Aero IFC- Band vs. Band

Jun

29th, 2016 by

Prateep Basu, NSR

The

recent saga of American airlines

flip-flopping between GoGo and ViaSat

over IFC services is a reflection of the

dilemma facing airlines. As satellite

operators continue to offer lucrative,

often discounted HTS capacity deals to

service providers in both Ka- and

Ku-band, the airlines now have one more

variable to trade-off as they ponder

their IFC business model–

which frequency band to choose?

NSR’s recently released report

Aeronautical Satcom Markets, 4th

Edition found that even if

GEO-HTS Ka-band market will grow

strongly, the

availability of backward-compatible GEO

HTS Ku-band capacity will offer a

compelling value proposition and thus

push IFC demand via Ku-band over Ka-band

in the long run. Economics,

quality of the IFC service, and

reliability are the three most

important parameters that NSR believes

would drive the decision-making process

for airlines.

Economics – The cost/bit

of GEO HTS Ka-band is suggested to be

cheaper than GEO HTS Ku-band, due to the

higher frequency and via its reuse

factor. This theoretically enables

greater availability of bandwidth using

Ka-band spectrum and spot beam

architecture, driving proponents of

Ka-band systems to conclude it is

cheaper than Ku-band systems. The scale

factor comes into play then, where

service providers point to more

subscribers thanks to the lower cost.

However, the CAPEX of GEO HTS Ka-band

satellites is higher than their Ku-band

counterpart, and NSR believes

that after accounting for teleport

charges and VSAT cost

(which is more than just antenna cost),

the economic advantages of GEO-HTS

Ka-band over GEO HTS Ku-band are likely

overstated.

Quality of Service

(QoS)– There is a popular saying that

‘no Internet is better than slow

Internet’. GEO HTS Ka-band based

services, introduced by ViaSat, changed

the IFC game by delivering loads of

bandwidth to users. A few ways GEO HTS

Ku-band based services can deliver

equivalent performance are by increasing

the size of the antenna, increasing the

signal power or optimizing the channel

noise. The success of GoGo’s 2Ku service

shows the market continuing acceptance

of Ku-band based IFC, despite the

availability of Ka-band capacity. Such

market behavior contradicts the rumors

about Ku-band systems not being able to

provide the same QoS as Ka-band HTS

systems. Improvements in antenna

technology have benefited the Ku-band

based IFC service providers to bridge

the gap in performance, and there is

only one way we see this trend going –

forward.

Reliability –

The Ku-band world is more secure due to

large numbers of backup options.

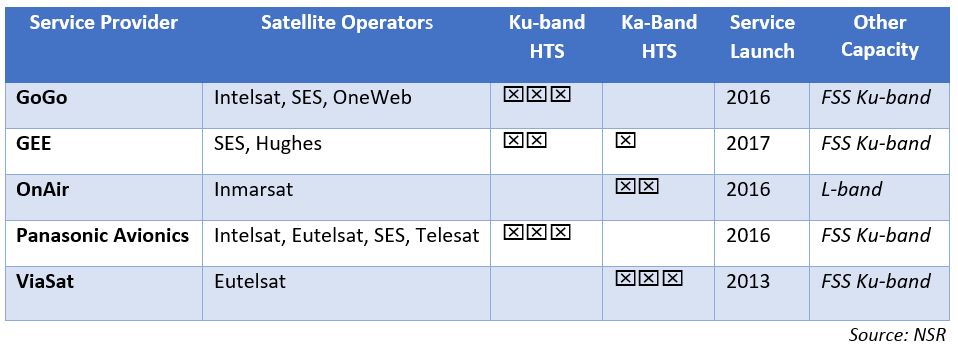

NSR’s research shows that IFC service

providers have landed more deals in

Ku-band (both FSS & GEO HTS), with GEO

HTS Ka-band deals being mostly held by a

vertically integrated ViaSat and the

oft-delayed Inmarsat’s GX Aviation.

Also, the fact that options for Ka-band

aeronautical connectivity antennas are

few and more recent (like GEE’s

partnership with QEST) adds to the

belief the Ku-band ecosystem will

continue to be seen as more reliable

from a service point-of-view. The table

below shows a relative comparison of GEO

HTS capacity procured by service

providers in both frequency bands.

The two biggest players with 75%

of global market share – GoGo and

Panasonic, have shown faith in

Ku-band HTS capacity, which points to a

leading position of Ku-band in the IFC

race in the long run.

Thus, as established in a previous

NSR article, the demand for Ku-band

systems (mostly HTS) in IFC will

continue to increase amidst the falling

capacity prices in the mobility market.

Indeed, NSR estimates

the total capacity demand for

GEO HTS Ku-band to reach 20 Gbps by

2025, supplemented by demand for close

to 130 transponders of FSS Ku-band

capacity.

With over 2,300 Ku-band aero

units currently in service, a ‘toggle’

between Ku-band FSS capacity and spot

beam HTS will have far more ‘pull’ and

be preferable than switching to a

different frequency band,

which is a considerable cost due on the

VSAT side and requires a completely

different ROI strategy from airlines.

Bottom Line

The noise about frequency

bands in the IFC market is reminiscent

of the times when Ku-band based VSATs

were introduced and many predicted the

death of C-band VSATs. Well,

C-band VSAT markets are growing because

they have a well-defined use case, and

NSR expects Ku-band to be still around

in the IFC market despite the

competition with higher throughput Ka-band

HTS systems, albeit in a bigger way than

C-band in the VSAT market, in large part

thanks to HTS spot beam architecture.

Unlike what most articles and other

analysis would lead us to believe,

the competition between Ku- and

Ka-band HTS systems is not so

straightforward, with

airlines weighing their options that

extend beyond user bandwidth

availability. As scores are

settled on this matter, what is the next

debate in the IFC industry – a ‘battle

of orbits’? With non-GEO HTS systems

offering low latency bandwidth services,

can we conclusively say that they will

better than GEO HTS based services in

the IFC market? Perhaps not, but that is

a discussion for another day…