Bridging the Mobile Broadband Gap

Jun 8th, 2015 by

Jose Del Rosario. NSR

Mobile broadband is no longer a “nice to have” for users

worldwide, especially as mobile device usage explodes in all regions

(just reference Cisco). However while mobile broadband demand

is undeniably ever on the rise, a divide persists between developed

and developing countries, mainly as a result of deployment costs and

business case issues. And here, Universal Service

Funds (USF) and satellite technology have a huge role to play.

ITU Data Highlights the Divide

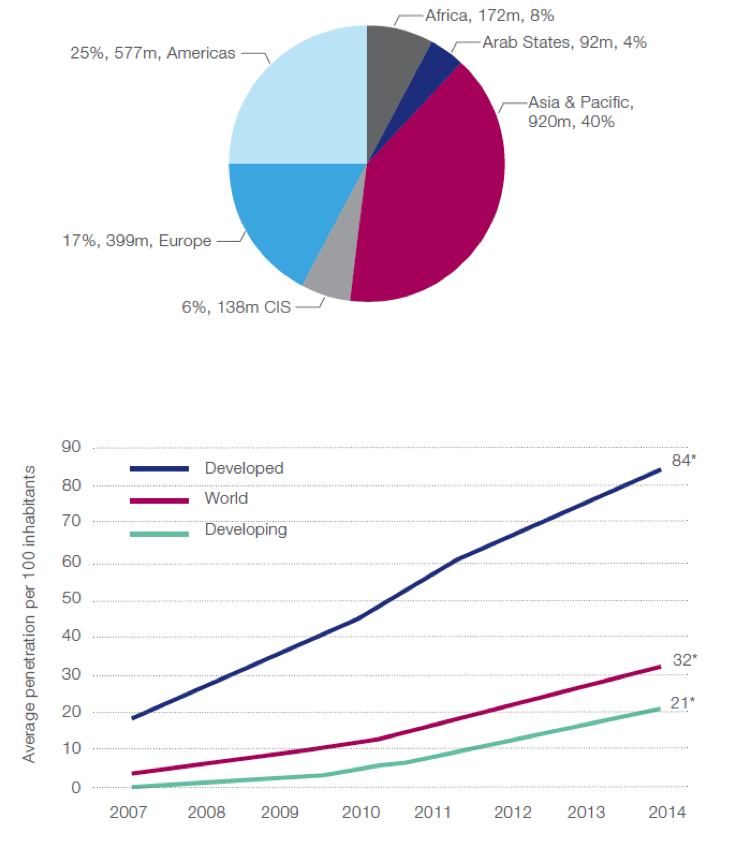

According to the ITU/The Broadband Commission report, there gap

between developed and developing countries (in terms of mobile

subscriptions) is significant. The “32” global average is

influenced by the average penetration of developing countries, which

stands at “21” compared to “84” for developed countries. Basically,

this means there are more non-broadband subscribers in the globe

compared to broadband subscribers. And this also means that

there is a huge market waiting to be tapped to upgrade narrowband

mobile subscribers to broadband mobile subscribers.

Status of Mobile Broadband: Geographical

Distribution of Mobile Broadband Subscriptions by Region and

Evolution of Mobile Broadband, 2007-2014

Source: ITU/The Broadband Commission Report: “The State of

Broadband 2014 – Broadband for All”

Satellite wireless backhaul from a technology standpoint can

bridge this gap or tap this large market, yet satellite platforms

have been traditionally relegated to 2G and 2.5G services.

Satellite technology, which is arguably the best fit for covering

large geographic areas of developing and impoverished countries has

been and still supports basic mobile services including voice and

texting or narrowband messaging. Costs of satellite platforms

have been prohibitive in terms of addressing the low ARPU levels

that rural area customers of developing country markets can afford.

But consider terrestrial microwave and other solutions face the same

hurdles. Following pure market dynamics in bridging

the gap obviously does not work and will likely remain so over the

long term for all technology platforms.

