SD Still King in High Growth Regions

May 27th, 2015 by

Alan Crisp, NSR

NSR previously noted that the DTH market is undergoing a great

divergence. Whilst in developed regions, UltraHD is poised be the

next big revenue driver, the fastest-growing developing markets tell

a very different story.

Sharp has now released 4K TV sets for under $600, and with all

the continued talk about UltraHD, one would be excused from thinking

that the transition to HD broadcasting is nearing its end, making

way for the future of UltraHD broadcasting globally. However, NSR’s

most recent study, Linear TV via Satellite: DTH, OTT and IPTV, 8th

Edition, finds that despite the hype, Standard Definition

(SD) still has strong growth potential in developing regions.

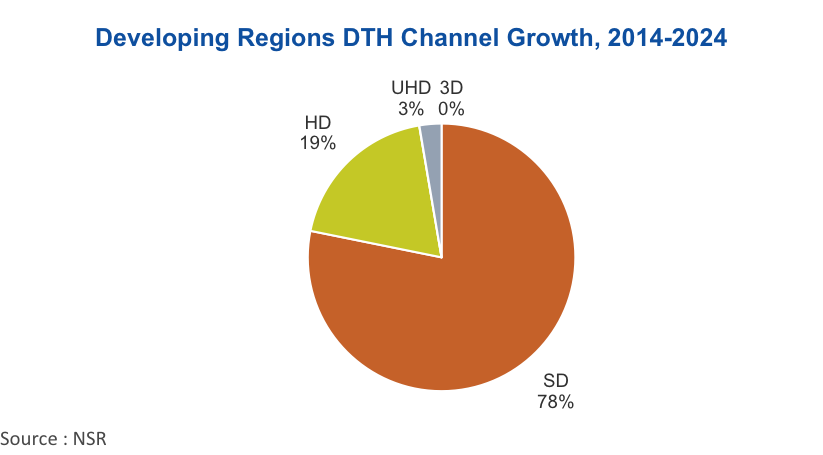

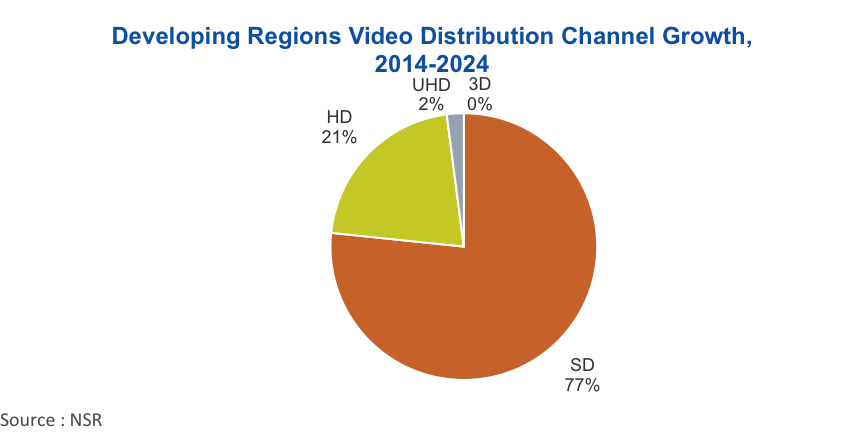

When looking at developing regions (defined here as Central and

South America, Middle East/North Africa, Sub-Saharan Africa, South

Asia, and Southeast Asia), the number of DTH channels available to

consumers is expected to show strong increases to 2024, from

approximately 7,300 to just over 12,700 DTH channels. Of the

nearly 5,400 channels to be added in these regions to 2024, over 78%

will be Standard Definition, with similar trends for Video

Distribution.

In more developed regions such as North America, growth

is primarily derived through increasing ARPUs. This results

in a transition from basic to premium channel packages, and a

reduced SD TPE capacity of -3.1% CAGR from 2014 to 2024 for DTH and

flat growth for video distribution. However, in developing

regions, growth is primarily driven by increasing subscriber numbers,

resulting from increased economic growth and households purchasing

their first TV sets.

Meanwhile the UltraHD market in developing regions has

accelerated with Indian DTH platforms Videocon d2h and Tata

Sky launching their first UltraHD channels. The set-top boxes for

this service will cost around US$100 for subscribers, which, it

should be noted, is several years of a basic subscriber’s ARPU.

Other platforms, such as Kino Polska TV in Poland, have announced

their intention to deliver UltraHD channels to consumers. Although

these new channels will introduce new revenue streams for both DTH

platforms and satellite operators alike, it will still remain

dwarfed by the giant of SD content.

Whilst the SD format uses significantly less bandwidth to

broadcast than HD channels, a sizable over

40% of satellite capacity growth in developing regions is attributed

to the growth in SD channels, showing the critical

importance of the SD DTH market, which should not be overlooked.

Bottom Line

Developing regions have the highest growth rates worldwide for

linear TV platforms, and in these high growth regions, the greatest

demand for TPEs is still coming from growth in the number of SD

channels available, despite the current hype for UltraHD. While the

upper to upper-middle class in these developing regions will keep

demanding more HD and UltraHD content, for the majority of the

population, there is far greater value in having a greater selection

of content available. This is number one driver of growth in the

developing regions, and satellite capacity will follow this trend

moving forward.