Has VSAT Won the Maritime Market?

Jul 16th, 2015 by Brad Grady, NSR

With the focus of the industry on HTS vs. FSS, LEO; MEO or GEO; or C-

vs. Ku- vs. Ka-bands; it is sometimes easy to forget about the MSS

segment of the maritime sector. As the larger side of the maritime

market in 2014, both by In-service Units and retail revenues, it is

quickly becoming the ‘legacy’ part of the maritime satcom industry – not

just true legacy services such as Inmarsat-B, but MSS-enabled services

as a whole. For good reason, data and the demand for data is

changing the entire maritime market, from fishing vessels who need to

report their positions at regular intervals to the latest social media

service on cruise ships to the rapidly increasing number of sensors on

offshore or merchant vessels.

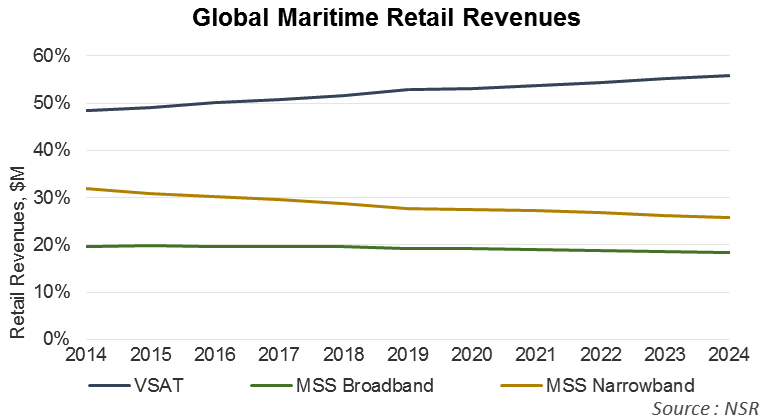

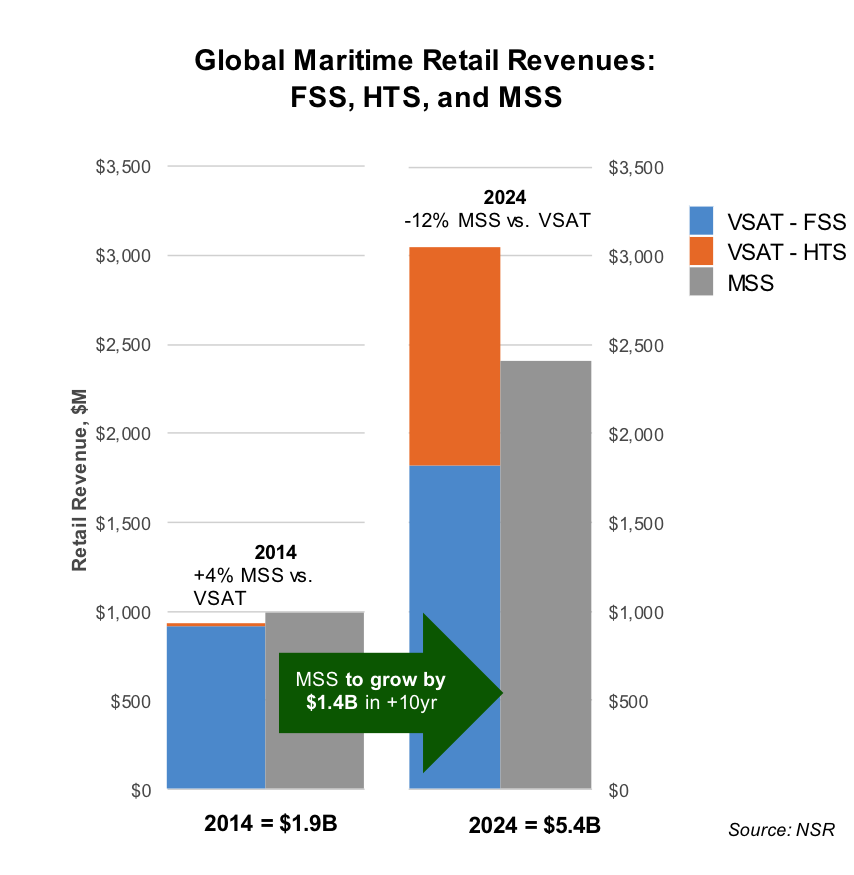

Data continues to drive the maritime market. Although it is

easy to paint a picture that VSAT is ‘winning' the maritime battle, and

by a lot of measures it is/not far off, there still remains a strong

market for MSS offerings; not only for critical safety-certified

applications, but as helping to enable the cycle of data consumption for

maritime customers. By NSR’s latest study of the maritime market,

NSR’s Maritime Satcom Markets, 3rd Edition there still

remains upwards of $1.4 Billion dollars’ worth of growth over the next

ten years for MSS maritime markets.

It is certainly true that a prime target for VSAT offerings will be

high usage MSS Broadband customers across the merchant, fishing,

offshore, and passenger segments. However, there still remain a

number of un-connected and under-connected vessels of all sizes in the

greater maritime segment who are still likely to start off with an MSS

connection as they start the ladder of data-addiction. Especially

where smaller vessels have typically forgone a satellite connection, the

changing dynamics of the maritime satcom market will continue to push

into these smaller vessel footprints, and other vessel demographics

where it simply doesn’t make sense to invest in VSAT infrastructure.

With both regulatory and business needs increasingly focused on

gathering, processing, and acting on ‘big data’, MSS narrowband can and

will remain a strong offering for tracking containers, fishing vessels,

or even within the leisure segment. Although these vessels and

applications will not be a significant per-unit source of revenue, with

upwards of hundreds of thousands of these in-service units to be in the

market by 2024, it provides an ongoing opportunity for what will become

‘legacy’ product offerings in the era of HTS. Just as we are

seeing across the space industry with nanosats and cubesats providing

new and innovative applications, cheap will not mean useless or

insignificant (or to be forgotten).

Bottom Line

Not even large numbers of In-service Units, emerging vessel tracking

requirements, situational awareness applications, or feeding ‘big data’

services can defeat an overall trend in the market – even fisherman need

more data. With safety-centric services evolving beyond a simple

voice or text alert into incorporating weather, sensor data, or video

feeds, the role of MSS in the maritime market will continue to evolve.

Yet, that evolution will not only serve to provide opportunities for

current service and application providers, but likely serve as the first

rung on the ladder of higher data demand. And, even at higher

bandwidth demand locations, connectivity will be a mix of both MSS and

VSAT, not an either/or set of solutions.

| |