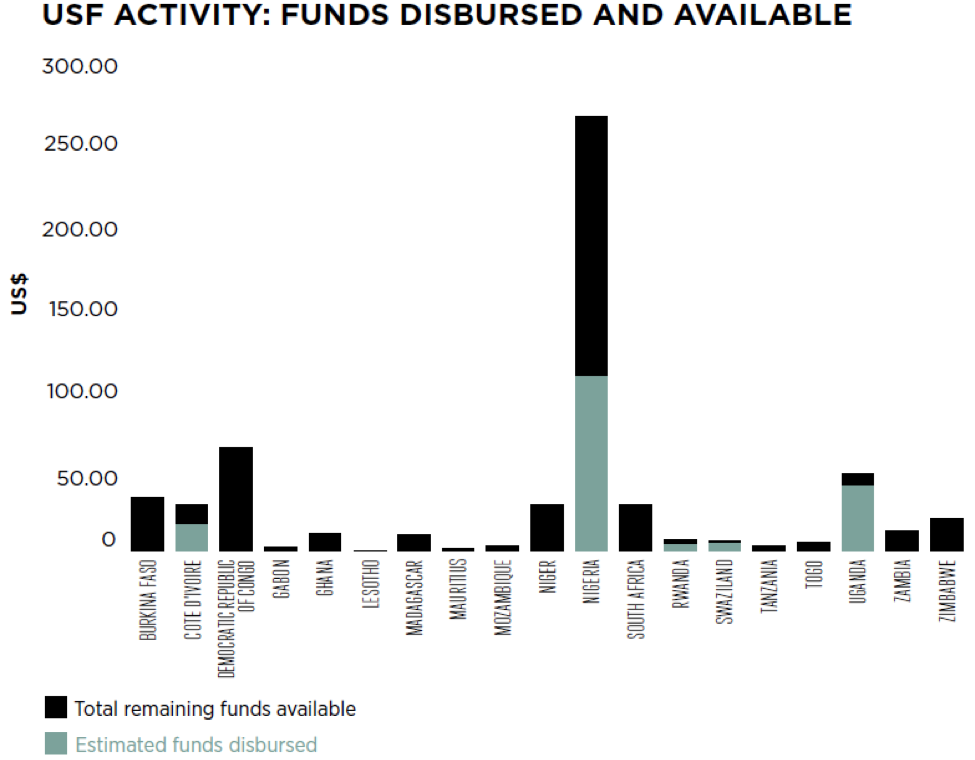

Source: Report prepared for GSMA by Ladcomm

Corporation, September 2014

Are USFs Part of the Solution?

So the key question is - How will 3G/4G services be

enabled by regions that need it the most? Or how can this large

market potential be realized? Let’s take Sub Saharan

Africa. Although satellite technology is available to provision fast

broadband speeds, ARPU levels in rural areas do not justify

investments by mobile telcos. This situation has been

pervasive for decades; however, the answer could lie in Universal

Service Funds (USF). We say could because these funds

have been available for years, but the funds are not being spent.

According a GSMA study (note the chart above), “19

of the 23 USFs covered contained more than US$400 million waiting to

be disbursed. “

Contrast this with developed countries such as the United States

where according to the FCC, Phase I of the Connect America Fund has

authorized nearly $440 million in funding to serve over 1.66 million

previously unserved individuals in 45 states and Puerto Rico. Phase

II of the Connect America Fund aims to bring broadband service to

Americans living in rural areas lacking broadband through a

combination of wireline, fixed wireless and satellite technologies.

Moreover, in April 2015, the FCC offered the nation’s largest price

cap telcos $1.7 billion annually for six years to bring broadband to

parts of their service territories where broadband is not available

currently.

3G via satellite has arrived, and satellite players

within the mobile ecosystem are beginning to trial 4G/LTE systems as

well. Even better news is that next-generation

programs such as O3b have been launched and other offerings such as

Intelsat EpicNG will be launching soon as well. These programs

are aimed at providing services to Brownfield and Greenfield

developing country markets where the need for mobile broadband

connectivity should bridge or at least narrow the gap between

developed and developing countries.

In its latest market research report,

Wireless Backhaul via Satellite, 9th Edition

NSR forecasts satellite in-service units to move past 2G/2.5G

installations by the 2019 timeframe. By 2024, 3G/4G will be

the dominant platform being served by satellite backhaul and even 5G

solutions should be available to wireless telcos as well. The

value proposition or the “game change” being offered by HTS is to

decrease the cost of Megahertz or Mbps, thereby dramatically

improving the OPEX equation.

However, although the costs have and will continue to improve,

ROI can only be maintained with a subsidy in place. In other

words, the move from 2G/2.5G to 3G/4G/5G can only happen in

regions such as Sub Saharan Africa if USF is spent as part of a

subsidy that allows for positive ROI. HTS based purely on

market dynamics is not enough to bridge the gap.

Bottom Line

Satellites have been relegated as the last resort for connecting

users in rural, remote and far-flung areas. The business case

has not been supported or justified purely on commercial metrics due

to the low ARPU level feature of these communities. With

next-generation satellite technologies that support lower cost

structures, a business case is beginning to be built that generates

reasonable ROI for wireless telcos to go into Greenfield markets as

well as improve the service level of Brownfield or existing

customers.

However, the market dynamics and the economic outlook of

poor rural populations will not change overnight and there

are certainly other serious challenges being presented in terms of

provisioning mobile broadband services to rural communities.

CAPEX, content generation, application requirements, equipment

costs, rural electrification and other components that go into

deploying a satellite service will continue to restrain investments

and perhaps impact the mobile broadband gap at more pronounced

levels.

Next-generation programs, specifically HTS solutions, will or

should be part of the solution mix that leads to larger deployment

of mobile broadband services to the less affluent citizens of

developing countries. But that is still not enough as it is based on

pure market dynamics. USF needs to be spent and invested by national

governments on mobile programs via satellite in rural areas in order

to dramatically bridge the broadband gap. Moreover, should

Universal Service Obligations (USO) incorporate satellite solutions,

USF and USO combined should lead to a large technology and

economic stimulus that can be part of beginning to bridge the mobile

broadband gap. And that is partly how this huge market can be

realized.