Spotting Opportunities Outside Spot Beams

Aug 5th, 2015 by

Blaine Curcio, NSR

High Throughput Satellite (HTS) systems have undeniably

transformed the satellite telecommunications industry, with new

markets opened, new verticals developed, and new players

entering the scene. With this year’s Global Satellite Capacity

Supply & Demand, 12th Edition, (GSCSD12) NSR has for

the first time broken GEO-HTS supply and demand into frequency

bands—in addition to regions and applications—with these new

breakouts revealing interesting new insights about the ways that

the GEO-HTS market will develop, and in particular Ku-band.

GEO-HTS—The Market Today

IPSTAR and Ciel-2 were the first to launch Ku-band HTS, and

while the latter was immediately fully leased for DTH services,

the former has taken time to build up its revenue contribution.

Going forward, Intelsat’s EpicNG fleet, and SES’s trio of

SES-12, SES-14 and SES-15 will be the big contributors of

Ku-band GEO-HTS capacity. The status of Ku-band as the “Video

Workhorse” combined with the relatively more difficult business

models of selling HTS capacity to data businesses, have thus far

prevented operators from investing in Ku-band HTS capacity. The

broader trends at play are an exponential Over-The-Top (OTT)

video demand, flattening of Linear TV viewership and the

acceptance of HTS as the “Data Workhorse”.

A few years in, NSR expects that those that have the spectrum

resources will opt for Ku-band HTS just as easily as today’s Ka-band

HTS launches. At that juncture, applications other than

broadband access will begin to make a significant impact to HTS

business planning decisions.

GEO-HTS—The Market Tomorrow

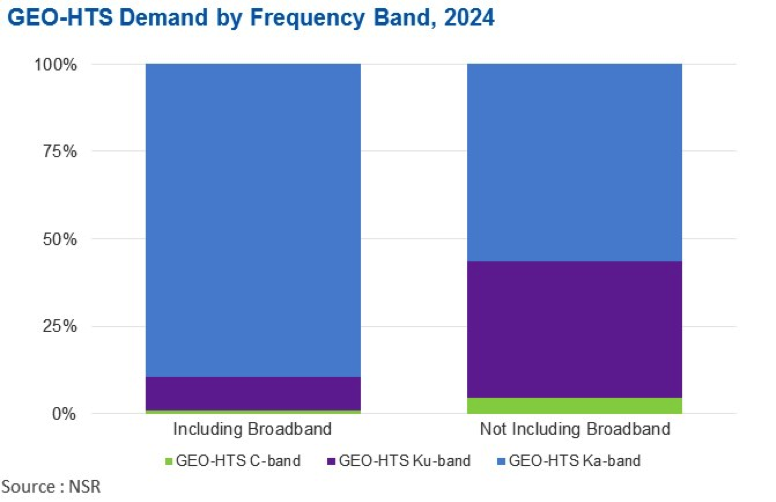

While broadband justifiably gets a lot of headlines as the

bread and butter for GEO-HTS payloads, and while this will

indeed largely be the case for GEO-HTS Ka-band capacity, it

should be considered that there will be a very real market

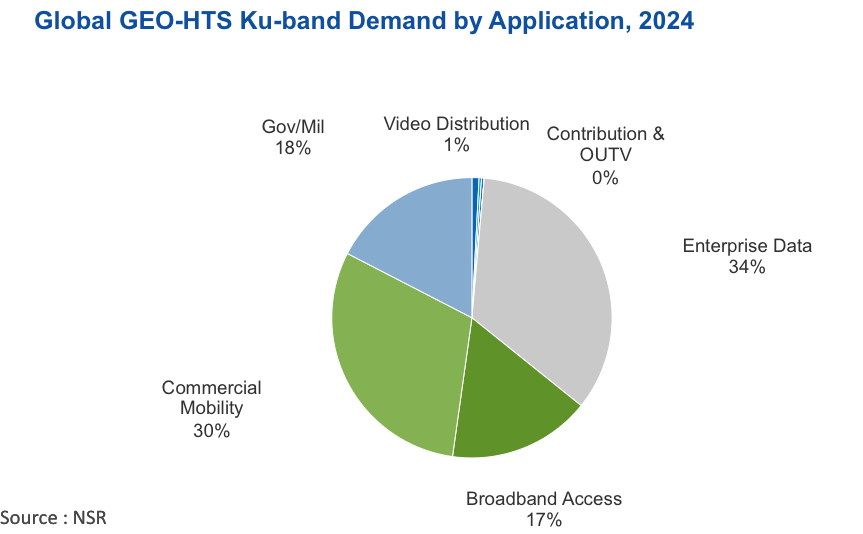

developing for HTS Ku-band, which is dominated by higher-value

applications such as Commercial Mobility, Gov/Mil, and

Enterprise Data.

