C-band: Still Suitable for Satellite?

Oct 7th, 2015 by Blaine Curcio, NSR

At the end of October, the World Radiocommunications

Conference 2015 (WRC-15) will commence in Geneva. The most

contentious topic of debate being whether to take away rights

that satellite operators currently, and for decades, have had

for C-band spectrum. Recent years have seen a lot of headlines

for HTS, and to a lesser degree Ku-band systems, and the new

demand that these satellites can create. However, lost among

these headlines is the very real, very diverse, and very much

essential market for C-band capacity.

The Market Today

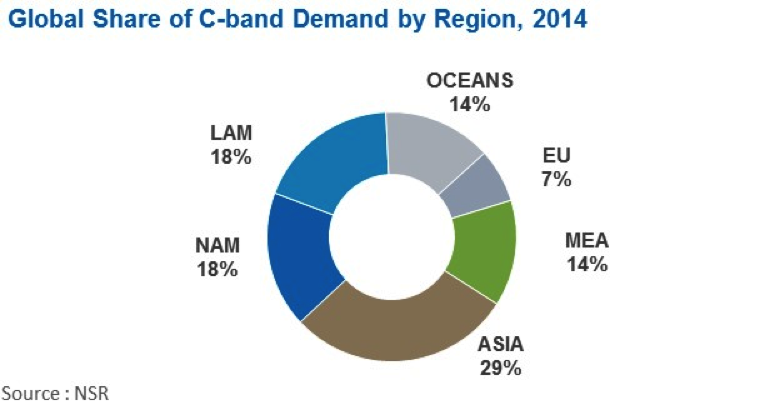

Taking data from NSR’s Global Satellite Capacity Supply &

Demand, 12th Edition study, one can identify several key

verticals whereby C-band is not only preferred, but oftentimes

the only option, or dramatically more efficient than

alternatives. This is particularly the case in regions with

significant rain fade issues, such as Southeast Asia, and

regions with large geographies, such as Ocean regions. As the

graph below shows, 2014 saw demand for C-band capacity spread

fairly globally, with some of the leading regions including

Asia, North America, and Latin America.

C-band For Video Distribution

Different regions utilize C-band capacity in vastly different

ways, with wide hemi-type beams being applicable to several

different applications. For instance, over 11% of Global C-band

capacity demand in 2014—or over two hundred 36MHz transponder

equivalents (TPEs)—was utilized for Video Distribution in Latin

America alone, with Pan-American Spanish language FTA content

being far more effective via C-band due to beam size. Other

regions that benefit from Video Distribution being broadcast via

C-band include significantly more lucrative regions, with North

American cable operators and FTA providers leasing nearly 300

TPEs of C-band capacity for video distribution in 2014,

equivalent to nearly 1/3 of the global C-band Video Distribution

total. All told, nearly 1,000 TPEs of C-band were leased

globally for Video Distribution in 2014.

In regions such as North America, proposed exclusion zones

for spectrum rights would ultimately end up being very difficult

to manage from a Distribution perspective, particularly with

more efficient video compression technologies (MPEG-4, for

example) leading to small bit errors or frame losses having a

stronger adverse impact on video quality.

The USO Play

Further, a number of developing regions, specifically

Southeast Asia, South Asia, Sub-Saharan Africa, and Latin

America, utilize C-band for Universal Service Obligation (USO)

applications, which would largely be backhaul in rural areas.

While HTS systems have begun to encroach on these markets,

C-band today remains a cost-effective way of delivering low

bandwidth backhaul solutions to underserved communities in much

of the developing world. With the cost of a full terrestrial

backhaul network in rural areas far exceeding the cost of C-band

satellite capacity, it remains likely that should terrestrial

telcos gain access to C-band spectrum, the economies of scale

would not add up to allow for a continued closing of the digital

divide, with the only areas likely to have lucrative enough

markets to justify the CAPEX being urban areas. Enterprise Data

in general remains one of the largest markets for C-band

capacity, with over 600 TPEs leased in 2014. And while we

know that wide beam Ku band and HTS are proven and less costly

alternatives for backhaul, there are still many cases when

mobile network operators (MNOs) or sister telcos favor C-band

either because of “inertia" or the high availability service

levels that regulators demand.

Important to note is many MNOs tend to favor C-band because

of its high availability virtues, even in areas that are not too

sensitive to rain fade. Here is an interesting paradox because

MNOs are pushing for terrestrial access to C-band while they

also need it for satellite backhaul in the developing world.

The Market Tomorrow

Despite concerns to the contrary, C-band usage is not falling

off a cliff anytime soon. NSR does forecast annual declines in

C-band capacity usage, with overall demand falling by around 2%

per year to 2024, however, by this time there will still be

around 1,900 TPEs of leased C-band capacity globally,

representing over $2.5B in leasing revenues, thousands of TV

stations, and orders of magnitude more VSATs, backhaul sites,

ships, and more.

Some applications will in fact see solid C-band growth moving

forward, with Commercial Mobility, for instance, seeing growth

of nearly 4% annually. This comes from mission-critical

applications onboard vessels in extreme or remote environments,

for which C-band is a robust option. Moving forward,

applications such as this will continue to provide a solid user

base for C-band capacity usage, and while areas of huge growth

will come elsewhere, C-band remains a workhorse in terms of

specific applications that, when totaled up, represent

significant cogs in global trade, development, and media

transmission.

Bottom Line

As with any significant policy decision, many factors must be

taken into account when the WRC convenes later this month in

Geneva. While C-band lacks the flashy headlines of HTS or even

Ku-band, it remains a large market currently, with nearly 2,400

TPEs leased globally in 2014. NSR expects it to be

utilized in a number of different ways moving forward, with

incremental declines in demand not taking away from the fact

that there are quite simply a large number of applications for

which only C-band capacity is suitable. Given these

trends, NSR is strongly against removing C-band spectrum (even

lower bands) from the satellite industry and hopes the WRC acts

to protect this vital resource that is so important to users

worldwide.