| |

The Great Satcom Convergence

Dec 14th, 2015

Historically, the satellite telecom universe has been made up of two

fairly distinctive business models—Fixed Satellite Services (FSS) and

Mobile Satellite Services (MSS). The FSS business model, characterized

by longer-term capacity leases, applications like video broadcast and

VSAT networking, has recently seen a continued shift towards GEO-HTS

payloads and a new, more data-driven demand profile. The MSS business

model, characterized by comparatively short-term leases for more

“specialty” markets such as maritime, aeronautical, and M2M, has

recently seen a certain degree of the same, with MSS operator Inmarsat

for example—the world’s largest MSS operator by revenues by some

margin—launching its fleet of Global Xpress satellites to offer higher

throughput and more data to its end users.

With these developments, and with the continued shift of satellite

telecom demand towards a common denominator of “Internet access” across

a wide variety of applications,

the business models of these two historically

very different types of operators are converging.

The impact of this convergence will be felt by a number of industry

stakeholders in a number of ways, with this being a trend that is

expected to continue for some time. Taking data from NSR’s Satellite

Operator Financial Analysis, 5th Edition, we delve into

the convergences taking place among these respective business models.

Convergence of Strategies—Moving Up

(and Down) the Value Chain

The idea of satellite operators trying to

move closer to the end customer in order to increase margins, decrease

revenue volatility, and ultimately be in a better position to grow their

business, is not a particularly new phenomenon. Indeed, when looking at

a player like SES, for example, the company has

put considerable effort on growing the

“services” component of their business.

The services part of SES tends to see lower EBITDA margins, but also

allows for more organic growth through new opportunities, compared to

“infrastructure” revenues, which tend to rely on service providers and

other players in the value chain to take the impetus to grow customers.

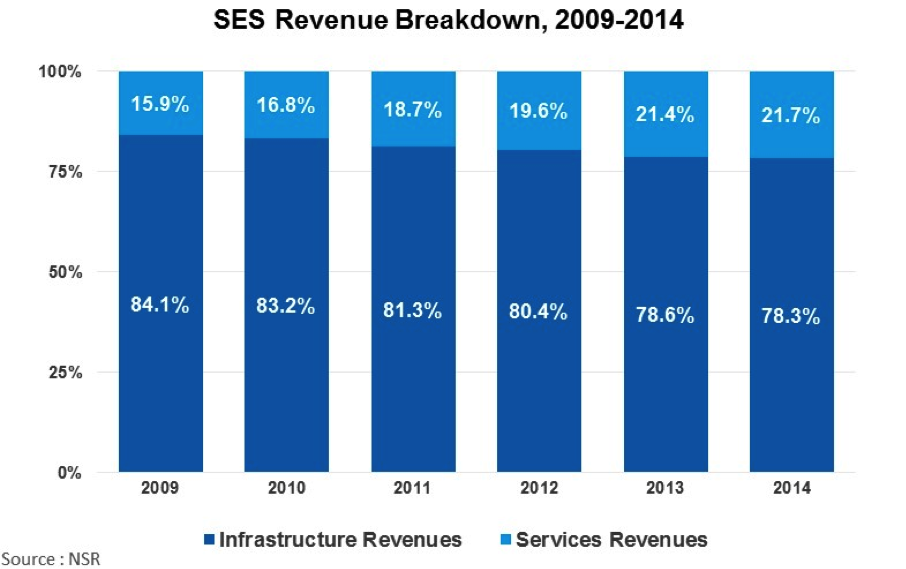

SES has seen the “services” component of overall revenues increase

from less than 16% in 2009 to nearly 22% in 2014, with services revenues

increasing from €274M to €455M in the process. Other operators have had

somewhat less organic strategies as it relates to moving up and down the

value chain. Inmarsat, for instance, has pursued an aggressive

acquisition strategy in recent years, with the company acquiring other

players along the value chain such as Stratos, Ship Equip, and Globe

Wireless in an effort to bolster its downstream capabilities in

preparation for the launch of IGX. Beyond this, even SES has hinted at

potentially moving further down the aero value chain, with the company

outwardly noting its intention to become more actively involved in the

distribution of its capacity to this fast growing vertical. Which brings

us to our next topic of discussion…

Convergence of Growth Prospects—The

Aero and Mobility Game

A somewhat more concerning development as

it relates to the convergence in business models of FSS and MSS

operators is the fact that several players are pinning major hopes on

the in-flight connectivity market for their long-term growth drivers.

Operators such as SES, Inmarsat, Telesat, and ViaSat, among others, have

launched, or have announced plans to launch, satellites targeting the

aero mobility markets. While NSR has frequently noted that the aero

market will provide significant opportunities, it nonetheless remains a

concern that so many players are pinning so much expected future revenue

growth on one market segment. Further, with aero still being in a

comparatively early stage of market development,

it could be several years or more

before the market has gained enough traction to support this

many players targeting one application, even if it is

a very fast-growing one.

Bottom Line

Ultimately, the FSS and MSS business models

are, to a certain extent, converging, with the trend continuing towards

HTS payloads requiring satellite operators to “get closer to their end

customers” in order to maintain strong margins on what is ultimately a

much larger amount of somewhat commoditized capacity. Moving forward, it

remains likely that players like Inmarsat, SES, and Intelsat will start

to look more and more alike as it relates to growth areas and business

model development, with Intelsat for instance starting to look somewhat

more like Inmarsat already by going more directly to its larger

customers with its IntelsatOne Flex service.

The convergence of business models across integration, target market,

and service offering lines will lead to an enhanced degree of

bifurcation within the industry as it relates to demand. Some customers

will simply want the most Megabits possible for the lowest price, and

for these customers, the satellite operator that wins out will

ultimately be the one with the biggest payload in orbit that can provide

the most low-cost capacity.

Conversely, a number of customers will require specialized, managed

services of some form or another, and in this case, it is likely that

the more comprehensively vertically integrated operators will find

themselves at an advantage. Ultimately, it will be up to operators to

make the most with orders of magnitude more capacity, and with

commoditization an omnipresent threat as demand converges onto

“connectivity”, those with the most compelling managed services, best

end-to-end offering, or lowest cost per bit will find themselves at a

distinct advantage in an increasingly crowded marketplace.

|

|

|