Instability Drives Mobility for Special Ops & Army

Feb 10th, 2015 by

Carolyn Belle, NSR

Geopolitical tension and instability are the ever-present

reality of today’s connected world: a smoldering insurgency in

Nigeria and Somalia, coordinated international strikes against

ISIS, conflicts in eastern Ukraine, the Ebola response in West

Africa, drug and human trafficking interdiction in Central and

South America, heightened hostility in the South China Sea… and

as evidenced by the January attacks in Paris, even terrorism in

regions long considered stable and remote from attacks. This

range and distribution of emerging military threats is driving

the evolution of U.S. defense strategy to one centered on

responsive and flexible capabilities supported by comprehensive

information, surveillance, and reconnaissance (ISR) activities.

As this strategy is implemented, and as other nations modernize

their militaries in parallel, a growing emphasis on mobile

requirements will reshape opportunities for the satellite

communications industry.

First, given the mandated reduction in U.S. troop levels,

addressing disparate threats in a responsive manner will require

reliance on smaller troop formations and mobile units.

This structure is already employed by Special Operations forces,

and is a growing component of Army operating concepts. With

smaller active units and remote engagements, communications will

become more critical to mission coordination and success,

boosting the addressable market for portable, quickly deployable

small form factor satcom connectivity.

A second implication of evolving defense strategy is

intensifying demand for ISR activities that directly

support targeted intervention and small formation operations.

This will include a dual approach of manned and unmanned

platforms, both of which are currently undergoing expanded

procurement and outfitting with satcom terminals. As coverage

areas widen and data collected grows from optical imagery to SAR

and video, bandwidth demand for data links will surge.

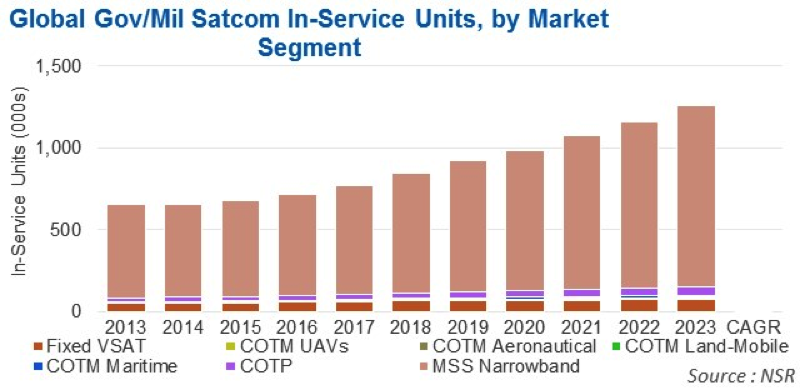

As a result of these new operational patterns, NSR’s

Government and Military Satellite Communications, 11th

Edition, report shows that mobility in-service units will

exceed one million by the end of the decade. Over 500,000 will

be new MSS narrowband terminals, and another 36,000 units for

broadband land mobile markets (COTM, COTP) will be added, driven

by higher bandwidth demands for VoIP and video conferencing. On

the ISR side, airborne manned and unmanned units will increase

by 5,300 in-service units. These additional users translate to

service revenue growth of over $4 billion by 2023.

Demand from mobile forces will drive future procurement

towards smaller and more user-friendly terminals. Evolution of

the Army’s WIN-T program is currently fielding SNAP-lite COTP

terminals to the company level, an extension of satcom

capability from the larger brigade and battalion levels

traditionally outfitted. Army acquisition of manpacks increased

during 2014, and a new solicitation to support Special Ops

issued in September called for additional terminals with a

small, 15 pound (6.8 kg) form factor.

Rhetoric on the demand for increased satcom connectivity is

plain to see, but the real concern is a steady funding source in

annual budgets. For Special Operations and ISR via UAVs, the

outlook is positive. The U.S. 2014 Quadrennial Defense

Review highlighted both ISR and Special Operations as

vital capabilities to augment, and this was reflected

in the FY 2016 Defense Department budget request earlier this

month. Special Operations Command funding, provided through both

the base DoD budget and Overseas Contingency Operations budgets,

has consistently increased. ISR funding saw reaffirmed support

in FY2016, with the budget request reversing FY 2015 decreases

in regional Combat Air Patrols. Thus while overall federal DoD

spending will remain strained in the near term, ISR and

Special Ops demonstrate preferential treatment and higher

funding – enabling investment in equipment

modernization and acquisition.

Bottom Line

Despite a negative outlook for government and military satcom

markets through 2016, demand continues to grow and funding and

procurement will catch up towards the end of the decade.

Emerging trends to equip lower levels of command and small troop

formations with satcom connectivity will drive in-service unit

growth in the land mobile markets, and ISR services

demand will similarly propel manned and unmanned aero

connectivity. In an environment of growing and diversifying

geopolitical instability, the response will require

highly mobile, well equipped troops that can both

exhibit a strong global presence and effectively pursue

low-intensity conflict unnoticed.