The Great Polar Broadband Leap

Mar 4th, 2016

by Alan Crisp,

NSR

Polar markets have

traditionally been an afterthought of a region

for broadband access. With residents having to

“make do” with dial-up Internet access,

low-speed L-band network connectivity at speeds

that don’t meet most definitions of ‘broadband’,

or high priced Ku-band connectivity, assuming

that VSATs even have a view of GEO satellites.

For the not so insignificant populations that

live above the Arctic Circle at 65 degrees

north, capacity has been relatively constrained,

such that despite the large ARPU supported by

consumer and business broadband services alike,

the relatively small number of people willing to

pay for such services in the Arctic still

translates to limited revenue opportunities.

NSR’s recently released Polar Satellite

Markets report found that Broadband

Access in the Polar regions (primarily in the

Arctic) is one of the key markets expected to be

altered significantly after the introduction of

LEO-HTS services in the 2020 time

frame.

|

|

|

|

|

|

|

|

|

|

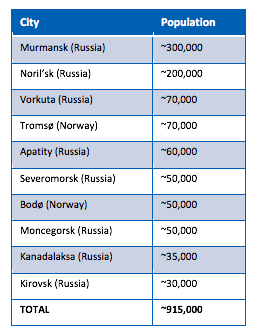

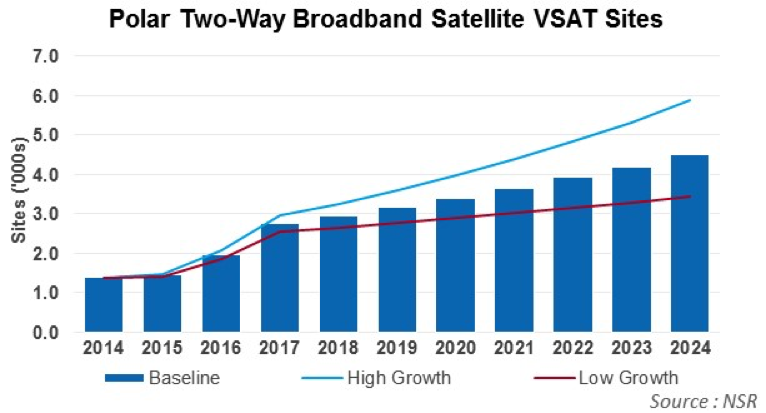

The current broadband picture in the Polar

region is largely Ku-band VSAT and GEO-HTS, with

a handful of platforms having been launched in

countries that have some spillover into Polar,

such as U.S./Canada with ViaSat, parts of Europe

with Ka-Sat, and to some extent parts of Russia

with Express-AM5/AM6. These payloads have

largely targeted the major markets listed in the

chart, but with a relatively small population in

the Polar region, part of these countries - and

still under these beams - will ultimately end up

benefitting from better quality of service at a

better price. ARPUs in the U.S. are somewhat

higher due to ViaSat having thus far seeing more

success in its business model, with WEU seeing

slightly lower ARPUs, and CEEU seeing lower

still, although still within the $20-30 per

month range.

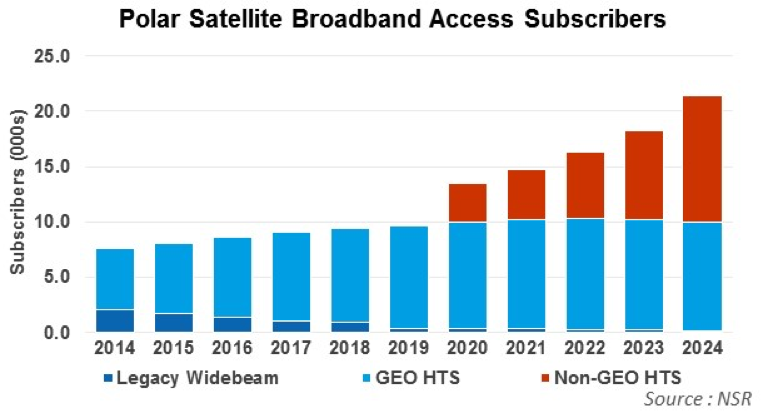

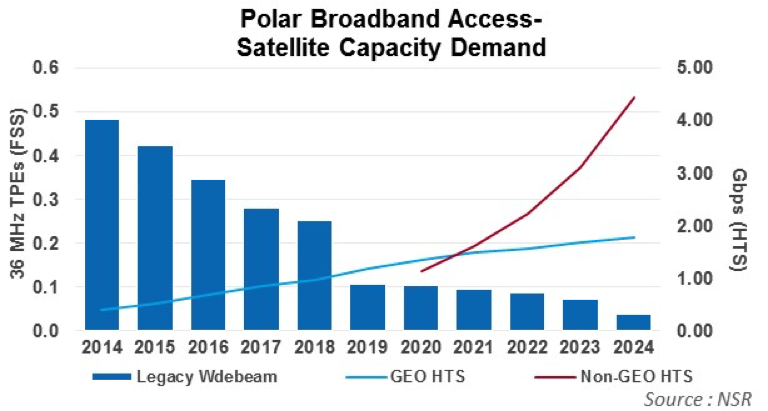

However, this all

is likely to change markedly with the

introduction of Non-GEO-HTS in the form of a

LEO-HTS constellation, which is expected to

target broadband access demand. A LEO-HTS

constellation targeting the broadband vertical

is expected to more or less

double the market in terms of subscribers,

adding around

12,000 subs between 2020 and 2024 that are

believed to be incremental demand

(without significant cannibalization). Not all

subs are created equal, though, and NSR does

believe that Non GEO-HTS subs will generate

somewhat lower ARPU.

Overall, broadband access services in the

Polar region are expected to be relatively

niche. For instance, by 2024, approx. 22,000

subs translate to an annual market size of

around $63M - hardly a tiny market, but also

hardly one worth launching dedicated capacity

over. Traditional FSS capacity that currently

serves broadband access in the region - of which

there is very, very little - is expected to no

longer be cost competitive; however, this would

represent a tiny sliver of a niche market

currently (~1,500-2,000 subs).

Bottom Line

Ultimately, the Polar broadband

market will by definition continue to be a niche

market simply due to small populations. The

region has historically been characterized by

highly ineffective or otherwise cost

uncompetitive fiber and terrestrial broadband

options. However moving forward, it is expected

that GEO-HTS, and eventually Non

GEO-HTS, will be able to bring down the cost of

broadband to the end user, expanding the market

to a slightly larger niche.

And although the population base is close to

a million in targeted cities in Russia and

Norway, which represents over 250,000

households, the satellite broadband subscriber

base is expected to be less than 25,000 or below

10% by 2024 as other challenges will be at play

in servicing these cities. These

challenges include equipment and setup costs,

ongoing bandwidth costs and a lack of

distribution to end consumers and focus by

retail partners.