| |

The Force is Strong with sUAS

Jan 7th, 2016

by Prateep Basu, NSR

The small UAS (sUAS) industry has grown

rapidly since 2012, from being a hobbyist activity to a full-fledged

commercial industry. At the beginning of 2015, there were only about a

dozen companies that had been approved to fly drones commercially in the

U.S. But within a year, that number has skyrocketed up to

2,500+ approved exemptions under

Section 333 of the FAA,

reflecting the effects of strong lobbying by various industry bodies.

As the U.S. commercial UAS industry awaits a much-delayed regulatory

framework from the FAA, European countries, led by France, have

leapfrogged in this domain by supporting firms through well-defined

regulations and public-private programs such as the Project SUNNY.

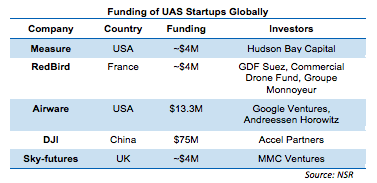

According to CB Insights, $172

million was invested in 2015 alone

(an increase of 300% from 2013), with China’s

DJI leading the pack at a $10 billion valuation and $75 million from

Accel Partners.

This industry’s technology refresh rate, both in the hardware

capabilities and software architectures, makes it difficult to analyze

where the market will be 10 years from now. Hence, in NSR’s UAS Satcom &

Imaging Markets, 2nd Edition, we looked at a set of

commercial UAS applications that are driving growth in this sector.

Imaging via UAS was found to be

by far the most promising area of growth for the industry and forecasted

for a 10-year period, as other

propositions like small cargo delivery (Amazon, Google working on it,

while DHL operationalized it last year) remain embattled in regulatory

roadblocks.

The rapid convergence of sUAS technology, consumer electronics, and

computing power has made image analytics the core of UAS-as-a-service

market. Companies like Redbird and Measure focus on providing customized

turnkey solutions in vertical markets such as agriculture, natural

resource management, and energy, to name a few. As the payloads, image

processing software capabilities, and endurance of these machines

improve, the cost of imaging will also come down. Unlike the general

perception, the total cost of

image acquisition and processing via UAS is more expensive than

satellites currently, but

with the added value proposition of providing sharp images up to 1 cm

resolution, which is not possible with satellites.

However, the biggest hurdle for the

commercial UAS imaging industry to mature is also is biggest strength –

its low barrier to entry. The

industry is highly fragmented across the globe, with no real

standardization in both hardware and the operating system. As the

hardware portion is rapidly commoditized, firms like Precision Hawk,

DJI, and Airware are currently trying to address the software part of

the puzzle. The challenges for doing so are the application-specific

requirements – a UAS that fits the bill for agricultural farm monitoring

may not be the best solution for entertainment and media applications.

NSR expects the trend of venture capital infusion in this industry to

accelerate the process of building strategic regional partnerships, with

many M&As to have better control of the UAS-as-a-service value chain.

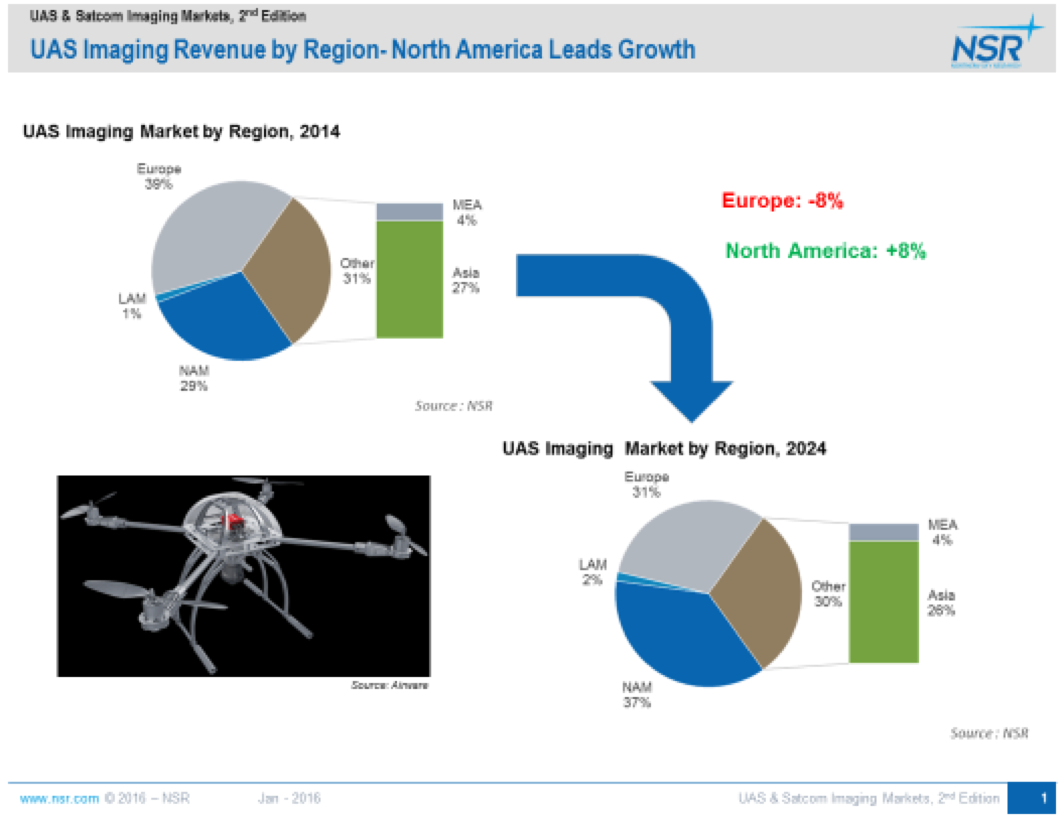

NSR projected the UAS imaging market (excludes manufacturers revenues)

to grow from close to $200

million in 2015 to over $540 million in 2024.

The North American UAS imaging market is

expected to overtake the European region during this time period,

largely due to a greater addressable market, strong industry growth

fueled by well-funded UAS companies, availability of air traffic

management solutions, and a robust regulatory regime.

Bottom Line

The impetus on data-driven decision making

is a sign of a bright future for the commercial UAS imaging industry, as

it continues innovating to reduce the time and cost of image processing,

while trying to enhance the end-value for the customers.

NSR expects

the increment in stability,

endurance, reliability, and processing power of UAS hardware, coupled

with sophistication in payloads over time, to be key factors for this

sector’s success and growth.

Despite regulatory logjams, the acceptability of sUAS for imaging

purposes in both developed and developing countries by commercial

entities and public authorities is a clear indication that the force

is strong with them.

|

|

|