Why Revenue per Bit is the "Fill Rate" of the HTS World

Sep 3rd, 2015 by

Prashant Butani, NSR

Fading Relevance of Fill Rates

Fill Rates have been a tried and tested metric in the

widebeam satellite world; a look at fill rate and EBITDA margins

reflects the financial health of a satellite operator. Yet, this

performance indicator falls short when it comes to High

Throughput Satellites and is of almost no meaning in the Non-GEO

HTS world of the future. Firstly, spot beam architectures carry

an inherent inefficiency in terms of total vs. usable bandwidth.

Most HTS operators are uncomfortable disclosing usable bandwidth

because it could reveal weakness against competition. As a

result, any fill rate figure is questionable as to whether it

applies to total or usable bandwidth. Furthermore, many HTS

operators offer managed services (not raw capacity) thus making

utilization irrelevant. Until, of course, it actually saturates

individual beams and one must stop adding customers to avoid

contention issues.

Revenues are King…until Margins attack

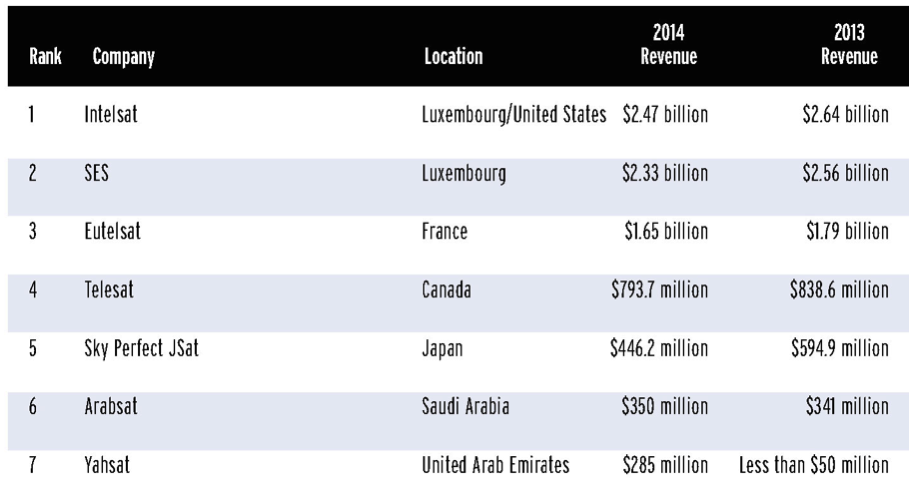

As of the end of 2014, the Big 3 (Intelsat, SES and Eutelsat)

reported combined revenues of about $6.8 Billion against roughly

3,600 leased TPEs. Considering a 2:1 Bits/Hz ratio, this puts

their Revenues per kBit leased between $20 and $30, reflective

of the premium that widebeam transponder leasing commands. If we

consider 3:1 Bits/Hz, that figure comes down to $15-$20 of

Revenue per kBit leased. All this against a fill rate of 70% or

higher for the fleets.

Source: SpaceNews

Avanti and Yahsat, on the other hand, together have approx.

40 Gbps of HTS bandwidth in orbit. Their revenue figures of

about $70 million and $285 million respectively, as reported by

SpaceNews, place them in almost the same range; i.e. $20 to $25

of Revenue per kBit leased. And this considering that Avanti

last spoke of fill rates of a “measly” 20%, while Yahsat may be

somewhat higher. Seems a bit strange that on a Revenue per Bit

leased basis, Yahsat and Avanti seem to be at par with the likes

of Intelsat and SES even if it is at a much smaller revenue

base.

If one were to judge these relatively young, largely HTS-only

satellite operators by the fill rate metric, they would be

considered as having a long way to go, and in many ways they do.

Yet Yahsat is now number 7 of the Top 26 FSS operators globally

with a grand total of 2 satellites in orbit. Sustaining

this Revenue per Bit leased and building on the topline is the

challenge, and that is where the expectation is that

the market demand will hold up. That expectation is universal

though and applies to both an Al Yah 3 as much as it does to an

EpicNG.

Bottom Line

Fill rates are important when an operator only has to sell

raw bandwidth in MHz. Operators have graduated to selling

contended (or dedicated) services with packages in Mbps and

download caps. Here, the more inventory one has available, the

better your control on quality of service and user experience.

What matters is that you have customers, that they buy premium

packages and pay their bills on time. In other words,

the race is to build revenues at a high, or healthy, Revenue per

Bit leased. If they start dropping prices, eventually

poor margins will catch up. However, if investors have faith in

the business and the management can grow customers smartly, the

returns are promising. Clearly the relevance of fill

rates reduces as you build bigger HTS satellites and more so

with LEO-HTS constellations. What matters is keeping

the Revenue per Bit leased at a level such that about half way

into the lifetime of your satellite, an operator has enough cash

flow to pay for the next one.