GEO-HTS Here Today…but is LEO-HTS the Future?

Jan 19th, 2015 by

Prashant Butani, NSR

New Pockets of Cash

LEO satellites have seen at least

four separate ventures announced, and surely

many more filings made, over the past two years. In an

industry that is always at the “cusp” of something and

perpetually ripe for a “paradigm shift” NSR has adopted

a cautiously optimistic stand to LEO constellations.

This time around, the entry of Elon Musk and

Richard Branson as heavyweights contending each

other for a piece of the global broadband pie, has

prompted a new wave of interest and deep pockets of

cash.

Satellite Broadband Numbers Today

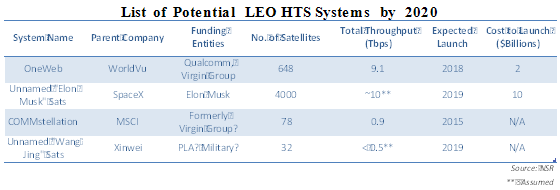

However, it is important to look

at consumer broadband economics, no matter how

well funded the kitty. If even half of the LEO

constellations in the exhibit above see the light of

day, we are looking at a subscriber and bandwidth

landscape that is totally different from any projection

that would be considered achievable in today’s date.

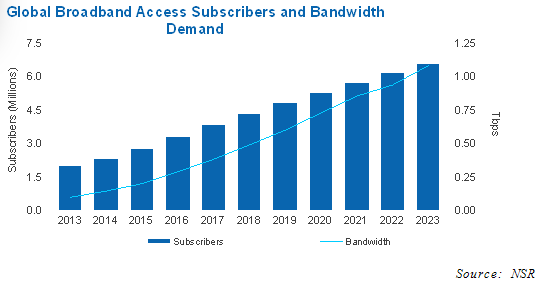

NSR’s

VSAT and Broadband Satellite Markets,

13th Edition report estimates

consumer broadband subscribers over satellite reaching

levels of 6.5 Million by 2023, and

bandwidth demand about 1.2 Tbps by the

same timeframe. These figures are made up almost

entirely of GEO HTS systems that have

built subscriber numbers over two or more

generations of satellites. NSR also projects

that the total supply of GEO HTS systems will cross 2

Tbps by 2023. The LEO HTS systems listed above are

together adding up to more than 20 Tbps

of supply! The deviation from what constitutes today’s

satellite broadband subscribers, including HughesNet,

ViaSat Exede, Eutelsat Tooway, SES SBBS, YahClick,

Avanti and others is clearly that of an order of

magnitude! So from purely economic terms, what

needs to change?

A Wish List

Two items are aimed at making

satellite broadband more affordable, something

that almost all LEO constellations want to achieve:

- Cost of CPE today

is around $250-$500. Is an order of magnitude

reduction expected here to $25-$50? Even a

terrestrial broadband connection needs $20 CPE in

most parts of the world, so perhaps a 50% reduction

at best is realistic?

- ARPUs today are in

the range of $50-$200. Another 10-fold reduction

expected here to $5-$20? Residential broadband in

most parts starts at about $10 per month for a 2Mbps

connection so this again seems to be an

over-reaching expectation.

Affordability and Alternatives

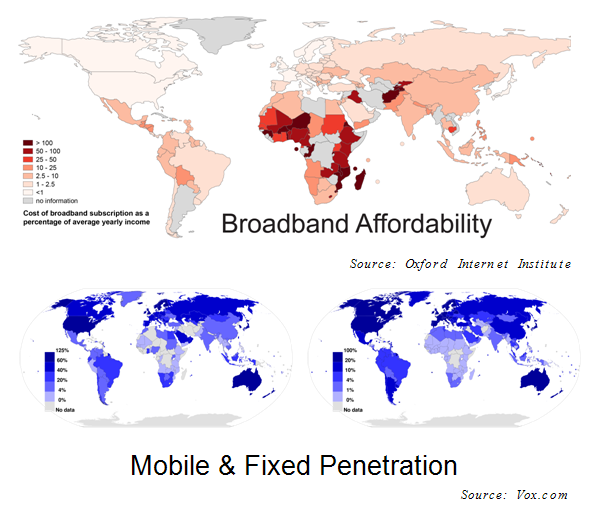

The first map exhibit below shows

broadband affordability as a percentage of income with

the darker countries having poorer connectivity.

Clearly, the ones that can afford broadband

already have it. They want more, yes, to watch

Netflix primarily but is LEO HTS the answer to a

soon-to-be slow 100Mb Fiber-to-the-Home? The two maps in

shades of blue show fixed and mobile broadband

penetration. Somewhat less clear are the African and

Asian countries where affordability may be low

but mobile broadband has done well in terms of

connecting people. Will this cellular industry be

disrupted by LEO-HTS alone, especially when its revenues

are larger than satellite by an order of magnitude?

Oh, By the Way…

Both SpaceX and Virgin have

launcher offerings of their own, which would

make it somewhat natural for the companies to see the

launch of hundreds, if not thousands, of satellites as a

nice way to flex some serious “space” muscle. There are

also plans to colonize Mars and send tourists to space,

but let’s not go there for now. Committing to providing

ubiquitous broadband coverage to billions is

altruistic on one hand and a “me too” stab at

Google and Facebook on the other. A happy

side-effect would be a share of the 30-odd

annual commercial satellite launches in GEO falling into

either basket in the longer term, even as both launch

systems are some way away from being truly flight

proven. It helps that the likes of Arianespace are

operating at a packed manifest and

smaller systems like Sea Launch are falling by the

wayside.

Bottom Line

If Elon or Richard or Google or Facebook

want to connect the “next billion” people to a satellite

based Internet solution, a lot has to change besides

just cost of hardware and service. Other constellations

that started with a similar vision soon ran into either

costly antenna design, or the need to

pivot to an enterprise market that made

more sense in the longer term, or both. The recent

shake-ups at the likes of Kymeta are not helping the

larger ecosystem, and neither are the hurdles in terms

of gateways required or landing rights

in various countries. Global ISPs, while growing into

behemoths of the likes of Comcast, AT&T, Verizon,

Vodafone and others are struggling to expand their

network infrastructure without adopting priority data

pricing strategies that are the subject of Net

Neutrality debates worldwide. Funding seems to be the

least of the concerns for the satellite broadband

entrepreneurs right now, and rightly so.