Financial Impact of a Capacity Explosion

Nov 16th, 2015

by Blaine Curcio, NSR

Ever since NSR coined the phrase

“High Throughput Satellite” more than 5 years ago, the industry

continues to view HTS as the “next big thing” for satellite

telecom. HTS can, if correctly leveraged, be the magic

concoction that allows satellite to benefit from the “coverage

everywhere” of old, combined with the economies of scale more

emblematic of terrestrial communications.

Since the beginning of November, there have been three

separate interviews with three industry players outlining the

ways in which they intend to alter the industry utilizing HTS,

with Greg Wyler of OneWeb speaking with Paris Match, Mark

Dankberg of ViaSat speaking with Space News, and Tom Choi of

Asia Broadcast Satellite speaking with Via Satellite. For sure

three very different companies with three very different

business models, but an undeniable trend emerges in the three

discussions—building

much bigger HTS payloads than ever before.

There has been talk of pricing coming down by 75% or more upon

the launch of so called “Ultra High Throughput Satellites”,

which would obviously have a dramatic impact on the finances of

the satellite industry. In a phrase, it would do more than any

past advancement to turn satellite into a “dumb pipe” and

commoditize capacity to where it can be marketed as strictly

bandwidth.

The Impact of LEOs, and HTS

Today—Revenues per Leased Transponder

NSR’s

Satellite Operator Financial Analysis, 5th Edition

delves into these issues at an operator and industry level, with

findings indicating a number of trends that bear repeating. The

report finds that

revenues per leased transponder fell by over 5% on average in

2014, with this trend

a continuation of the past several years. Interestingly,

the industry has thus far not

seen major contraction

as it relates to top-line revenues, indicating a “pie expansion”

in line with decreasing revenues per transponder. Beyond this,

standard deviation in this metric has decreased by around $40k

per transponder

as compared to 2013,

indicating that it is becoming

more difficult for “brand name” operators to charge premium

pricing for their capacity.

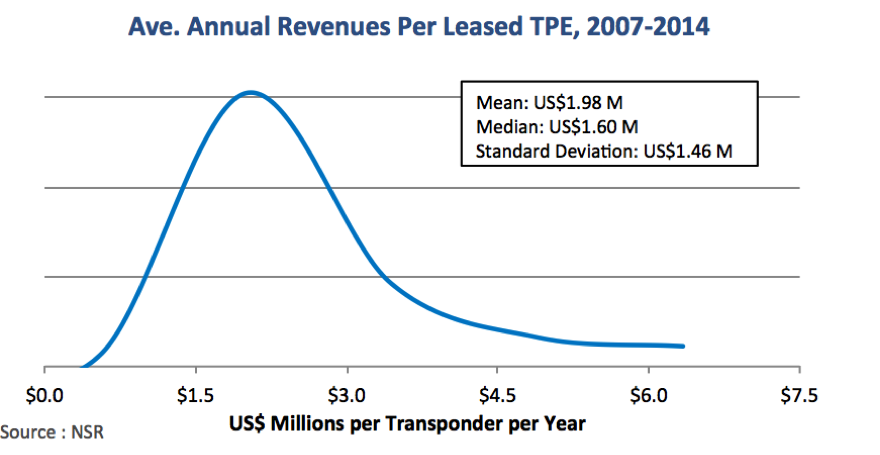

As the chart below shows, standard deviation remains significant

due to several outliers in key markets, but on the whole,

pricing converges at a point under $2M

per leased transponder, with

further declines expected moving forward.

As this trend continues,

it will become more essential

than ever for operators to either sell a compelling end-to-end

“solution”, or to bring down the cost of raw bandwidth to where

it can be competitive with terrestrial,

at least when taking into account other factors such as

reliability and setup costs. As this occurs, margins are likely

to fall since there

needs to be significantly more capacity leased.

The common anecdote is that when ViaSat-1 was launched, it

had as much capacity as all other North American GEO satellites

in orbit combined. As such, on a per-satellite basis,

margins will fall as more

throughput is utilized per satellite

despite CAPEX not increasing at a proportional rate. More effort

must be put into pushing capacity out the door,

particularly as HTS payloads become

the only sensible product to put into orbit.

Put another way, if an operator were,

for example, to put 3 traditional FSS satellites into orbit at a

CAPEX of around $1B, vs. 1 “ViaSat-2” type satellite at a CAPEX

of $650M, the obvious choice from a raw capacity standpoint is

the latter. Given the evolution of the industry towards “more

bits for less money”, the second option is virtually the only

viable one, and thus moving forward, HTS will be not only a

better business case, but in most instances the only business

case.

The Impact of LEO-HTS

Constellations Tomorrow—Revenues per Mbps and a Pricing

Apocalypse?

With LEO-HTS constellations still

years away from launch and operation, financial information

remains scarce and profitability metrics nonexistent. However,

NSR estimates pricing

for LEO-HTS broadband could dip as low as $50-60 per Mbps per

month following

launch, and drop further still once the business model

establishes itself. To put this into context,

this is around 40% lower than even the

lowest-cost GEO-HTS broadband costs,

and orders of magnitude lower than leasing prices paid for

“connectivity-like” capacity for applications like Enterprise

Data and Commercial Mobility, which could theoretically “make

the switch” to LEO-HTS should connectivity become the common

denominator.

