Polar Markets are Calling

Feb 9th, 2016 by

Alan Crisp, NSR

One head-turner relating to Polar markets were

comments by LeoSat in 2015 about their Polar aspirations, a

business plan analyzed by NSR in our previous Polar bottom

line post. However one of the more interesting discoveries of

the Polar Regions is the significant Polar FSS demand

coming from Legacy Telephony & Carrier applications

and the Video markets.

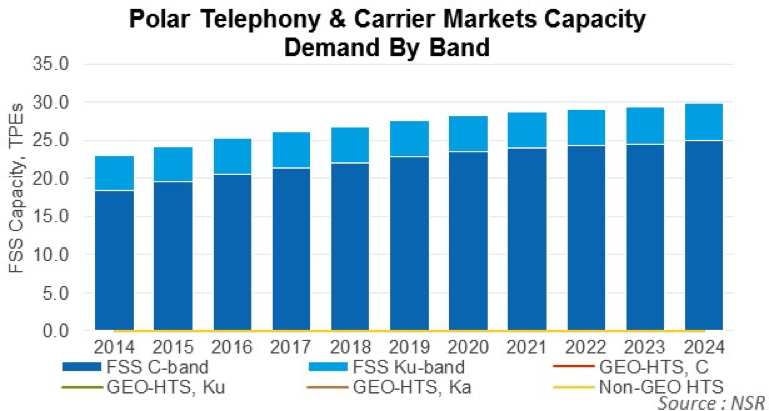

NSR’s newly released report, Polar Satellite Markets, shows that

out of ~80 transponders of combined FSS C- and Ku-band Polar demand,

23% is used solely for Legacy Telephony & Carrier

applications, a share which is projected to increase to 34% by 2024.

80% of this capacity demand comes from Canada, Alaska and Russia

combined, with the rest coming from islands in the north Atlantic

Ocean (Iceland) and the Nordics. Interestingly, this growth in Polar

bucks a global trend of downward demand for Legacy Telephony &

Carrier, as noted in NSR’s Global Satellite Capacity Supply & Demand

report, which states that Legacy Telephony & Carrier will decrease

from 460 TPEs globally in 2014 to 280 TPEs in 2024 on C-band, with

similar declines on Ku-band.

Outside the Arctic, Telephony & Carrier carriage is shifting to

fiber based communications, or in some cases microwave or other

terrestrially based technologies. Likewise, communications are

shifting to IP-based links due to cost considerations and consumer

trends migrating to OTT voice standards.

However in the Polar Regions, due to extreme remoteness and

inhospitable climates, fiber rollout remains challenging. With

limited governmental budgets moving forward, and in many cases

“short term” thinking, fiber penetration isn’t expected to improve

much over the short to medium term. It is also unlikely that

governments in the north will ‘pull the plug’ on these populations,

and due to the unpopularity of such a move should it take place, the

logical ‘Band-Aid’ solution will continue to be utilizing satellite

capacity for connectivity in remote areas in Canada, Russia,

Scandinavia and islands in the Arctic. While the Polar Regions may

appear sparsely populated, there remain at least 10 cities

with populations over 30,000, the largest being Murmansk

and Noril’sk in Russia, which have populations over 100,000 each.

These cities will continue to drive satellite capacity for their

telephony requirements long-term, with no changes expected, over the

foreseeable future.

While other applications will feel the impact of GEO-HTS and

LEO-HTS capacity pushing down demand for legacy FSS capacity, Legacy

& Telephony will hold onto, and grow satellite demand in the Polar

Regions. Percentage share will grow too as other applications in

general shrink their demand requirements on FSS capacity as more and

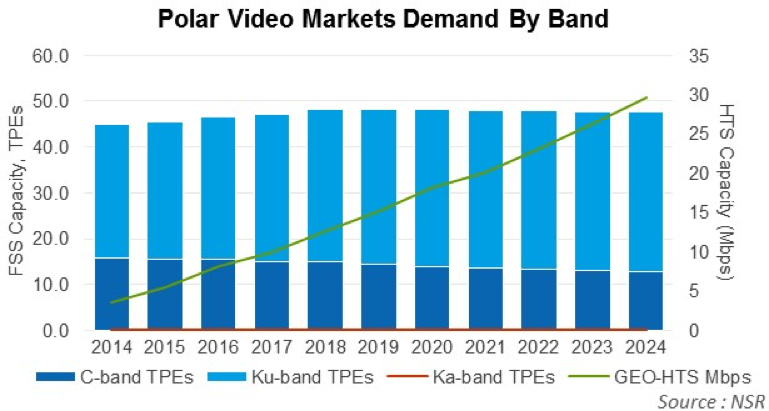

more demand shifts to HTS based solutions. The main other

holdout is Video, which also encounters strong demand in

the Arctic.

However, all demand seen in the Polar Regions is

effectively spillover demand from Russia, Canada, and

Scandinavia. DTH platforms such as Tricolor primarily target

populations at lower latitudes, but beams do cover areas of the

Earth—and populations, however sparse—which are beyond 65 degrees

North. Due to the fact that low look angles cause issues, larger

satellite equipment is required to receive video broadcast signals

in these regions. And while broadband access remains fairly costly

in these regions, the price of DTH services remains at a much more

reasonable level and will continue to enjoy strong demand longer

term, especially with new UltraHD services around the corner. While

video demand will remain essentially of the legacy FSS type, there

is expected to to be some limited demand for satellite contribution

and occasional use television over GEO-HTS, such as through

Telenor’s Thor-7 in Northern Europe, and on ViaSat-2 after launch.

Bottom Line

While LEO-HTS services will impact the Polar market significantly

across some applications (most notably broadband access and VSAT

mobility), there remains a strong legacy FSS market across other

applications – most notably Legacy Telephony & Carrier and the Video

markets. These two applications are responsible for keeping fill

rates relatively high in the Arctic, with limited additional

capacity becoming available from decreasing demand from other

applications. Overall, FSS C-band and Ku-band are expected

to remain a stable, but a niche market in the Polar Regions

long-term.

However, there is the prospect of a game change where LEO-HTS

with 100% Polar coverage could offer solutions bundling telephony,

broadband access and video, running on an all-IP platform in the

form of VoIP, high-speed Internet access and OTT, which could

diminish, if not remove, the value proposition of FSS for Legacy

Telephony and Linear TV. At the writing of NSR’s polar study,

however, prospects for LEO-HTS are still highly speculative and the

Arctic may be seen more as opportunistic rather than core for

revenue generation.