UltraHD: An Ultra Growth Story

Jul 23rd, 2015 by Alan Crisp, NSR

Despite continuing concerns about OTT threatening the future

growth of Linear TV (which are for the most part unwarranted),

UltraHD, with its premium nature, is being seen as a fresh way

to grow DTH, Cable and IPTV businesses further worldwide.

While 3DTV never really took off, UltraHD investment has

risen to new highs, with seemingly every few weeks another DTH

platform announcing its UltraHD intentions, trials, or

commercial broadcast. Just last week Sky Deutschland secured

more capacity in order to commence UltraHD broadcasts, and the

Polish public broadcaster, TVP is trialling UltraHD on

terrestrial television in Warsaw. Don’t be surprised to see more

UltraHD announcements coming to a DTH platform near you.

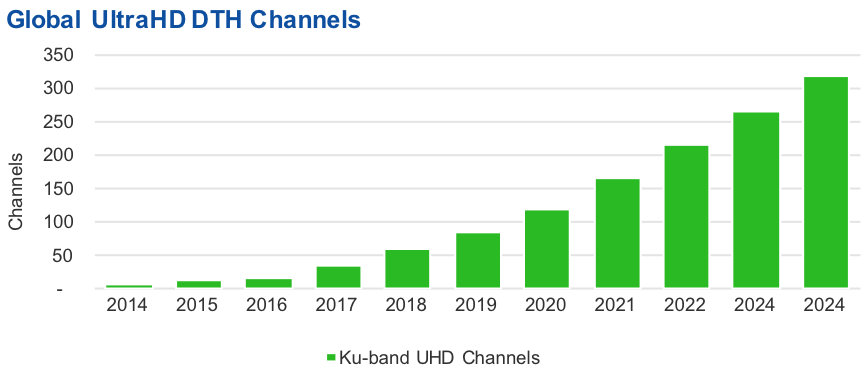

According to NSR’s recently released Linear TV via Satellite:

DTH, OTT & IPTV, 8th Edition, the number UltraHD channels

broadcasting will accelerate longer term with growth of the new

format in every region worldwide, developing and developed.

On DTH platforms, by 2024 NSR expects UltraHD linear content

to consume approx. 70 transponders globally from 315+ UltraHD

channels. This equates to an estimated additional $185M in

leasing revenues from UltraHD content on DTH alone. This means

in 2024, UltraHD represents 1.2% of capacity globally on Ku-band

DTH – a niche market, but one which is highly sought after by

the premium market.

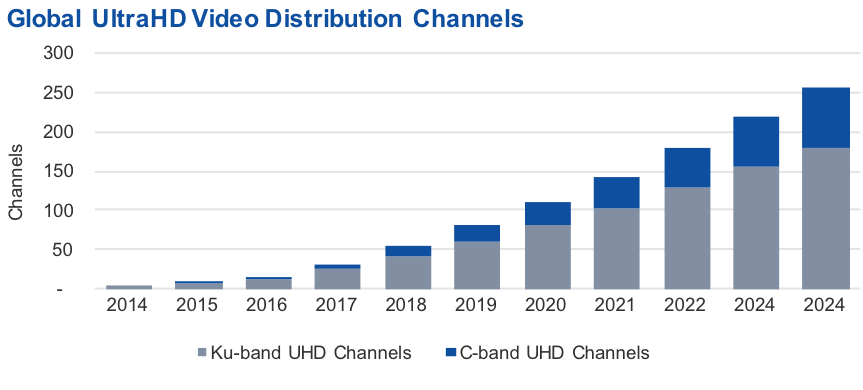

For video distribution to Cable and IPTV headends, a similar

trend emerges. 180 UltraHD channels on Ku-band and 75 channels

on C-band, leading to a combined total of 57 transponders,

roughly 4% of global distribution capacity on all bands

attributed to UltraHD, leading to an even larger $219M in

leasing revenues.

NSR previously noted that SD programming is the largest

driver for subscribers, revenues, and channels in developing

(high growth) regions. Whilst NSR sees SD to be the largest

growth opportunity in these regions, UltraHD plays a key

supplemental role at targeting those with increasingly higher

levels of disposable income available. This is the view that DTH

platforms in India took when they publicly announced their

UltraHD plans, with sports content now available in the format,

likewise with Tricolor TV in Russia when they are expected to

launch their UltraHD channel in the next year.

On the other hand in developed regions, where subscriber

growth remains low, and in the United States in some instances

declining, UltraHD is poised to be a way to move customers from

basic TV packages, primarily SD content, towards premium and

ultra-premium services, thus increasing ARPU and revenue growth.

KT SkyLife in Korea and Sky PerfecTV in Japan are already

broadcasting 24 hours per day a variety of content on their

linear streams. Both markets are already quite saturated with

pay TV, but they intend for UltraHD to increase revenues from

their existing subscriber bases.

UltraHD isn’t limited to the realm of Linear TV – in fact far

from it. The popularity of the format has already been

demonstrated in North America and elsewhere with the success of

the UltraHD subscriber base on Netflix, where not only is

Netflix able to charger higher monthly fees for UltraHD access,

but actually been successful in convincing customers to join

this highest tier. Higher ARPUs from UltraHD content have

already been demonstrated.

This combined with the fact that UltraHD TV sets are now

lower in price than ever before, with Sharp now selling UltraHD

TV sets for under $600, means that Linear TV will follow in the

footsteps of OTT services and start broadcasting content soon in

the new format.

Although these OTT services are cutting into viewing hours of

traditional Linear TV content, it is NSR’s view that there

remain very compelling reasons for consumers to continue

subscribing and paying for Linear content – most notably movies,

sports, and other live events. What’s notable is this is the

exact type of content that is first being filmed in UltraHD –

movies and sports. Without an UltraHD service in the

medium-term, Linear TV may appear to be a lower quality service

compared to OTT in regions that are offering UltraHD content.

Thus implementing UltraHD for sports content adds yet another

compelling reason for customers to sign-up and remain

subscribers for pay TV services. With Netflix, YouTube and other

OTT platforms already serving UltraHD content and consumer

awareness and familiarity of UltraHD rising, consumers in

developed regions will come to expect UltraHD content on their

pay TV services, sooner rather than later. No wonder satellite

operators are upping their investment for these high quality

products.

Bottom Line

UltraHD programming is expected to see strong takeup rates

globally, with fastest growth expected in North America and the

weakest in Sub-Saharan Africa. Although SD content is driving

growth in developing regions, providing UltraHD content is

important to capture the higher levels of spending that some in

these markets can afford. While the satellite capacity

requirements over the long-term are a niche market, it is an

important niche that will drive Linear TV platforms towards

higher ARPUs and revenues. The upward trend for UltraHD is

clearer than ever, and a failure to invest now will mean a

failure to tap into its growing premium revenues.