| |

MSS Moves Mimic Mobile Terrestrial Markets

Jan 6th, 2016

by Claude Rousseau, NSR

As a rather slow-moving year came to an

end, the land-mobile satellite market nonetheless saw continued growth

in diversification of products and form factors such as hotspot devices,

consumer-oriented handheld and push-to-talk (PTT) solutions. All these

helped revitalize the MSS

equipment ecosystem in a manner that mimics the mobile wireless market

and helped spur growth as

competitive pressures increased from terrestrial networks.

In its recently released Land-Mobile & SNG via Satellite, 3rd

Edition report, NSR noted that this core market for the MSS

players, be they operators, service providers or distributors, will show

constant upward revenues over the next ten years.

The rates for each will be wildly different,

with the core satellite telephony showing a low single-digit CAGR.

For MSS players to expect better performance,

new and innovative solutions and channels to

users are a must and will

continue to be developed with a view to leverage mobile terrestrial

networks, their stiffest competition, yet their biggest inspiration.

We saw a re-orientation take place

many years ago as more

consumer-oriented products

such as the Globalstar SPOT and the Iridium InReach handheld form

factors were launched. This new direction accelerated with the roll-out

of the Thuraya SatSleeve, an ‘augmentation’ device that unmistakably put

satellite into the hands of the fastest growing communications market,

the consumer smartphone. Since then, four satellite-based Hotspot

devices have also emerged, and two new push-to-talk solutions launched

in 2015.

It is fair to say the drivers for Hotspot devices (such as the

ISatHub, Iridium GO, Globalstar Sat-Fi and Thuraya SatSleeve Hotspot)

are the various smartphone applications not historically supported with

satellite when away from terrestrial networks.

Much like the consumer handheld, NSR sees Hotspots as key for revenue

to progress on a per unit

basis as these are strongly dependent on, and designed for, customers’

use of fast-growing and established social network applications such as

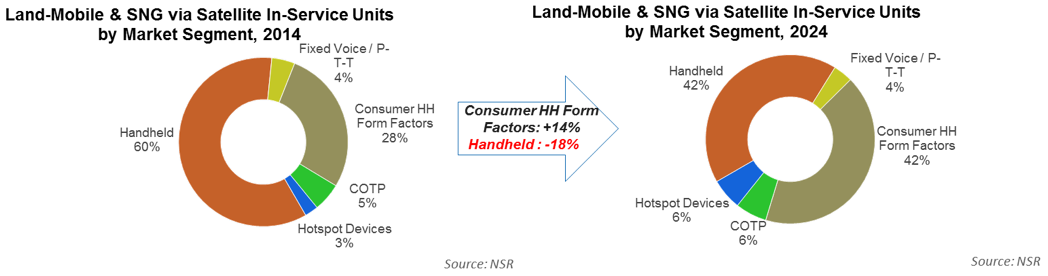

Facebook, Snapchat, Instagram and Twitter. NSR estimates Hotspots and

Consumer handheld form factors will each grow their market share on a

per unit basis by 3% and 14% respectively over the next ten years, while

at the same time satellite handhelds will drop more than 18%.

Another example of MSS services moving in step with the greater

telecom market was the late November agreement between ViaSat and Cobham

for a combined vehicle-mount and PTT solution. The solution uses

LightSquared satellite capacity with a flat rate service plan and a

seamless transition between cellular and satellite. Earlier in

the summer, Iridium launched its Extreme PTT handset to leverage its

military version of push-to-talk to reach deeper into first responder,

utilities, forestry and fishing markets with lower price points on a

monthly basis than current satellite phones.

For its part, Thuraya announced last September that the SatSleeve+,

which added a universal smartphone adapter, would sell through

non-traditional channels via an agreement with online retailer Expansys

and, since late in December 2015, through mobile operator Etisalat.

Bottom Line

The land-mobile via satellite market has

entered a more dynamic product and distribution network development

phase than ever before, and many recent hardware launches have

reinforced this notion.

This renewal is key to expanding the user base and find pockets of

growth with an expanded

portfolio of solutions to keep market share and grow margins. With

more wireless network build-up ‘invading the footprint’ of satellite

networks, we can expect more

land-mobile consumer-oriented (or –inspired) products that leverage and

mimic advances in the mobile

wireless market to sustain growth going forward.

|

|

|