Buying Low in Energy Satcom

Mar 25th, 2015 by

Brad Grady, NSR

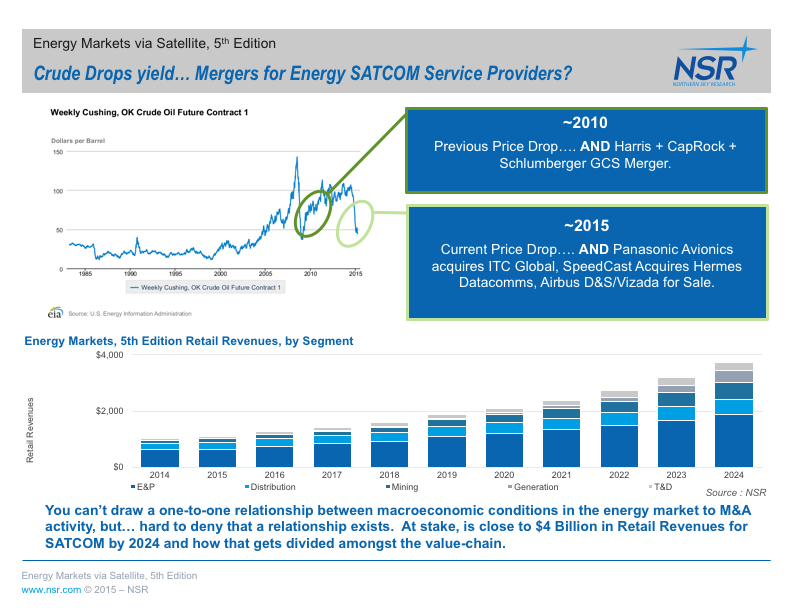

Not since the 2010 merger of Harris-CapRock-Schlumberger GCS has

there been change amongst the larger Energy market service providers.

However, over the past two weeks Panasonic Avionics Corp. acquired ITC

Global, and SpeedCast acquired Hermes Datacomms and Geolink Satellite

Services. Meanwhile, Airbus Defense & Space’s commercial SATCOM service

division (Vizada), which has a strong presence in the Offshore Support

Vessel market, remains for sale. Although it is hard to put a

one-to-one relationship between energy market commodity prices (such as

crude oil or iron ore), it’s hard to deny that there isn’t at

least a casual relationship between them.

As NSR noted in 2011 when the Harris-CapRock-Schlumerger GCS M&A

occurred, the impending introduction of HTS capacity into the

mobility markets is at-part a consideration of ‘buying

end-users’ to increase returns on capacity investments. With the

Airbus D&S/Vizada sale still on the market, service providers

are taking the first steps in expanding market share and diversifying

the vertical markets they serve. For Panasonic, they get

the benefit of levering geographic, frequency, and growth rate diversity

between the core satellite mobility markets – Aeronautical and

Maritime/Energy to further improve their economics of scale to their

extensive HTS footprint. For SpeedCast, Hermes is yet another

company in a steady string of acquisitions over the past months to

increase their presence in the energy sector – and, further increase

their presence outside of Asia-Pacific. With aims at becoming a

‘Top 3 player in the energy services space’ there is still probably some

additional organic and inorganic growth in the SpeedCast playbook.

Looking forward, not only is the M&A activity likely to

continue until the market reaches a new equilibrium around

crude oil prices, but now is the time for service providers to

encourage end-users to look at new technologies to improve operations.

Just as NSR found in its Energy Markets via Satellite, 5th

Edition – the timing of crude oil price collapse couldn’t be

better timed for the satellite sector. As a traditionally

conservative market, energy market end-users were more likely to embrace

the ‘if it aint broke, only change it a little’ approach to acquiring

satellite capacity – add a few (or a few dozen depending on the specific

sub-segment) Mbps over existing systems and maybe migrate from FSS

C-band to FSS Ku-band but, largely wait until HTS options fully mature

before jumping on the bandwidth wagon. Now, O&G end-users

are looking towards improving operational efficiencies (both in

terms of better ‘return’ on their spending, and expanding automation

and/or data-centric processes to their remote operations.) All said,

new offerings leveraging HTS from GEO, MEO, and in the future

LEO, are likely to meet lower resistance from the boardroom

With NSR projecting $4 Billion in Retail Revenues from FSS, HTS and

MSS Satellite Communication services by 2024 from the Energy Sector

(O&G, Mining, and Electrical Utilities), this changing mindset will help

be a key growth driver over the next ten years. For service

providers and the value-chain in general, it also opens the door for

‘non-traditional’ or lower-tier players to compete with the

bigger brand names. Although track record and legacy will

be big hurdles to overcome, the bar has likely dropped a bit

as end-users question ‘what they’ve always done.’

Bottom Line

Although disruption to energy market commodity prices is not a

necessary condition for greater M&A activity in the SATCOM markets…

it is definitely sufficient. Furthermore, as the

market settles into a new equilibrium, expect the door into the CIO’s

office to be open a bit wider to new technologies, and new players than

it might have otherwise. However, the core metrics of

success still remain – right service, right location, right price.

| |