Are “Walled Gardens” the Key to Volume-Centric Maritime

Markets?

Jun 22nd, 2015 by

Brad Grady, NSR

In the coming years, a key challenge for maritime service

providers will be to turn the “volume markets” (by number of

vessels) of merchant shipping or commercial fishing into valuable

market segments on a per-vessel basis. Scale obviously rules

in these segments now in terms of revenue generation, with more

boats equaling more revenues – but, are the tides turning and how

quickly can we expect to see the seas change?

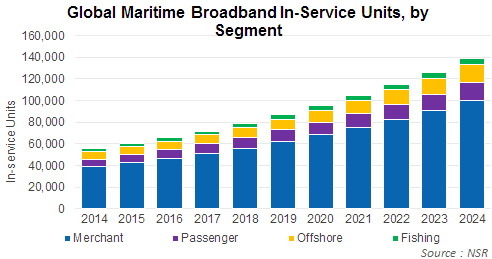

According to NSR’s Maritime Satcom Markets, 3rd

Edition 7 out of 10 broadband terminals (both MSS and VSAT)

will be in merchant shipping. The segment will be one

of the largest sources of retail revenues for service providers, but

with a large number of service providers competing in the space for

a large number of vessels, the real measure of success will

be to steadily increase the amount of value per vessel.

Some steps are easy – Electronic Charting (ECDSIS) is largely a

mandate across the merchant fleet, and we’ve already seen a number

of offerings aimed at solving that problem. Others, like crew

welfare, are a bit more nebulous in terms of what and how those

problems can be monetized. Others still, like remote

monitoring of onboard equipment, have clear pay-offs, but execution

presents even more complications between end-user, service provider,

and equipment manufacturer.

All of these really boil down to if service providers need to

develop a ‘walled garden’ approach to developing and deploying

value-added applications. By that, should service

providers develop their own ecosystem of value-added services that

are built and optimized for their own networks and equipment, or

become an application developer who also happens to provide end-user

connectivity? With service providers continuing to

purchase value-added providers, it would seem that the market is

leaning towards owning the network and the application. But as

these applications mature, and the cost of bandwidth decreases with

the introduction of HTS, are we going to see a Netflix-Verizon “Pay

for Access”-style problem develop within the maritime satcom market

as service providers try to encourage adoption of their own

value-added offerings?

While a long way off, all the pieces are in place for such a

system to quickly develop as we saw in the terrestrial consumer

broadband market. Service Providers own the last-mile

customer, and end-users are looking to bring more data to/from the

vessel to solve their problems (and don’t necessarily want to

develop the solutions themselves.) And, each year we continue to

see more and more applications enter the market aimed at solving

problems within the merchant maritime market. In short, as the

entire maritime SATCOM industry is quickly moving from the ‘Internet

café’ to ‘BYOD’, how is the industry going to respond to

“BYOA” – Bring your own App?

Bottom Line

Will the maritime industry really see similar deals as JetBlue/Exede

and Amazon Prime in the aero world? Perhaps, as KVH and

Inmarsat recently announced a deal to distribute KVH’s Videotel

offering to Inmarsat customers over Inmarsat’s network. And,

one can imagine there are similar deals in the works that will turn

service providers into ‘application developers.’ The real

question still remains to be answered – Does the application

sell the connectivity, or does the connectivity enable an

application (and does it matter whose application)?