Overall, by 2024, NSR expects over 1.5 Tbps of

GEO-HTS demand, with around 1/10 of this bandwidth

demand coming from Ku-band HTS. That said, Ku-band HTS will have

a much larger percentage of non-broadband demand, with

around 39% of the 325 Gbps of “non-Broadband HTS demand” by 2024

coming from Ku-band HTS. This is expected to total over

$1 billion in leasing revenues by 2024, or more than 25%

of total GEO-HTS leasing revenues. All said, the

Ku-band GEO-HTS market will total 150 Gbps of demand, spread

fairly evenly across several high value applications, including

Enterprise Data, Commercial Mobility, and Gov/Mil. The

opportunities in Enterprise Data—the largest vertical for

Ku-band GEO-HTS—will include nearly 30 Gbps of demand

coming from Trunking and Backhaul.

Beyond this, a large portion of GEO-HTS Ku-band demand will

come from Commercial Mobility, with a significant percentage of

demand coming from aeronautical, due to the suitability of

GEO-HTS widebeam Ku-band beams. Overall, these higher-value

applications will present a solid market for the right GEO-HTS

Ku-band offerings, with a number of major players having already

announced considerable investment into HTS Ku-band to target

these key growth applications.

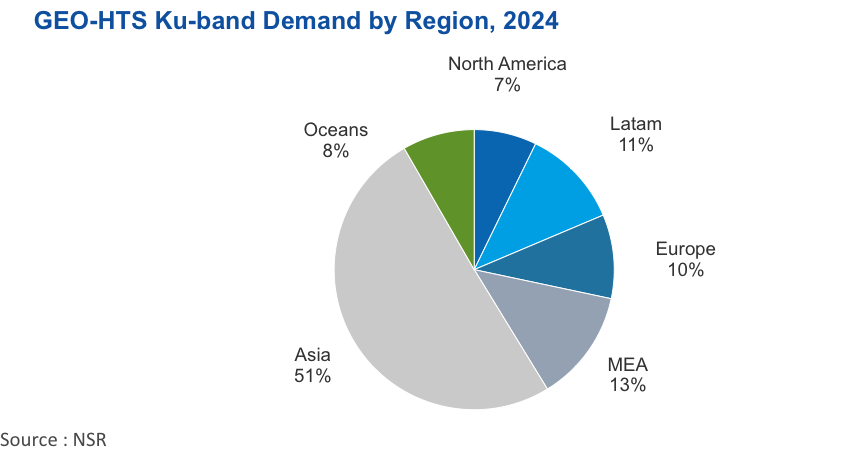

Regional hot spots include Asia-Pacific, where Ku-band

GEO-HTS has significant legacy through Thaicom’s IPSTAR, as well

as the Middle East & North Africa, which is expected to see

offerings enter the market in the coming years from players such

as SES, Intelsat, and even ISRO with GSAT 11. For example, by

2024 it is expected that over 50% of GEO-HTS Ku-band

demand will come from Asia, with the region currently

leading the world in GEO-HTS Ku-band adoption.

Bottom Line

With this the first year in which NSR segmented GEO-HTS

capacity into frequency bands, a number of interesting trends

have emerged that have given us a new lens through which to look

at the way that the GEO-HTS market is evolving. While spot beam

Ka-band coverage tends to steal the headlines, there remains

a significant market for Ku-band GEO-HTS services,

with over $1 billion in revenues and over 150 Gbps in demand by

2024. Beyond that, these services tend to be more

specialized—for instance, a commercial airliner flying at 500Mph

could not practically use a <100 mile-wide spot beam—and as

such, there may be a premium paid moving forward for Ku-band

GEO-HTS capacity. All said, the 150 Gbps of demand coming for

Ku-band GEO-HTS will be concentrated in higher-value

applications, and will indeed pose a significant market

moving forward.