Will UAS Market “Drone” on for Satcom?

Feb 26th, 2015 by

Prateep Basu, NSR

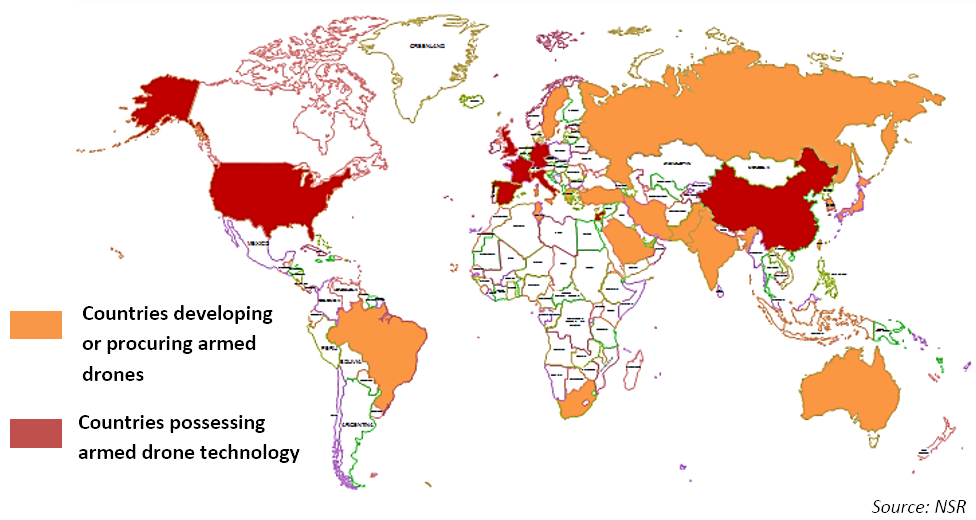

Despite shrinking military budgets, the U.S. DoD’s

plans for unmanned aircraft systems (UAS) will not diminish

anytime soon. Evidence of this trend comes via the recently

unveiled USAF RQ-180 program with Northrop Grumman, or the

involvement of U.S. airstrikes in military conflicts in

Middle-East countries such as Syria, Iraq and Yemen. The

U.S. is certainly not alone in pursuing a military drone program

with countries such as China, U.K., France, India, Japan,

Australia and Italy pushing strongly to develop and procure UAS

capabilities. Given the increasing role of satellites in

supporting UAS activities in all regions, one has to wonder if

this application could be a bright spot in an otherwise troubled

milsatcom market.

HALE UAS, especially the ‘Global Hawk’ and its

naval variant MQ-4C Triton, are the most sought after UAS

globally for their ISR capabilities, and Japan, South Korea,

Australia and India have lined up purchases of this UAS by

2017-18. The U.S., which is the largest producer of HALE and

MALE UAS, recently announced expansion of their sale to

‘Allied Countries’, amidst rising tension in global

trade from Israel and China. As news of an aggressive Chinese

drone export program surfaced, with rumors of UAS sales to Saudi

Arabia, Uzbekistan, Algeria, Pakistan and Myanmar, the developed

world was shaken out of its slumber regarding the prospects of a

deteriorating global peace situation, especially in developing

regions.

Continuing geo-political tensions in the

Middle-East and Eastern Europe have also catalyzed other Western

European countries to stack up the arsenal of UAS, with the U.K.

presently testing its combat purpose stealth drone ‘Taranis’

developed by BAE Systems, and France planning to buy General

Atomic’s ‘Reaper’ drones for $1.5 billion by 2016-17. With Asian

powers such as China, India, Japan, Indonesia already increasing

their defense expenditure to protect their territorial and

maritime sovereignty, the U.S. decision to ‘go soft’ on

allies for sale of combat and strike drones provides a case for

a substantial UAS fleet build-up across the globe in the coming

decade. NSR expects the growth in HALE and MALE UAS

airframes globally to be more than twice that of current numbers

by 2023.

What Is In It For Satellite Operators?

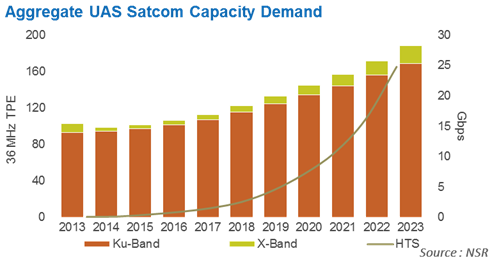

The explosive growth expected in the HALE and MALE

UAS market translates into a major role for commercial satellite

operators to play. As the past decade has shown, satellite

bandwidth for UAS operations is a critical resource that

government satellite programs alone cannot provide. In the

backdrop of the expected increase in the number of UAS airframes

across the globe, NSR’s recent Unmanned

Aircraft Systems via Satellite report predicts that

commercial satellite capacity demand for UAS operations will

increase significantly during the period 2013-23,

with FSS Ku-band leading the way due to the high

latency on the governmental front in overhauling the existing

UAS designs and existing ground systems, which primarily make

use of this frequency band.

With high definition live video becoming the most

sought after UAS application, NSR expects the usage of

GEO-HTS (both Ka-band and Ku-band)

for UAS operations to increase rapidly by the end of

this decade, since it allows higher data rates to

smaller antennas, and its beam characteristics reduce the

chances of signal jamming or cyber-attacks. The combined demand

for Ku-band, GEO HTS, and X-band satellite bandwidth has a

revenue generation potential upward of $700 million by 2023 from

capacity leasing, and close to $2 billion through UAS Satcom

equipment sales for the Defense &

Intelligence markets alone.

The Bottom Line

The proliferation of large UAS platforms across

the globe presents a unique opportunity for commercial satellite

operators to capitalize upon, due to the high revenue generation

potential of this market. NSR expects the role of both

government and commercial bandwidth to increase equally in UAS

programs globally, and that means more demand for satellite.