Dawn of the ‘Friendly’ Unmanned Aircraft Systems

May 13th, 2015 by

Prateep Basu, NSR

There is no questioning the rise of Unmanned Aircraft Systems (UAS)

worldwide, and their recent use in Nepal after the recent earthquake is

another sign of the UAS surge. A widely untapped aspect of UAS,

civilian government applications such as homeland

security, border protection, scientific experimentation, environmental

monitoring, and peace-keeping missions (to name a few) are being

increasingly performed on are highly capable platforms like the

Predator, Global Hawk, and Heron. The big question that satellite

operators should ponder against this backdrop is – how will it impact

satellite services, for both communications and Earth Observation?

Will these UAS compete with, or be a complement to, or a

customer of satellite services?

Scenario 1: As Complement AND a Competitor

The use of UAS for communication relay is well understood, and

architectural studies have been conducted for integrating stratospheric

UAS with LEO and GEO communication satellites for localized high quality

service. Despite none of these studies leading to implementation, the

announcements and investment by Internet companies such as Facebook and

Google in High Altitude Long Endurance (HALE) UAS for data connectivity

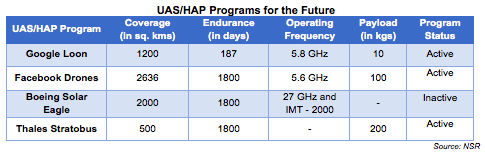

globally has generated renewed interest in this concept. The table below

lists a few popular UAS and High Altitude platform (HAP) programs that

were in the spotlight lately. These UAS can complement and compete with

satellite and terrestrial networks for data and voice communications at

the same time, by acting as a backhaul service for LTE networks.

Given the payload capability, these UAS can also be used as a means

of imaging narrow and wide corridors. Such applications are already

popular in the civilian and commercial value-added EO imagery markets of

Europe, where UAS imagery is used as a complement to medium to high

resolution satellite based imagery.

Scenario 2: As a Customer

The U.S. has taken the lead when it comes to civilian government use

of UAS, with its Border and Customs Forces operating a fleet of 9

Predators, operating in Ku-band and covering from the eastern Pacific

Ocean to the Caribbean. The U.S. Coast Guard and the U.N. forces also

fly HALE and MALE UAS for imagery, communication relay, and live video

broadcasting applications. Israel has used its Heron and Searcher UAS

for border protection since the late 1990s, and other countries have

ramped up buying such UAS, quoting similar civilian government usage.

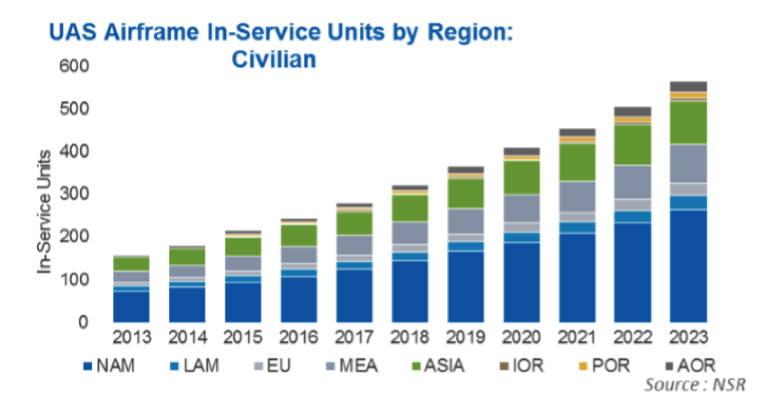

NSR’s

Unmanned Aircraft Systems via Satellite report forecasts the number

of civilian UAS Satcom units to grow three-fold by 2023. The

maximum growth is expected to be observed in North America, follow by

Asia and Europe, where military UAS units, after completing their

stipulated flight hours, are expected be moved for civilian government

use.

Most of these UAS are expected to continue using Ku-band for

communications as changes in airborne and ground satellite

terminals to higher frequency bands are expensive and beyond the budget

allocation for civilian government UAS operations.

Bottom Line

UAS can be a competitor, customer, or a complement to satellites,

depending on the application for which they are used. The growth in

military UAS is expected to spillover to civilian government use, both

over land and sea. These high performance UAS platforms

provide governments ‘quick action’ capabilities for various civilian

purposes, most important being emergency disaster management operations

and homeland security. As these civilian uses of UAS gain popularity

globally, it presents an opportunity for commercial satellite

operators to capitalize on, due to the expected continued use

of FSS Ku-band by these platforms.

| |