In-Flight Connectivity: Are the Puzzle Pieces

Together?

Sep 2nd, 2015 by

Claude Rousseau, NSR

The successful launch of Inmarsat’s 3rd Global

Xpress satellite signals the beginning of a new era for

in-flight connectivity, characterized by a step up in

satellite capacity supply and the advent of global coverage

at speeds not before seen. However, will this mean

that airlines as well as all players along the value-chain

finally reap the benefits that improved technologies bring

to the market? Unfortunately, missing elements along

the IFC value chain don’t permit a resounding ‘Yes!’ to that

question.

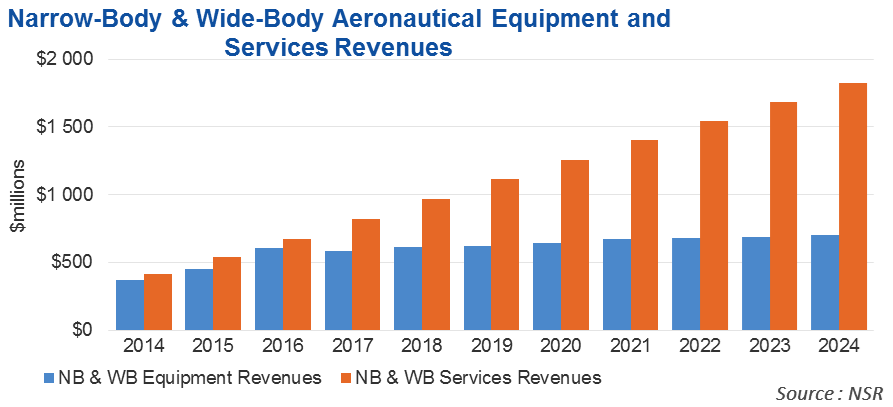

In its recent Aeronautical Satcom Markets, 3rd

Edition report, NSR’s revenue forecast from equipment

installed on aircraft of all sizes is still a very large

part of the overall revenues in the short- to medium-term.

But if we take a microscopic view on the two main IFC

markets, wide-body and narrow-body, the difference is even

more stunning. It is not until 2020 that

revenues from satellite-based services to passenger aircraft

will be double that from equipment, and this even

takes into account a strong drop expected in the unit price

of antennas, modems and associated gear needed to bring

connectivity onto the aircraft. In a truly

‘commercial’ satellite market, this ratio would be 10:1 to

be considered healthy.

Technically, solutions today are sufficient for a vast

majority of the market, and improvements such as

metamaterials and low profile gear are expected in the

mid-term that will have a lasting impact on the market.

But will the promise of flat panels break the ROI so much

that airlines will find it a ‘no-brainer’ to give their

passengers free Wi-Fi connections? A few players are

working hard at it from both a GEO (‘FSS’) and LEO or mobile

perspective. However, it is grasping at straws to

believe the business case closes all at once when the form

factor of antennas give airplanes less drag through smaller

size, weight and power.

The cord-cutting of ‘traditional’ VSATs (or bulky radomes)

is years away as certification and OEM deals need to support

the thesis, and these take time. Given all the hoops

that vendors need to go through, is global coverage enough?

The promise that sooner rather than later, connectivity via

satellite will be a solution that reaches (the Holy Grail

of) 100% market penetration rate for both wide-body and

narrow-body (those flying at least over 1.5 to 2 hrs) will

take time to be fulfilled. There

are still roadblocks such as regulation in the U.S. (under

both House and Senate acts and under the FAA ban on cell

phone calls) that steal a bit of the value from the whole

package.

Finally, business-wise, the jury is still out as to what

will be successful: offering airlines a revenue share, or

giving all the controls such that over a certain

‘allotment’, vendors are paid for equipment or services.

Many HTS providers consider that their solutions provide

airlines the most leverage and care less if a certain

threshold is not reached as they are confident in their

ability to get traction across the aircraft population. But

who pays in the end is the customer and for them, the cost

equation is still not sorted out.

Bottom Line

The oncoming jump in capacity with many HTS launching in

the coming years with increasing coverage of promises to

unlock the potential of in-flight connectivity for the

satellite industry. However, there are still many pieces of

the puzzle needed to be in place to realize its potential,

not the least of which involve figuring out a rather complex

and uncertain IFC business model.