COMSATCOM Capacity: DIY… or?

Jan 12th, 2015 by

Brad Grady, NSR

Every homeowner will eventually reach a point

where they will ask themselves, “If I was to remodel my

kitchen, would I Do-it-Myself or get a

Kitchen-as-a-Service?” With a Swedish kitchen remodel

offering organized bliss and respectable prices… the extra

labor often gets lost amongst the endless supply of nuts,

bolts and Allen wrenches. Left to wonder how an entire

kitchen will fit into a hatch-back, another big-box store

promises to not only deliver… but design, install, and

finish. While both will support the kitchen sink,

homeowners everywhere are left to weigh the merits of

Scandinavian design against the ‘one-and-done’ approach.

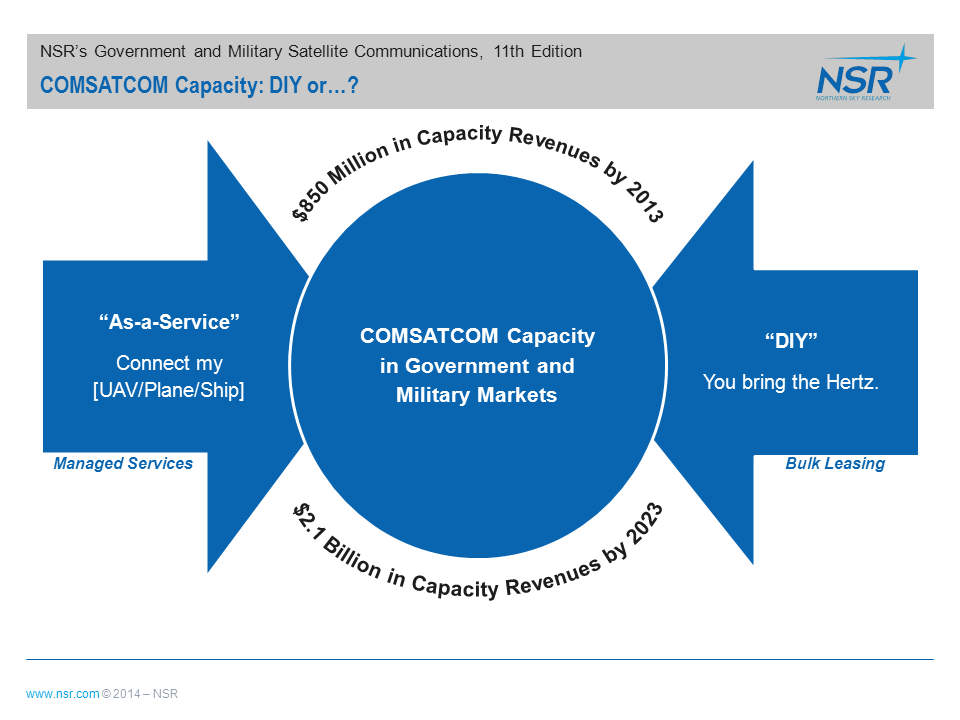

Similarly, Government and Military end-users

must make a choice when procuring Commercial Satellite

Capacity (COMSATCOM), “Do I get the Hertz myself, or

Get-it-as-a-Service?” Mainly, do they go the bulk

leasing route, which offers cheaper per-MHz pricing and more

flexibility at the cost of ‘some assembly required’, or the

Managed Services direction that offers full-service,

tailored solutions/applications at a potentially higher

cost?

Just as every homeowner will reach that

crossroad, the U.S. Government has found that ‘DIY’ vs.

‘As-a-Service’ depends on the situation. Specifically, it

depends on the demands on the ground, the supply of

proprietary capacity available in space, the technical

abilities of the organization procuring the capacity (and

security requirements), and the timeline over which the

capacity will be used… plus the available budget. For

the U.S. Government, Bulk Leasing has long been the popular

choice when demands exceeded proprietary supply, taking

advantage of the flexibility of raw capacity.

