Polar LEO-HTS: A Game Changer?

The Polar Regions – Arctic and Antarctic – have all the ingredients for a great satellite market—widespread population, limited terrestrial infrastructure and challenging geography. However, due to limited coverage and comparably high pricing, combined with limited population, the region has remained a niche market.

With new HTS launches expected, including LEO-HTS constellations and even HEO constellations being considered, the Polar communications landscape is about to change quickly, with lower per bit pricing in most cases, but higher overall revenues, along with a significant increase in end-users served.

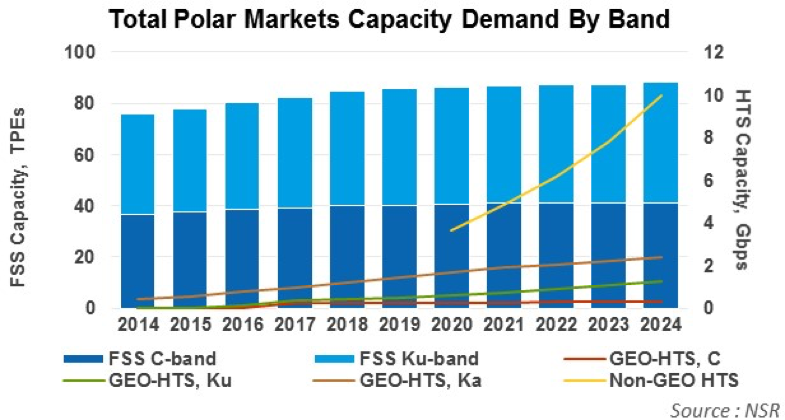

NSR’s newly released Polar Satellite Markets report projects Polar satellite capacity revenues increasing from $151 million in 2014 to approx. $290 million in 2024. This growth is driven by significant increases in Polar demand, primarily for Non-GEO-HTS capacity, which is expected to increase to 9.9 Gbps in 2024. This represents a rapid increase in capacity demand, considering NSR does not expect LEO-HTS service to launch until 2019-2020 with 3.7 Gbps expected then, driven by pent up demand in the region. This is contrasted with FSS C- and Ku-band demand, which are expected to show much flatter growth, from a combined 75 TPEs in 2014 to 88 TPEs in 2024. GEO-HTS capacity demand is likewise expected to show modest growth, increasing to 4 Gbps between C-, Ku- and Ka-band GEO-HTS.

However the supply leading to this demand is generally an offshoot from neighbouring regions. For example, SES has coverage over the Nordic regions that spills over to the Polar Regions – defined here as beyond 65 degrees North and South. Likewise RSCC and the Yamal series from Gazprom have spillover demand from CEEU, and Telesat from North America. Consequently, as of today, there are no satellites dedicated to the Polar Regions as a primary market, with operators perceiving the region to be high in risk, with greater ROI seen elsewhere. While generally this is the case despite the limited supply today and technological challenges, NSR identified key applications presenting solid growth opportunities.

There are currently no non-GEO-HTS solutions at the poles, due to limitations of O3b’s coverage, but LEO-HTS constellations, which NSR expects to be launched in the 2019-2020 timeframe, will significantly increase supply. LeoSat, for example, has spoken about ‘petabytes of demand from the poles’. However the poles still represent a secondary market compared to the rest of the world, and NSR does not expect to see this paradigm changing, with coverage at the poles a small scale by-product of the design of LEO-HTS.

Nowhere is the expected launch of LEO-HTS constellations more apparent than the jumps for Broadband Access capacity revenues, increasing from $16 million to $36 million from 2019 to 2020, representing a more than doubling of capacity revenues across a single year due to pent up demand for higher bandwidth solutions at the poles.

However, not all applications are expected to see a game change in the Polar Regions from LEO-HTS constellations; for example, Legacy Telephony & Carrier and Utilities applications see no significant spike in revenues and demand in 2020 from LEO-HTS constellations, with both applications seeing 100% of 2020 demand remaining in the traditional FSS C- and Ku-bands. While other regions are seeing a slow migration away from C-band and towards Ku-band and HTS solutions, this trend in the Polar Regions will lag behind trends elsewhere, due to the spill over nature of supply in the region.

Bottom Line

Poor service and comparatively high costs have traditionally been a barrier to satellite communications in the Polar Regions. Although the Polar Regions are currently supply constrained with fill rates of commercialized supply being over 80%, the Polar markets represent a risky investment. The regions are strongly affected by oil & gas investment (which needs to rebound) and/or large government-funded programs (which are budget constrained) that could be military or scientific research-based. Geographic challenges and economics driven by low population levels drive this risk even higher.

New HTS solutions, specifically LEO-HTS constellations, will address supply shortages in the Polar Regions, but this is not a primary market due to higher levels of industry and populations elsewhere. Nevertheless, supply growth in the Polar Region means that exciting times are ahead. Pent up demand in both the Arctic and Antarctic means there is a significant first mover advantage to operators that bring new, high speed and lower cost bits to the poles.