Clear(er) Skies for Business Jet Connectivity

Jul 8th, 2015 by

Claude Rousseau, NSR

If contract announcements and news from airshows in

Paris, Geneva and Shanghai are any indication, business

aviation connectivity is headed for clearer skies.

And as the second largest addressable market for aero

satcom, this trend is welcome given clouds hanging over

the sector since the market crashed in 2008-2009.

A quote from a Honeywell Aerospace representative

summarized the focus on in-flight connectivity in the

business jet market: “A couple of years ago,

connectivity was in the top five, but now it’s number

one”.

At the airshows, Gogo announced the global

availability of its Gogo Vision IFE system, while

Honeywell started offering almost 3 Mbps service over

Swift Broadband. Then, ViaSat’s Ku-band Yonder

service was chosen by Gulfstream for its large business

jets, while the operator said it would have HTS

equipment certified for business jets early next year.

These announcements reflect the different needs of

owners when discussing connectivity: it’s not a

“one-size fits-all’ market.

The segment is indeed the 2nd largest

addressable aeronautical market for satcom behind

general aviation with an estimated 20,000 airframes that

could be outfitted with some form of connectivity.

Growth is solid in the segment, and Bombardier recently

upgraded its forecast for the segment to 9,000 new

aircraft in the next decade. Their numbers also

say North America will see the highest deliveries with

close to 40% of all aircraft followed by Europe, with

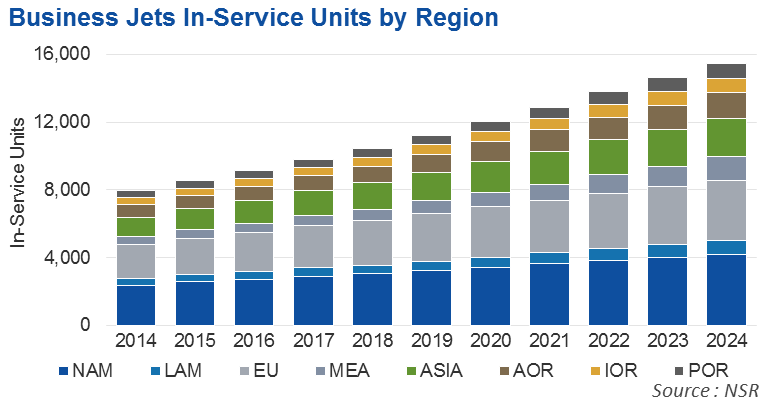

bigger jets and China helping drive growth. These trends

mirror NSR’s forecast in which the in-service units in

North America, Europe and Asia represent 27%, 23% and

14.5% of the total, respectively.

But to offer the broad range of solutions that the

passengers and crew alike require, service providers

such as Rockwell Collins (ARINC) and SatCom Direct have

combined offerings that enable MSS (Iridium, Inmarsat)

and FSS (Ku-band) and HTS (Ku- or Ka-band) connectivity

to live side-by-side in a diverse portfolio of

solutions. MSS remains business jets’ favorite

play as close to 12,400 in service units will generate

$150 million by the end of 2024.

But with growth being strongest in larger business

jets, which NSR sees as a prime target for VSAT (Ku-band

and HTS) capacity due to customer ability to pay and

their thirst for always-on connectivity, we expect VSAT

solutions to increase their penetration rate faster

(from a much smaller base today).

However, the move is on to help owners spend smarter

with new products for least-cost routing, efficient

operations via online diagnostics and troubleshooting,

while providing higher performing-lower cost traditional

services for voice (VoIP) and GSM (over Wi-Fi). The

low-cost services are not left behind as higher

bandwidth demand is addressed via channel bonding and

aggregation to give users faster speeds when they need

it. The example of

ViaSat and ICG integrating their systems so

customers can use Yonder for Internet and Iridium for

voice or low data rate communications let them afford

more diversity for both cabin and cockpit.

The various novelties take time to reach the market,

but services providers have gained approval for

installation of their hardware on a host of airframes of

all sizes, from the Cessna 550 through the Gulfstream

G450 to the larger Dassault F7X. And given the

replacement aircraft will grow to about 25% of the new

deliveries in the next decade, it is important to ensure

type-approval for customers that already have a solution

and are looking for an easy upgrade path.

Amongst all these new solutions hitting the market,

there remains the valid question of comparing satellite

connectivity to air-to-ground (ATG) solutions and there,

the answer is not settled. Business aviation was

the fastest growing segment for Gogo last year adding 5

times more systems in this segment than in commercial

aviation. It knows ATG bandwidth is constrained

unless new spectrum is allocated, but the signing of a

major program for fractional ownership operator NetJets

to outfit 650 aircraft with its Gogo Vision on its ATG

network is a sign that anything below 3 Mbps is still

sufficient for most users. The operator has

already installed ATG on more than 2,800 aircraft, and

the addition of new Swift Broadband units and its

leadership among Iridium resellers (more than 5,000)

certainly points to a large number of users satisfied

with connectivity below what FSS and HTS providers have

to offer.

Bottom Line

Connectivity has gone up the ladder of priorities for

owners and users of business jets, while recent aircraft

delivery forecasts show greater growth. For

aeronautical satcom, this means the biz jet segment will

grow at a faster rate than previously expected as users’

need to remain ‘online-in-the-air’ grow in part due to

more solutions available. In the end, the higher

number of connectivity options and the recent deals

announced are proof that the sky is clearing for

business jet connectivity.