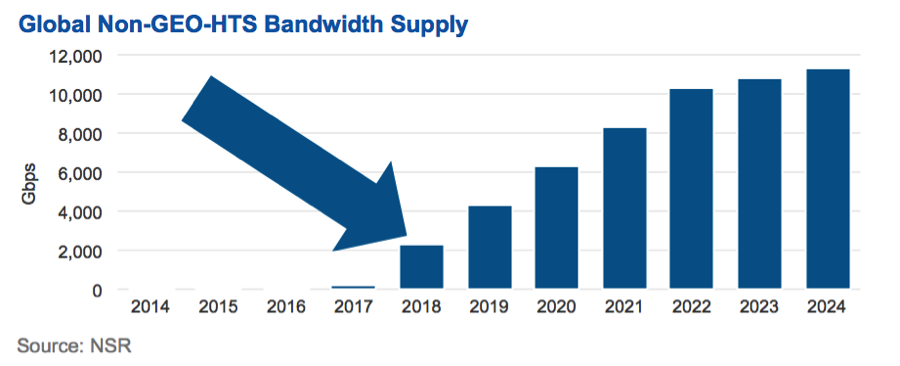

For comparative reference, the chart below from NSR’s

Global Satellite Capacity Supply &

Demand, 12th Edition shows forecasted

Non-GEO-HTS supply coming online to 2024. The 2018 figure,

indicated by the arrow, is just over 2 Tbps,

or 5 times the amount of GEO-HTS

capacity in orbit worldwide at the time of writing.

This will significantly bring down

the cost of capacity, and force operators to turn their business

models on their heads. We have already seen in recent weeks and

months a trend towards vertical integration by satellite

operators, forging long-term partnerships with, or acquiring

outright, service providers or other players in the value chain.

This is a trend no doubt brought on by concerns about future

competitiveness and being boxed out of the very markets that

operators have helped to develop, through building out

infrastructure, pushing boundaries of capacity constraints, and

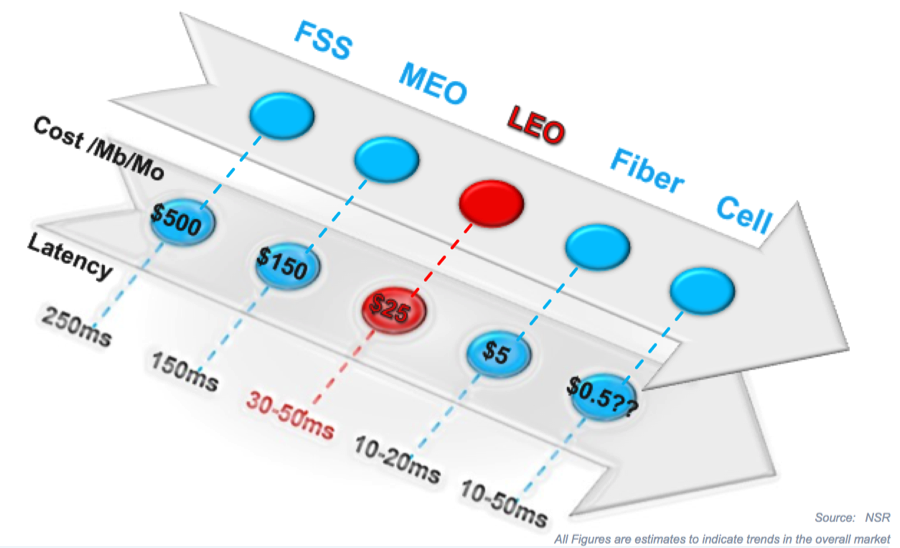

helping foster new technologies such as UltraHD. The graphic

below, taken from an NSR webinar earlier in 2015, shows the

potential development of Mbps

cost per delivery method, with LEO-HTS being potentially cheaper

than FSS by a factor of 20x on a Mbps basis.

Bottom Line—What Does this All Mean to the Industry

Today & Tomorrow?

With Internet connectivity driving

all markets and applications, one of the few ways that satellite

operators will be able to remain competitive is to increase the

“size of the pipe” as it relates to being able to transmit

content. Lower pricing

is here to stay, and

it is likely to accelerate in the coming years, and as content

delivery players like satellite telcos or terrestrials continue

to see a smaller piece of their legacy pie, the impetus will be

on these very companies to find ways to ensure they’re in a

better position to capture

the rapidly expanding pie of demand

for connectivity.

Last week, Cisco announced that

global cloud traffic is

expected to increase to 8.6 zettabytes

by 2019, with 1 zettabyte

equal to 1,000 terabytes. Clearly, demand for connectivity is

here to stay, and with words like zettabyte being thrown around,

it is arguable that players such as OneWeb announcing 10 Gbps

satellites at a cost of $400K each, or ViaSat announcing 1 Tbps

payloads are not so much revolutionary, as they are

evolutionary. There will remain ample opportunities for

satellite operators to sell compelling end-to-end solutions, and

enormous demand for raw bandwidth at the right price, but the

days of $2,000 per Mbps per month for a stationary enterprise

VSAT appear to be long gone indeed.