Versatility in Satellite Manufacturing

by Carolyn Belle, NSR

A peek into the RFPs issued to prime satellite manufacturers over the

last year quickly shows how far the industry has come from the

cookie-cutter satellites of past decades. Similarly, manufacturer

portfolios have developed into a diverse set of options that enable an

operator to tailor the spacecraft to their unique demands more than ever

before.

In some ways this is the natural evolution of a market that only

began in earnest 30 years ago. Yet the fact remains that end-user

markets coupled to CAPEX determine commercial satellite design, and it

is these factors that are currently driving versatility in the satellite

marketplace. Traditionally, end-user markets have been stable enough to

satisfy the operator and investors that a satellite designed today,

launched in 3 years, and retired in 18-20 years would be able to address

a profitable market for the duration of its service life. Today the

story has changed. Given the rate of global development, operators now

face both rising competition and declining certainty in the longevity of

target markets, leading to fear of trapped capacity as demand shifts

regionally or to new applications.

As a result of this uncertainty, NSR’s Satellite Manufacturing and

Launch Services, 5th Edition established a

convergence between manufacturers’ provision of a broad tool-belt of

capabilities with operator willingness to adopt non-traditional designs.

A trend is emerging for operators to blend technologies in unique ways

and co-locate different payloads to address multiple markets with a

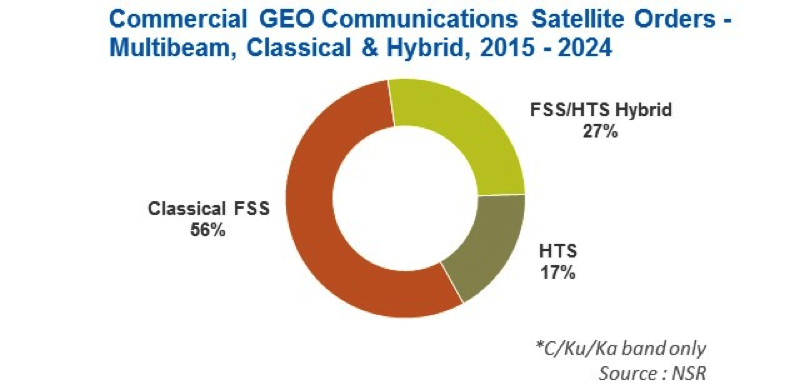

single satellite. During the 2015-2024 period, 44% of commercial

GEO communications satellites are expected to adopt HTS or hybrid

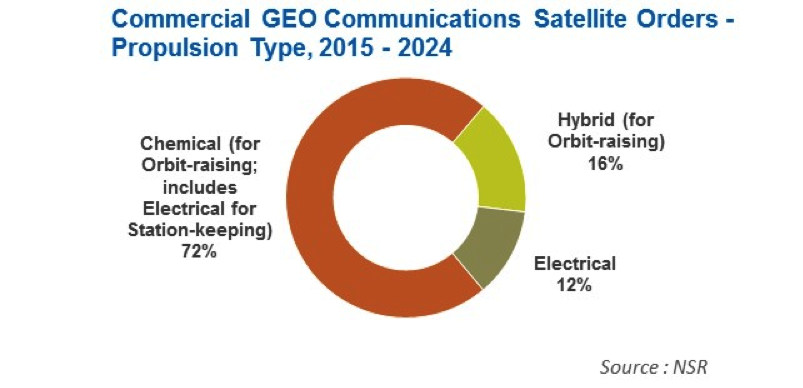

HTS/FSS payloads. Over the same years, 28% of commercial GEO

communications satellites will use hybrid chemical/electrical or full

electrical propulsion in lieu of the traditional chemical-only.

Even as these technologies mature, the next phase of

capability diversification has already emerged as on-board flexibility

– an overarching concept that includes components already developed but

rarely employed as well as entirely novel technologies. On-board

flexibility, in the form of steerable/reconfigurable beams to redirect

coverage, multi-point amplifiers to reallocate power, or on-board

processors to dynamically manage traffic, has become more valuable in

light of the challenge to ensure high fill rates throughout a satellite

lifetime. 2015 contracts have already highlighted these trends: the

first commercial GEO communications contract of the year, between New

York Broadband LLC and Boeing, included steerable beams and

reconfigurable power. A mere month later, SES contracts with Airbus

Defence & Space for SES-14 and SES-16 each included an element of

on-orbit flexibility (digital processor and steerable beams,

respectively).

This growth of on-board flexibility and combination of many flexible

sub-systems and components into a single highly adaptable satellite

could become an important turning point in design, transitioning from

ground customization to in-orbit customization. Procurement of the first

Quantum satellite between Eutelsat and Airbus Defence &

Space/SSTL is expected later this year, promising to take one step

closer to such a software-defined satellite.

Despite widespread interest, the key stumbling block of the

flexible marketplace remains the tradeoff of price with capabilities.

Manufacturers have found creative ways to introduce new tools and

flexible components at low or no added cost, but many feasible

capabilities lay beyond today’s operator-acceptable price points. While

previous reticence to pay a premium for added flexibility could be

approaching a turning point, cost will remain the main

complication moving forward.

Bottom Line

As operators continue to seek ways to ensure their satellites remain

relevant long after design and launch, manufacturers will be challenged

to provide ever more options and a balance of ground and space

customization – at the right price. The ongoing exploitation of HTS

payloads and electric/hybrid propulsion, alongside growing prevalence of

on-board flexibility, will build the foundation for a flexible

architecture of assets that can be compiled and recompiled in different

ways to address shifting demand and opportunities. Operators who invest

in such capabilities will be better equipped to adapt to changing

markets and new competition.

| |