UAS: SatCom Platinum Club Members

Nov 23rd, 2015

by Prateep Basu, NSR

The recent spate of human tragedies orchestrated by terrorist

organizations across the globe, from Paris to Mail, Beirut and

the Sinai, has made one thing clear: the world is readying up

for another long war. The key that defense planners tout

to maintaining the edge over the enemy is reliable Intelligence,

Surveillance, and Reconnaissance (ISR) capabilities. Unmanned

Aircraft Systems, or UAS, are now battlefield proven for ISR,

courtesy of the decade-long wars in Iraq and Afghanistan by the

U.S. and NATO forces, and their numbers have seen an

unprecedented increase during the same period, providing the

satellite communications industry a lucrative source of

revenues. The recent intensification of war in the Middle-East

and geopolitical tensions in the Asia-Pacific region prompted

the U.S. to increase

its UAS flights by 50% in the next two years,

and this is only the tip of the iceberg.

In 2011, when defense budget cuts

were made after U.S. and NATO troop pullout from Afghanistan and

Iraq, there was still a spark

in the gloomy defense and intelligence markets for Satcom

operators: UAS. The U.S.

Government kept funding UAS programs for its Navy, Air Force,

Army, and Homeland Security, with other nations realizing their

importance and funding or purchasing high performance HALE and

MALE UAS like the Global Hawk, Predator, and Reaper. These UAS,

capable of flying continuously for more than 24 hours at high

altitudes, have rapidly increased in their sophistication to

assist the forces in hunting and targeting enemies, providing

real-time high definition slow motion video, and for tactical

purposes. These trends point to a key question –

how much satellite bandwidth

do these machines require, and how much demand will they create

in the future?

UAS are ‘bandwidth-hungry’, partly due to payload needs and

partly due to the need for a reliable beyond-line-of-sight data

link for avoiding accidents. To meet such requirements, a good

link budget is needed that necessitates a high power two-way

signal. Thus, despite a

requirement of perhaps 4MHz only, up to 18 MHz of capacity may

need to be purchased for a single UAS flight operation.

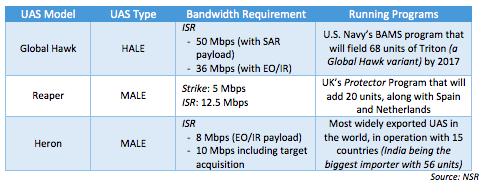

In the table below, NSR summarizes the bandwidth requirements of

some of the popular UAS models in operation.

With almost 1,500 active

in-service UAS units currently (~40% operated by the U.S.

alone), and this number expected to more than double in the next

10 years, the

burgeoning bandwidth needs cannot be met by military satellites

communications (protected Milsatcom). The conflicts in Syria and

Iraq, which have spilled over to the many countries in the

Middle-East and Africa, in addition to their regional conflicts,

strengthens NSR’s belief that UAS and their Satcom demand has

nowhere to go but up.

Add to it the simmering situation in the South China Sea,

border conflicts in Asia and Eastern Europe, and U.S.

Government’s intense lobbying at the ongoing WRC-15 for

persuading global governments to allocate Ku- or Ka-band

satellite spectrum for command and control of UAS,

it can be said without a doubt

that UAS are here to stay.

Taking all such drivers and

constraints into consideration, NSR’s UAS Satcom & Imaging

Markets, 2nd edition report forecasts

global capacity demand will grow at a

CAGR of 9.3%, generating demand of 122 TPEs for FSS operators

and additional 33 Gbps of HTS capacity by the end of 2024.

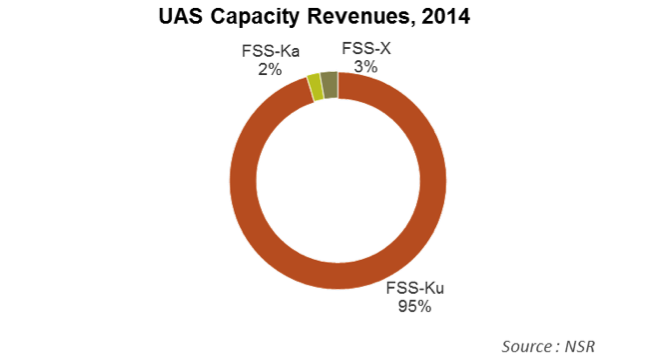

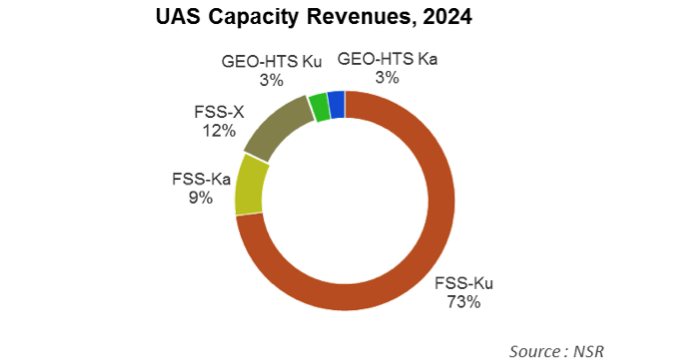

The switch to cheap HTS capacity is however imminent, as

global coverage through Inmarsat’s GX and Intelsat’s EPIC

becomes available, and current ‘cost-effective’ solutions like

FSS Ku-band inclined satellite capacity slowly starts running

out of favor for supporting high bandwidth, requiring payloads

like Synthetic Aperture Radars, GMTI and Weather Radar. However,

this transition is expected to be slow as airborne Satcom

terminal retrofits are expensive and time taking affairs,

leading to FSS Ku-band maintaining its hegemony in this

market, with good gains made by FSS Ka

and X-bands over the forecast period.

Bottom Line

-

Defense and security needs are

pushing countries across the globe to invest in UAS

programs, which are expected to drive Satcom capacity demand

through this decade and provide opportunities for operators

to generate revenues.

- The bulk of this

demand is expected to arise in the Middle-East & Africa and

Asian regions due to armed conflicts and geo-political

tensions.

- Both FSS and HTS

capacity demand is expected to grow steadily till 2024 to

meet the bandwidth demands of these UAS, which keeps

increasing by the day, with Ku-band continuing as king of

this niche market.

Thus, interest from all over the world to adopt UAS in fleets

for carrying out ISR operations clearly implies – UAS are here

to stay and their growth will fuel Satcom bandwidth demand

throughout the next decade.