Internet of Things: Prime Time for Satellite?

Feb 17th, 2015 by

Alan Crisp, NSR

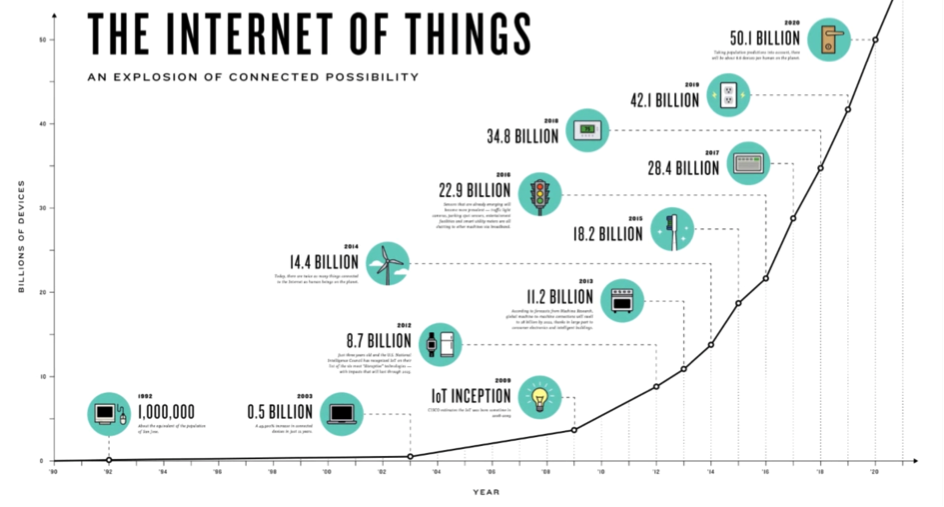

The Internet of Things (IoT) continues to make headlines,

with enormous numbers of devices poised to go online in the

coming years. Huge predictions dominate, for example with Cisco

forecasting that by 2020, there will be an estimated 50 billion

Internet connected devices worldwide, including computers, smart

phones, tablets, as well as the traditional corporate M2M/IoT

and SCADA units. This is massive growth from the estimated

12 billion devices in 2013; but, can satellites grab a piece of

this ever growing pie?

Source: Cisco

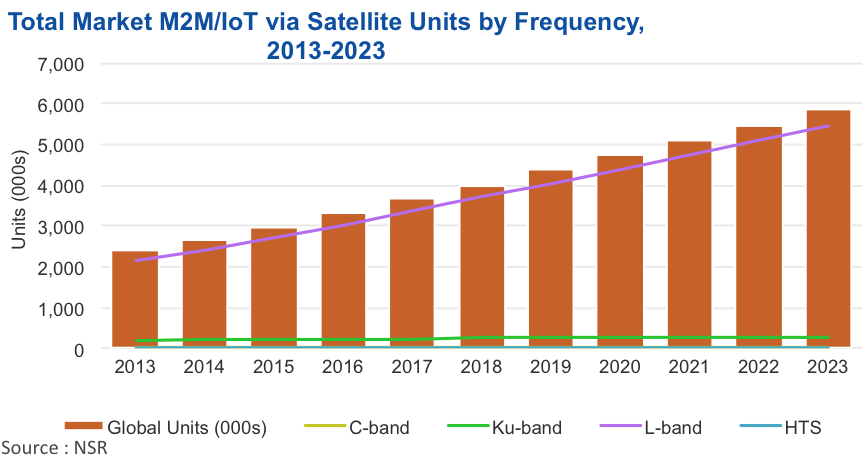

In its recently released

M2M and IoT via Satellite, 5th Edition study, NSR

found that by 2023, there are estimated to be 5.8 million

satellite M2M and IoT connections globally. This is led by

L-band with over 93% of in-service terminals in 2023. Ku-band

comes a distant second with 5.2% of units, and C-band and HTS

remain, with less than 1% each, in use for niche markets – in

very specific applications and regions. L-band dominates

primarily due its lower cost terminals, and their smaller

physical size. The key question is: will lower cost L-band

terminals be enough to drive adoption in the consumer IoT

market?

The majority of upcoming consumer IoT applications

will be based on terrestrial technologies due to its lower cost

– both in terms of airtime and hardware. Nowhere is this more

visible than the recent funding for the up and coming

terrestrial M2M network Sigfox to the tune of $115 million,

which includes funding from satellite operator Eutelsat.

Sigfox promises to charge consumers as low as $1/month for

airtime on consumer IoT devices. Currently only rolled out in

France, Spain and the UK, the company aims to use this funding

to expand worldwide in Europe, Asia and the Americas.

Sustainable or not long-term, aggressive competition globally is

becoming the new norm in this space.

Nevertheless despite plentiful competition, research from NSR

finds the satellite consumer IoT market has potential,

although it is still finding its place. Currently a lack

of communications standards is limiting growth, with most

devices using existing communication methods of Wi-Fi and

Bluetooth (especially the low energy variant, Bluetooth LE).

With that said, the satellite dominant IoT market is

currently found in personal safety devices, such as

those currently served by SPOT on the GlobalStar network and

DeLorme InReach on the Iridium network. Due to the growth in

this sector, NSR expects additional safety and location products

to enter the market in the medium-term.

Developing a new product in this category in an already

expanding market means that many risks are already mitigated,

although companies looking to enter this market will

need to mindful of the free competition. Entrants must

compete with the not-for-profit Personal Location Beacon (PLB)

devices as part of the International Cospas-Sarsat Programme,

which has no monthly fee.

What this means is that additional value added

services need to be provided such as Duplex messaging,

telephone services, and even personal Internet hotspot

accessibility. Without these additional value added services as

well, ARPUs remain low, so additional add-on options and

flexibility will be needed to ensure future growth. One specific

opportunity NSR has identified here is for dual-mode

solutions, which can connect to both satellite and

cellular solutions, when in range. These features have been

successfully added to reduce the potential of price shock of

satellite access and to reduce costs to the end-customer.

Although this may be seen by some as a form of cannibalisation

of the satellite services, outcomes for some providers have

found the addition of cellular services to be additive to their

satellite businesses. Furthermore Eutelsat has demonstrated this

by contributing part of the $115 funding to Sigfox, aiming to

accelerate the development of the IoT market.

The other side of the business where satellite can grow is in

the consumer IoT market are backhaul-type solutions

where M2M/IoT data is aggregated via a VSAT network,

either in a consumer’s residence, or aggregated regionally.

Typically this is established in areas outside of a cellular

footprint. However in the long-term when there is expected to be

increased dependence on IoT technologies, there is also

certainly a role for VSAT networks in acting as a backup for

when terrestrial networks fail – especially in developing

regions where cellular networks can be significantly less

reliable or in mission critical applications such as in

healthcare.

Bottom Line

The consumer IoT via Satellite market is still

finding its place – but upcoming opportunities can be found,

with potential new entrants entering the personal safety device

market. Whilst the majority of consumer applications will be

based on cellular technologies, the vast growth of the number of

connected devices will mean that even a small sliver of devices

being connected to satellite networks will allow the consumer

IoT market to grow well into the future.