Are OTT Concerns Over the Top?

Jun 9th, 2015 by

Alan Crisp, NSR

OTT seems to be wearing on the minds of many these days.

DTH and Cable TV platforms are perhaps the most threatened, given

the rise of OTT video products and the potential to reduce revenues

for video platforms and satellite operators alike. However NSR’s

latest report on the satellite video markets, Linear TV via

Satellite: DTH, OTT & IPTV, 8th

Edition finds that much of this concern is

unwarranted, with a few exceptions.

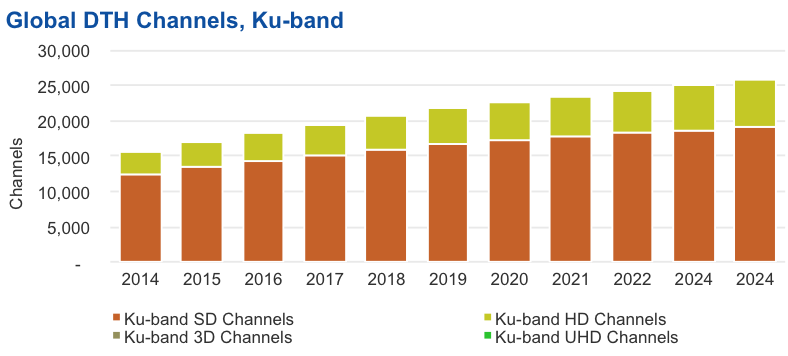

NSR forecasts that globally, DTH channels will increase to over

26,000 by 2024, representing a 67% increase over channel counts in

2014, with similar trends for both C-band and Ku-band video

distribution. This corresponds to 438 transponders of additional DTH

capacity required to handle this growth with a further 343

transponders for video distribution for Cable and IPTV headends.

The plethora of options for consuming video content has never

been higher, including (but not limited to):

ouTube

Netflix, now available in 80 countries worldwide, along with

similar service

Youku and iQiyi in China

OTT platforms provided by DTH and cable platforms

However, NSR found the rising OTT presence represents a growing

video market pie, rather than cannibalization of revenues. Instead,

cannibalization is in the form of viewing time, with consumers

spending less time viewing linear content and more on OTT content.

However, this doesn’t correlate to cord-cutting in most instances,

with the exception of the United States where a number of variables

have lined up to cause subscription cancellations to occur:

An existing very high pay TV penetration rate

Pay TV is a high cost as a percentage of income for many

households, whereas in many other regions, low income households

have never signed up for pay TV services

Plethora of options for OTT platforms, both free and paid

A home-grown advantage for OTT, as high percentage of high

quality content is produced in the U.S.

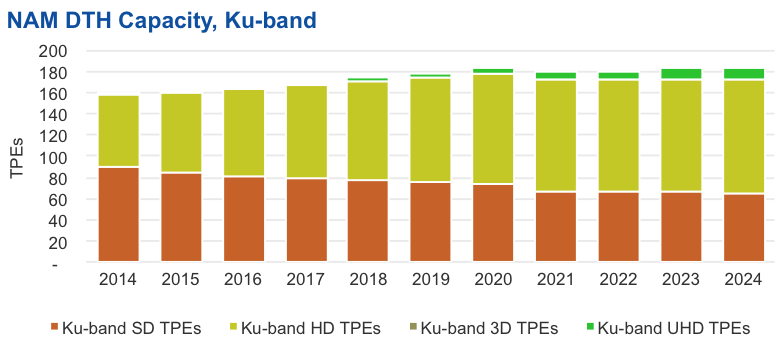

As a consequence, NSR expects leased DTH capacity growth in North

America to remain fairly soft over the next decade.

However, OTT is not a major cannibalizing factor elsewhere, where

there is insufficient incentive for consumers to cancel their pay TV

subscriptions, as much higher quality local content is available for

lower cost, and the lack of maturity of many OTT services and

oftentimes broadband (a key to solid OTT). Further, as economic

development expands in many developing regions, large numbers of

consumers are signing up for pay TV services for the first time,

boosting revenues globally. Instances of this include India,

Indonesia, and Brazil, with India having overtaken the United States

in 2014 for largest DTH market by total subscribers, for example.

Even with OTT acting as a form of complimentary competition,

there still remains significant DTH and cable growth opportunities

in most regions, which appear sustainable for a decade or more. For

instance, the Pay TV market in large parts of Sub-Saharan Africa

remains largely unregulated, with piracy being a major issue,

particularly with STBs flowing from South African DTH platforms to

other parts of the continent.

Some DTH platforms have been able to capitalize on OTT content to

expand their subscriber base and overall revenues, such as Sky

Deutschland and Sky Italia, and this is a trend which NSR expects to

become more prominent. Sky Deutschland (for example) saw their

largest subscriber increase ever in terms of total number of

subscribers in 2014.

And much longer term, after Internet connectivity and OTT become

much more ubiquitous, there is likely to be a trend for quality over

quantity for Linear TV content, including significant added capacity

from the higher bitrate UltraHD format.

Bottom Line

Although OTT is perceived as a fierce threat, in reality the

overall video market pie is increasing, rather than there being

cannibalization of Linear TV revenues in most regions. However, this

shouldn’t mean that video platforms should stay still. Rather, video

platforms will need to diversify to have an OTT product and become a

part of the continually expanding video market pie. 2015 is really

the beginning of the growth curve for OTT, and if traditional

platforms don’t step up and offer their own OTT products, their

dominance long term may be taken away by those who do.