Falcon 9 Loss a Failure for Industry at Large?

Jun 30th, 2015 by Carolyn Belle, NSR

Sunday’s Falcon 9 complete failure during a cargo resupply

mission to the International Space Station (ISS) was a first for the

vehicle, and the industry’s third in 2015. Valuable ISS supplies and

scientific experiments were lost during the mission, but this

event’s more lasting repercussions affect widespread stakeholders.

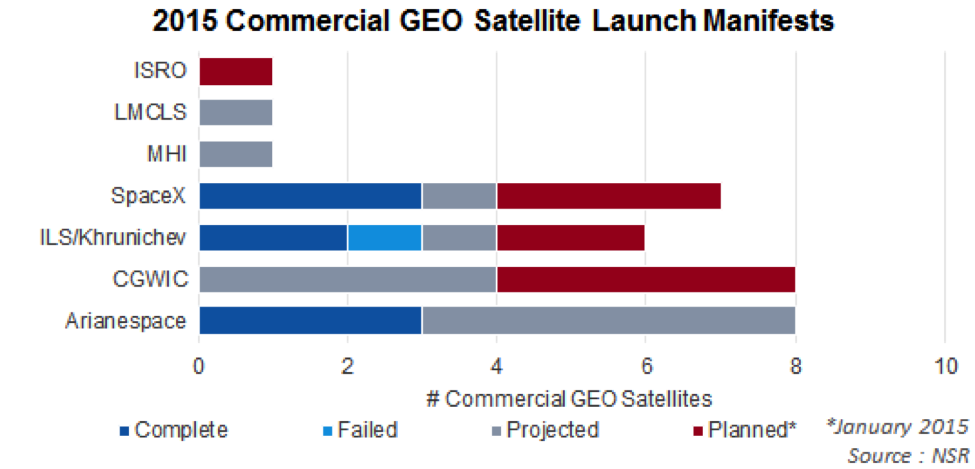

15 commercial and 3 government satellites are manifested for a

Falcon 9 launch in 2015, but it is unlikely more than one additional

mission will be completed before the end of the year. This spells

in-service date and revenue delays for the commercial operators, and

potential data lapses for government.

More significantly, the long-term reaction to Sunday’s failure

could herald a perception change of SpaceX and a strained

environment for the commercial satellite industry at large.

SpaceX Still Moving Forward

Coming on the heels of a $1 billion funding round and long

awaited U.S. Air Force certification, the Falcon 9 failure is an

unexpected hiccup in the SpaceX success story. How this could impact

the potentially lucrative U.S. national security launch market is

yet to be seen, but here SpaceX already faced steep competition from

incumbent ULA.

Despite being the newest entrant to the commercial launch market,

a low price and thus far good reliability have meant no trouble in

winning commercial contracts. NSR’s

Satellite Manufacturing and Launch Markets, 5th Edition, found

that SpaceX enjoyed 21% market share of commercial GEO backlog at

the end of 2014, a 5% jump over 2013. However, losing the position

of rookie star does not denote corporate disaster. Indeed, the path

to becoming a seasoned launch veteran inherently includes

challenges; the ability to promptly identify the cause of failure,

resolve issues, and return to flight is a step along the way.

The Falcon 9 now has a 5-year reliability rate of 89% compared to

100% and 85% for main commercial competitors Ariane 5 and Proton,

respectively. The key difference that operators will draw between

SpaceX’s failure and the Proton loss in May is the frequency of

failure: though the reliability rates are similar, the Proton has

experienced 4 complete and 4 partial failures in the last five

years, compared to just 1 complete and 1 partial for the Falcon 9.

Pending final conclusions of the technical review board, the SpaceX

cause of failure could be viewed more favorably than Khrunichev’s

consistent quality control issues. NSR therefore does not foresee

SpaceX suffering a material loss of future business as a result of

this event.

Hands Tied for Commercial Satellite Industry

At the start of 2015, 32 commercial GEO satellites were scheduled

to launch by the end of the year. Half way through, a mere 8 have

successfully launched and no more than 21 are expected to reach

orbit before 2016. These Proton- and Falcon 9-driven delays,

alongside postponed commercial LEO and government GEO/LEO missions,

will have knock-on effects into the 2016 and 2017 manifests of both

vehicles. Without Proton or Falcon 9 in operation in the near term

and catching up after a return to service, do operators have any

recourse?

In NSR’s view, not much. Arianespace is operating at full

capacity. Sea Launch has been quiet of late on plans for a vehicle

or launch site adjustment, but in 2014 had cited an ability to

conduct GTO launches in 2015 or 2016 with sufficient client notice.

MHI and Lockheed Martin are similarly under-booked for commercial

launches, but given government obligations do not have a manifest

that can accommodate additional clients in the next year. China

Great Wall Industry Corp. remains out-of-bounds for most commercial

payloads, and is also experiencing delays.

This emphasizes the importance of maintaining multiple vehicles

and launch service providers as viable market players. Operators

reference three LSPs as the minimum for a healthy market, but over

the past two decades the market has supported only two primary

players with an occasional tertiary player. The challenge is that

higher reliability and lower costs are associated with frequent

launches of a given vehicle, but the global market remains low

volume to the extent that not all LSPs operate at optimal rates.

Further, satellite operator contracting practices only occasionally

support market diversity in lieu of best mission value for the

company.

Bottom Line

Occasional launch failures are an expected, and even inevitable,

element of space utilization. Sunday’s Falcon 9 failure is a

momentary stumbling block that will impact clients in the near term

but should not lessen SpaceX viability in the long term if the

technical review is appropriately pursued.

Rather, the real implications of this failure are not for SpaceX

or even affected clients but in how commercial operators will

respond to experiencing two GTO vehicles out of service

simultaneously. The long expressed desire to have a distributed

launch services market could be more seriously pursued in coming

years. Diverse technologies are being realized to solve trapped

capacity in orbit, perhaps operators will now explore more solutions

to freeing trapped capacity on the ground.