LEO HTS Constellations: “What Happens If…”

Mar 23rd, 2015 by

Prashant Butani, NSR

The LEO Constellation Ecosystem

OneWeb, SpaceX and LeoSat seem to be taking on, or at least

complementing, Cellular & Fiber in terms of trying to marry the reach of

LEO satellites with the price per bit approaching terrestrial offerings.

Announcements over the past few weeks peg total system capacities

between 0.5 and 10+ Terabits for investments ranging from $2 Billion to

$10 Billion. A long standing question about CPE prices seems to be

generating answers within the $100 to $300 range for a Metamaterials

antenna that is still some time away from availability. Nonetheless,

with speeds of anywhere from 50 Mbps to 1.2 Gbps being offered to the

end user, it seems that entrepreneurs, and investors, have woken up to

the idea that LEO satellites are the answer to deliver

a global service with terabits of capacity.

…And Terabits It Is!

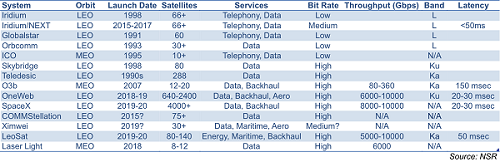

The table above clearly shows that anywhere from 20-30 MEO satellites

and 30 to ~5,000 LEO satellites can possibly launch into these two,

relatively untapped, orbits in the next decade. As an analyst and

strategic advisory firm trying to pin down the satellite market, NSR

observes a change in satellite capacity supply of an order of magnitude

never seen before. NSR’s VSAT and Broadband Satellite Markets, 13th

Edition and Global Satellite Capacity Supply & Demand, 11th

Edition reported that a total of 2.5 Terabits of High Throughput

capacity would become available by 2023; this figure only included GEO

and MEO HTS. This figure also does not include the hundreds of

transponders worth of traditional FSS capacity. Nonetheless, the quantum

leap that was taken over the last 5 years from a few Gigabits (widebeam

FSS) to hundreds of Gigabits (GEO HTS) may very well be repeated when

LEO HTS satellites change the goal posts from hundreds of

Gigabits to tens of Terabits of capacity. NSR’s VSAT &

Broadband study estimated nearly 1 Gbps of demand for broadband

services, but if price per bit comes down significantly, that

demand curve for Enterprise VSAT and Consumer Broadband will get more

exponential very quickly.

But What Happens If…

Scenario 1: Only One Constellation Launches

With satellites ranging from a minimum of 80 (LeoSat) to a maximum of

4,000 (SpaceX) it would be safe to say that even if one constellation

launches, it could mean a pretty sizeable order to a “prime" satellite

manufacturer (SpaceX intends to manufacture in-house). With a maximum of

17-20 launchers in service, averaging 75-80 launches per year to GEO and

LEO combined, launching even one constellation will put severe pressure

on the rocket supply chain. The total cost of any one system is easily

in the Billions of dollars, and the last time such a significant

investment was made on one constellation (Iridium) it ended up being

sold post financial woes for a fraction of the original investment cost.

Bottom line is that even one constellation presents

challenges and the TCO of the system is high, which could

prevent bandwidth costs from coming down to a few dollars per megabit

range. What this does to Enterprise data applications on FSS satellites

is offer them an alternative to GEO HTS that they can either grow

incrementally towards (i.e. from GEO HTS to LEO HTS) or simply

leapfrog by going from widebeam FSS directly to LEO HTS.

Scenario 2: All Constellations Launch

Now if one looks at the absolute maximum, some very serious questions

start to emerge. How does an industry build and launch ~5,000 satellites

even if they are much smaller than the traditional GEO COMSATS? With the

same 17-20 active launchers, averaging the same 75-80 launches per year

to GEO and LEO combined, launching all constellations in a 2 to 5-year

window seems near impossible. NSR estimates that if all constellations

do go ahead as planned, we are looking at capacity of the order

of 20-30 Terabits coming online in the next decade, which is

orders of magnitude higher than the 2.5 Terabits of GEO/MEO HTS capacity

that NSR expected by 2023. The biggest questions on everyone’s mind when

looking at those figures are two-fold:

- Where is the demand to fill up 20-30 Terabits

of supply and generate positive returns?

- Where will the falling price points finally settle

from the hundreds of dollars per megabit today, and will there be a

“race to the bottom”?

Bottom Line

To the average enterprise, the advent of HTS meant they now had

access to a much cheaper cost per bit for their VSAT networks. Some

switched quickly (Retail, Banking etc.), while some took their own time

(Oil & Gas, Mil/Gov etc.), but GEO HTS is clearly here to stay. The next

big quantum leap is LEO HTS and to the enterprise this means putting

plans of changing HTS platforms on hold for a bit and “wait and watch”

what the big guys bring to the table before either leap frogging

to LEO HTS with say OneWeb or LeoSat or growing incrementally with GEO

HTS on EpicNG, NBN and others.

Even if the industry remains divided on whether all this

capacity constitutes a “bubble”, it remains feasible that

20-30 Terabits of capacity could be launched by 2020.

Hypothetically, if all this capacity were available today and sold at

rates of $500/Mbps (equivalent of $1,500-$2,000 per MHz in Ku-band at

1:3 or 1:4 Bits per Hz modulation & coding) it would mean

revenues of the order of $15-$20 Billion, which is 10% of the

entire satellite industry’s revenues as per the 2014 SIA report. Now one

must factor in that only a portion of this capacity can be truly

“commercialized” and only 30-40% of it is over land mass,

not to mention unique landing rights in each country

that make selling this capacity a rather tough problem to solve.

And cost effective antenna technology

required on the ground is far from reality anytime soon, which may be a

larger problem that launching massive volumes of capacity into orbit.

The common belief in the satellite industry that “users need more,

cost effective capacity” is certainly without question; high cost and

scarce satellite capacity have limited growth potential for years.

“Offer users more bandwidth and they will use it”; this trend is

prevalent in every segment of the telecom industry. However,

the true metric for success is return on investment,

and given the high cost of proposed LEO systems, turning a profit in

short(er) order is vital. And, if all of this LEO capacity hits

the market at once, questions remain of how big the addressable market

really is and if revenue generation will be compromised if there is

indeed a “race to the bottom” on prices.

Which of the scenarios mentioned above actually sees the light of

day? The answer, as always, lies somewhere in the middle where out of

the multiple announced LEO constellations, NSR would wager about

2 or 3 actually launch. Even if only one constellation

launches, the leap in capacity and drop in price will most certainly

mean that Enterprise Data and even Consumer Broadband applications on

widebeam FSS satellites will almost entirely migrate to GEO or LEO HTS

thereby leaving traditional GEO COMSATs to become video-only

in the long run. And then, there is always OTT…

| |