Flexibility: A New Paradigm in Maritime Satcom

Jun 3rd, 2015 by

Brad Grady NSR

Growth in onboard applications has added another layer of

complexity to the maritime market, keeping maritime fleet IT

departments busier than ever. To make their life easier, the

satellite industry has integrated flexibility in network services

and operations, but is it enough to answer the growth in bandwidth

demand?

Within the satcom industry, service providers, satellite

operators, and hardware manufacturers are all undergoing a shift in

how satellite communications networks are designed, and deployed.

At the forefront of that change, and most visible to end-users, is

not only the migration from MSS to VSAT, but the introduction of HTS

services.

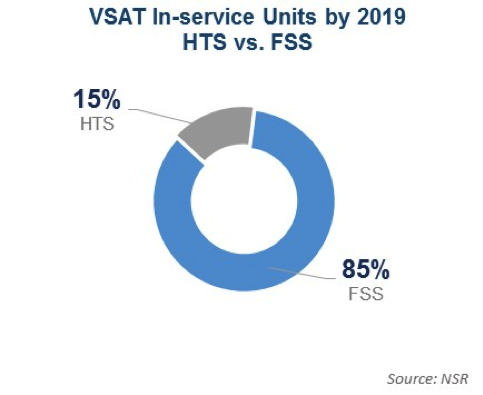

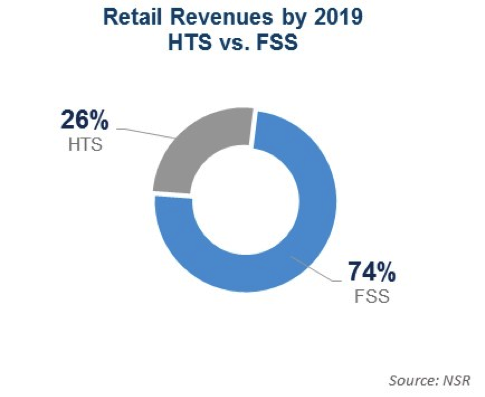

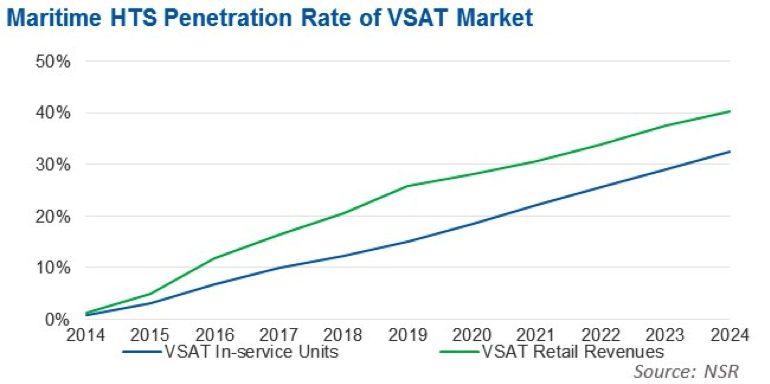

According to NSR’s Maritime Satcom Markets, 3rd

Edition over the next five years, over 4,000 HTS terminals will

enter the market, generating almost $450 million in VSAT retail

revenues for service providers. Compared against FSS markets,

in 2019 HTS will account for 15% of VSAT In-service Units, and 26%

of VSAT retail revenues.

That difference between In-service units and retail revenues in

the VSAT market is not because ‘new technology is more expensive’,

but that in the first five years, there will be higher-end customers

migrating towards HTS offerings and consuming larger amounts of

bandwidth, such as Royal Caribbean and O3b. However, with new

capacity coming online over the next five years and new technologies

changing the hardware landscape, the following five years are poised

for heavy growth in HTS-based offerings, but with a closer balance

between HTS In-service Unit market share and HTS Retail Revenues.

As end-users focus more on deriving value from the applications

and the ‘connected ship’, everything is on the table. From route

optimization in merchant shipping to improving seismic data handling

in the offshore sector to connecting the next wave of social media

apps in the cruise industry, the focus has turned towards

the applications. It will be these applications and

services that help push FSS (and HTS by association) into new

markets and vessel profiles.

Yet, the promise of HTS and the ‘connected ship’ has brought

challenges into the Maritime VSAT markets. Service providers

need capacity where their customers are, which becomes an extremely

complex equation with spot-beam-based HTS capacity. The answer

traditionally has been a closer relationship of the satellite

operator into the day-to-day management of end-user bandwidth.

We have already seen those ecosystems develop in the

consumer-broadband markets with ViaSat, Eutelsat, Hughes, etc.

Inmarsat with GX is another example for the mobility markets.

And, maybe even Intelsat is moving towards that model in their own

way with the recent announcement of their IntelsatOne Flex service.

Although still remaining an offering for service providers to

avoid some of the negative cost economics on their end (fewer hub

equipment required, etc.), one has to ask the question: What if

multiple high-end vessels are under the same spot-beam, but served

by different service providers? How much traditional FSS wide

beam capacity will need to be dedicated by Intelsat to allow service

providers to meet their SLAs with their customers (and who needs to

own it)? And, whose responsibility will it be to ensure any

transition happens seamlessly to the end-user? In other words,

is Intelsat’s new offering the closest approximation to a

scalable ‘infrastructure-as-a-service’ that service

providers can expect in the mobility space? With the

elasticity coming from FSS capacity, can we expect other satellite

operators with hybrid FSS and HTS satellites to follow?

Are other satellite operators likely to announce similar services

for mobility markets? The answer leans heavily towards “yes”.

However, that also does not mean the ‘traditional role’ of

service providers will be extinct. There are myriad

possibilities of how to operate in a hybrid environment, where just

as we’ve seen in traditional ‘cloud environments’, the right mix is

a little of owned infrastructure in high density areas, and access

to flexibility to buffer demand/supply. The real

question is if Intelsat has created a de-facto ‘closed ecosystem’

within its fleet, or if service providers and ‘Flex-enabled

vessels’ will still have a choice of satellite operator using the

same equipment.

Bottom Line

Intelsat’s recent announcement of their “Flex” service reminds us

of one thing – innovation behind the scenes is just as

important as innovations the customer can see and feel.

These days, maritime end-users do not need/want to be

bothered with the nuts-and-bolts of satellite communications – with

the onslaught of onboard sensors, remote monitoring, crew welfare

concerns, and health/safety regulations - the applications

themselves are occupying the time of end-user’s IT departments.

But, the jury might be out as to if this and the other likely

hybrid-infrastructure models have solved more questions than

answers. If nothing else it has helped simplify the

conversation between service providers and end-users which is the

ultimate goal, right?