Lower Bandwidth Pricing = Double-Edged Sword?

Jul 21st, 2015 by Jose Del Rosario,

NSR

In every segment of the telecom industry, lower costs and decreasing

prices led to higher market penetration, greater service uptake, and

stickiness with end users and key verticals. The satellite industry has

benefited from lower bandwidth pricing, especially across apps like

wireless backhaul; however, these prices come with new challenges as

well in terms of the ROI picture. While users enjoy lower

bandwidth pricing and perhaps more for less, some vendors may struggle

with proving ROI as bandwidth prices plummet.

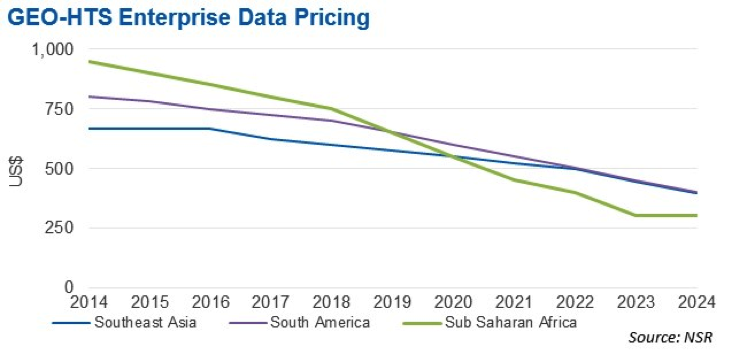

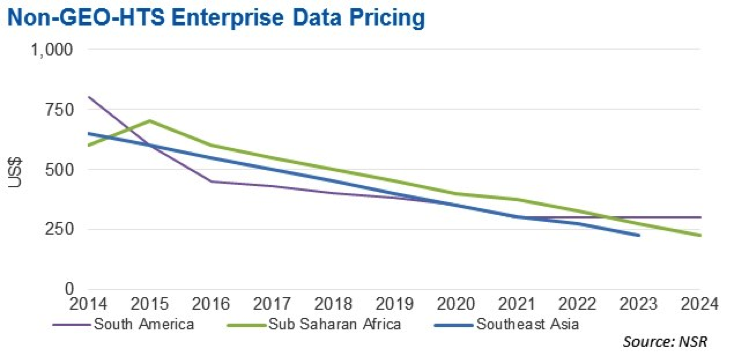

HTS pricing for enterprise data has fallen in the 3 key regions where

wireless backhaul usage is expected to exhibit the largest demand. In

comparing 2014 and 2015, Non-GEO-HTS (i.e. MEO) prices in particular

have fallen at high levels and are expected to continue specifically in

South America where a large amount of capacity is to be deployed.

Lower satellite bandwidth costs are positive in general,

given that the industry is likely to enlarge its

market niche due to a pronounced increase of capacity usage.

In the wireless backhaul segment at least, lower bandwidth costs can and

will enable 3G, 4G and even 5G services that is in line with the

explosive growth of data and video streaming requirements on

smartphones, tablets, laptops and over time, perhaps even wearables.

In its latest report, Wireless Backhaul via Satellite, 9th

Edition, NSR generated ROI models to support 2G, 3G and 4G services on

various satellite platforms. GEO FSS solutions on traditional

C-band and Ku-band capacity could generally only support 2G services and

a small number of 3G sites. On the HTS front, various solutions

could support 3G and 4G services and as the number of sites increased,

the ROI became higher and thus sustainable.

One of the key components of profitability and justification from the

mobile service operator’s (MSO) perspective will be the lower cost of

satellite bandwidth being provisioned by the satellite operator.

With a higher number of sites, the MSO will be able to generate higher

profits, which should lead to an even higher number of installations

over time.

However, the flipside is that lower bandwidth costs will likely

create problems on the operator and VSAT vendor side as ROI periods will

take longer to be realized. Cheaper bandwidth means longer time for

vendors to see net positive ROI for VSAT equipment and capacity, which

increases the risks of highly ambitious next-generation programs.

Moreover, the investor community, which is an integral piece in enabling

competitive and technologically advanced systems, may hold back on

funding such programs due once again to a longer payback period.

To illustrate this issue with capacity, if a GEO-HTS program costs

roughly US$625 million such as the ViaSat-2 satellite, which includes

its launch, insurance and ground infrastructure, pricing capacity at

$800 per Mbps per month in order to breakeven on year 1 would need a

backlog or sales of 65.1 Gbps of capacity. If priced at $500 per

Mbps per month, capacity sales need to increase to 104.2 Gbps to

breakeven.

Fortunately for ViaSat, its business model is not solely contingent

on capacity sales or the wholesale play. Rather, it is more

involved in the retail part of the value chain. Although it can

likely sell 60 to 100 Gbps of capacity of its total 160 Gbps total

throughput to breakeven via selling capacity for 4G LTE

mobile wireless services, ViaSat’s main application is broadband access

on its Exede platform. Exede likewise sells to enterprise, aero,

government and other verticals where ARPU rates are much higher.

Bottom Line

Is the eventual impact of HTS a good or bad thing? In NSR’s

view, it is a very good thing because satellite usage increases and its

niche is enlarged due to lower capacity prices to be offered in the

marketplace. However, the key is to move up the value chain and

not just be a capacity or wholesale player where margins are thin.

Rather, a similar model like ViaSat’s Exede, which generates much higher

revenues compared to a commodity play, is a better example and better

use of HTS capacity in terms of both increasing market penetration and

generating revenues.

NSR no longer reports fill rates on HTS satellites simply because the

metric is irrelevant. Revenue generation is THE key metric as it

can measure ROI and the period where breakeven is accomplished and when

profits are realized. As such, a retail play achieves quicker ROI

compared to a wholesale or commodity play. Using low cost HTS capacity

to internally increase margins via an end-to-end service offering is the

way of striking that delicate balance of achieving market penetration

and achieving positive revenue generation, and the all-important ROI.

| | |