Failure Looms in U.S. Government

Launch Market

Jun

15th, 2016 by

Carolyn Belle, NSR

Between congressional RD-180

debates, SpaceX’s GPS III launch award,

and millions in federal funding for new

launch technologies, the past year has

been filled with discussions of access

to space and to the U.S. Government

launch market. Current activity shows

widespread interest in addressing this

market, but do future prospects match

the interest levels of industry?

U.S. Government EELV class launch

demand has historically been addressed

by few players, and for the better part

of a decade was served by ULA alone.

The entry of SpaceX has added a

note of diversity to this

market, particularly with the recently

announced NRO contract that demonstrates

activity across the triumvirate of

government players: the NRO, Air Force,

and NASA. Yet the market

continues to grow: the Air

Force awarded development contracts

earlier this year to Orbital ATK, SpaceX,

Aerojet Rocketdyne, and ULA/Blue Origin

that will broaden the launch vehicle

landscape. By 2020, today’s

market of two players and three vehicles

could double to four players and six+

vehicles.

In what will be a challenge for

incumbent and new market entrants,

U.S. Government launch demand is

not expected to increase at a comparable

rate in the coming decade.

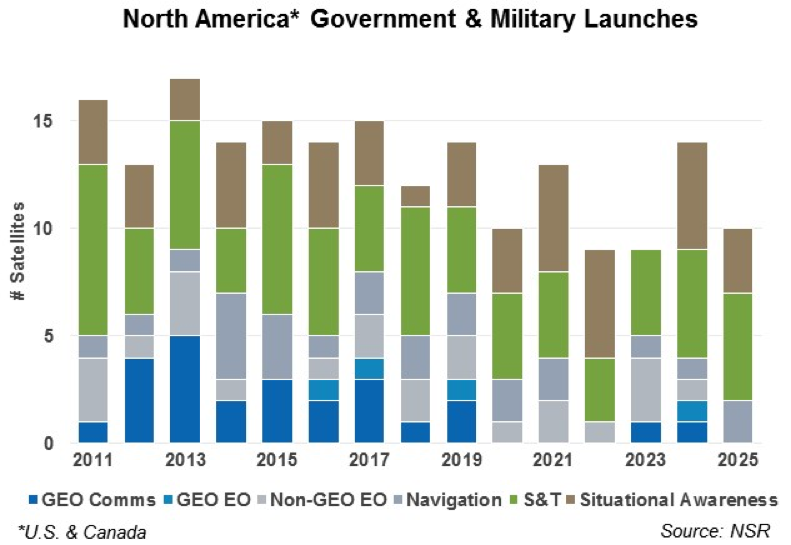

NSR’s recent Satellite Manufacturing and

Launch Services, 6th Edition

report found that government

launch rates will average 12 satellites

per year between 2016-2025, 20% less

than the 2011-2015 average.

While GPS III launches are scheduled to

begin in 2017 and continue throughout

this forecast period, other

constellation-based programs are

reaching the end of their deployment

cycles. MUOS, AEHF, and WGS should be

fully launched by 2019, leaving little

GEO communications launch demand until

follow-on systems begin to deploy in the

late 2020s. Increased focus on

situational awareness and space security

will boost demand slightly, but

insufficiently to fully counterbalance

the lower GEO communications launch

demand.

This narrowing launch

opportunity window showcases the fading

days of pursuing only government and

military contracts. With a

growing pool of players and lower

demand, launch service providers

will not be able to achieve minimum

annual launch cadences – 5-6

for some, up to 10 for others – with

government contracts alone. Further, the

historically high prices and revenues of

U.S. Government contracts will decline

with increasing competition and the

implementation of next generation

vehicles. The challenge then

becomes competing for sufficient

commercial contracts to complement

government business.

Yet, the net entry of three or more

vehicles to the global commercial market

in 2020 will transform an already

competitive market to be even more

competitive. EELV class launch

demand is not expected to increase

significantly in the 2020s, meaning

either fewer launches per player,

decline in price to the point of

elasticity and increasing demand, or a

market exit. Requirements for

manufacturing volumes and reliability

mean the requisite reduction in launches

per player to accommodate seven of them

is not sustainable. The

point of launch demand elasticity

remains untested, but for Beyond-LEO

markets the regulatory restrictions and

addressable market will be other key

limiting factors to demand growth.

Finally, the other launch service

providers – Arianespace, ILS, MHI –

benefit from government support through

guaranteed launch contracts,

manufacturing volume, or R&D funding and

will not be allowed to fail.

This leaves one or more U.S. launch

service providers as most likely to exit

the market, begging the

question: By funding and supporting

multiple new vehicles and launch service

providers without providing a guaranteed

market, is the U.S. Government

setting up its own industry to fail?

Bottom Line

Recent U.S. Government initiatives to

expand the monopolistic launch market to

initially two players, and potentially

up to four, will increase diversity of

launch options, decrease average

pricing, and reinforce assured access to

space. Yet the simultaneous slackening

of government and military demand will

force these launch service

providers to look to commercial

opportunities to complement

government business, driving competition

in a market that ultimately cannot

sustain all players.

While recent U.S. Government awards

present an attractive opportunity to win

funding for R&D and a piece of its still

lucrative launch market, current and new

EELV class launch providers must be

conscious of the challenges they will

face in building a sustainable business

with a commercial market component.