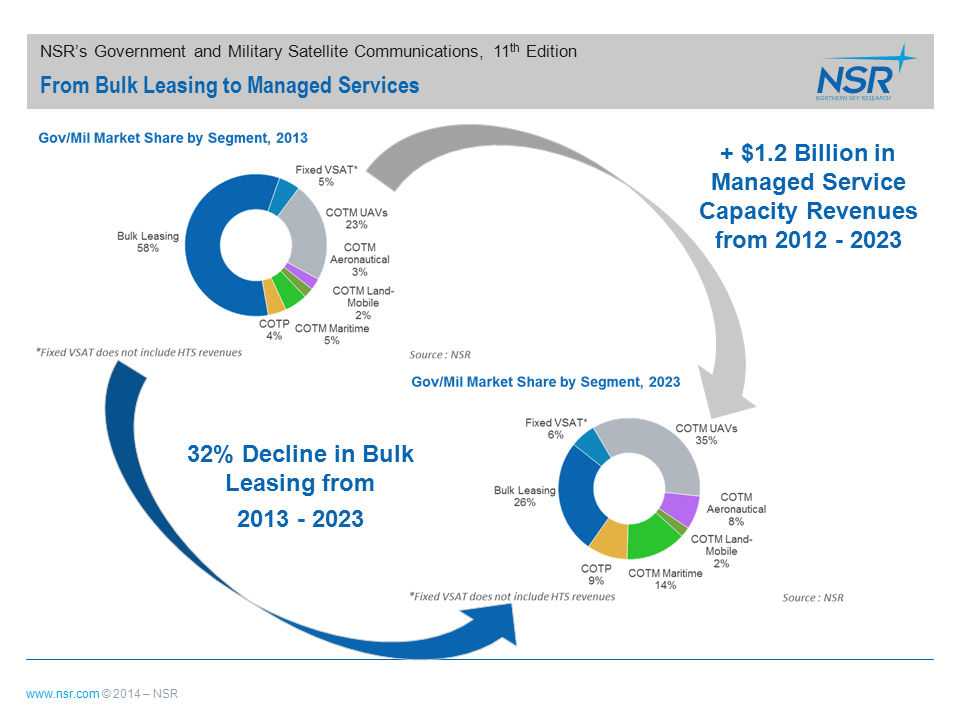

In its recently released

Government and Military Satellite Communications, 11th

Edition study, NSR found that bulk leasing contracts

contributed 58% of Gov/Mil Satellite capacity revenues in

2013. Yet, over the past few years, managed services have

become more attractive – both in the U.S. and around the

world. Looking forward, that trend will only intensify

with bulk leasing expected to contribute only 26% of Gov/Mil

Satellite capacity revenues by 2023. In dollars, it

will grow by just over $50 million, compared to $1.2 Billion

for managed services from 2013 to 2023 – a clear shift in

market direction.

Why then, if the DIY route has provided value

and flexibility for years, are Military and Government

end-users opting for the ‘As-a-Service’ offering? The

drivers of this change are two-fold: cost and capability.

As homeowners seldom include the cost of

renting a larger car and the tools/training required to

assemble the cabinets, counters, plumbing, and appliances

into the cost of their ’DIY’ kitchen, government end-users

have found that the “Do-it-yourself” aspect of satellite

capacity can strain budgets and complicate operations.

By consolidating the many disparate elements of coordinating

a networked service into a single external contract, managed

services can provide a more cost effective solution than

bulk leasing and internal network management.

Further, as demands for satellite capacity

increase, uses of satellite connectivity become more

complicated and greater expertise to establish and manage

networks is required, it is increasingly attractive for the

entire process to be outsourced through a managed service

contract. This contract draws on expertise and solutions

already developed and refined through industry experience.

The ‘As-a-service’ solution through managed services

procurement can contribute new capabilities to the overall

system without requiring development investment by Gov/Mil

players.

Even when the necessary capabilities in

manpower and technology do exist, the reallocation of

resources to manage the network in-house is not always

justified by the gain in network control and flexibility.

The dynamics of Gov/Mil SATCOM has thus morphed towards

application centric thinking – making the question, “How

many meatballs do I want” rather than, “what size Allen

wrench do I need (and then learning about kitchen design

theory)?". Managed services that provide integrated

solutions with fewer moving parts streamline procurement,

and NSR expects new services (such as UAVs) to opt for these

solutions as they are rolled out.

The homeowners have already seen the shift –

you can now have your Scandinavian kitchen without lifting a

single tool.

Government and Military markets are in the

middle of this transition, with providers moving further

down the value-chain, consolidating offerings, and similar

to kitchens, focusing on how people will use capacity.

HTS will only further accelerate this shift. With a

greater focus on delivering maritime mobility, serving UAV

platforms, or supporting highly-mobile armed forces, the

role of the Managed Services will be a go-to solution across

the Gov/Mil markets.

However, there will always be users with a

love of ‘DIY’. For them, this model of Bulk Leasing

some X-band, MEO-HTS, and Ka-band capacity (while still

maybe getting the ‘countertop-as-service’) will be how they

support their requirements.

Bottom Line

Changing fiscal and technical landscapes are

driving Gov/Mil users away from the DIY bulk leasing to the

“Kitchen-as-a-Service” Managed Service model. With

emerging programs such as USAF’s Pathfinder, bulk leasing

will not go away – but an overwhelming share of growth over

the next decade will be from Managed Services connecting

Aeronautical, UAV, and Maritime SATCOM terminals on C/Ku/Ka/X

and GEO/MEO-HTS networks. Overall, service providers

and satellite operators will need to work on the right mix

of “do-it-yourself”, and “as-a-service” to capture this

market potential.