementing

best practices

and new

deployment

systems to

support

rideshare

customers.

However, rollout

of new solutions

takes time and

global launch

rates are not

increasing – the

recent Falcon 9

anomaly impact

highlighting the

fragile state of

this type of

ride – meaning

the

incremental

capacity per

launch will only

support a

limited

augmentation of

smallsat

rideshare

opportunities.

- Cost and

scale have

restricted

dedicated

rideshare

missions thus

far to a few

Dnepr and

Antares

launches. New

vehicles will

also serve this

market once

available, as

evidenced by the

three VCLS

contracts NASA

awarded to

Rocket Lab,

Virgin Galactic,

and Firefly in

2015. Yet it is

the expanded use

of current

vehicles for

high volume,

dedicated

rideshare – such

as the Falcon 9

mission next

year – that

presents

the best

near-term

opportunity for

higher launch

availability.

- More than

three dozen

smallsat launch

vehicles are in

development,

aiming to

provide a

tailored service

for operators

seeking to

control the

orbit and

schedule of

launch

services.

Should even a

few of these

launch, launch

flexibility for

smallsat

operators could

exponentially

improve. NSR has

noted the myriad

challenges along

the route to

successful

operations of a

new vehicle, and

many endeavors

will fail along

the way.

Bottom

Line

The smallsat

launch bottleneck

has no near-term

solution in sight.

Expanded

opportunities for

rideshare and

dedicated rideshare,

with added solutions

for dedicated

launches, will

alleviate this

restraint by the

2020s.

Until then,

limited launch

access will continue

to restrain market

expansion. First, by

preventing existing

players from putting

new satellites in

orbit. Second, by

hindering the

success of early

smallsat ventures

that is required to

prove the concept

and prompt

engagement from new

players and

investors. The

question, therefore,

is: will

better launch

opportunities arrive

in time to prevent

market contraction?