The Absent Demise of M2M/IoT via Satellite

Jan 5th, 2015 by

Alan Crisp, NSR

When most businesses first dabble with

machine-to-machine (M2M) and Internet of Things (IoT)

communications, the first solution that comes to mind isn’t

satellite, but cellular-based options

from Vodafone, Verizon or Kore Telematics, to name a few. Why

then, are satellite M2M products not in decline despite having a

single-digit share of the overall M2M market, with terrestrial

services enjoying a continually growing footprint,

ever-increasing data speeds and lowering data costs? And what

will the impact be of new low-cost cellular operators such as

Sigfox?

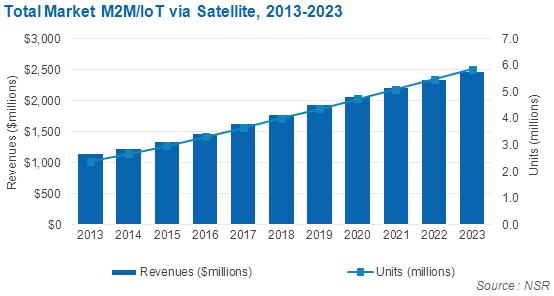

Looking at data from NSR’s

M2M and IoT via Satellite, 5th

Edition, far from any sort of demise, it is expected that

overall satellite revenues will reach almost $2.5 billion by

2023. With 50% of these revenues expected to come from North

America where terrestrial coverage and reliability is

widespread, terrestrial competition isn’t being felt immensely.

This trend is combined with a continuing uptake in terminals on

satellite M2M networks, reaching nearly 6 million units by 2023

– an impressive growth from 2.4 million units that were in use

in 2013, resulting in a CAGR of 9.3% over the period.

In terms of key sub-verticals,

M2M and IoT via Satellite, 5th

Edition breaks the M2M/IoT market into 10

sub-verticals, including Transportation, Green Energy and Civil

Government. Of these, the two largest by a wide margin are, and

will continue to be, Transportation and Cargo. Throughout the

duration of the forecast, these two sub-verticals will account

for between 65% and 70% of the total market for in-service

units, and just under half of total revenues for much of the

forecast. This is despite the Transportation sector being the

most prone to terrestrial competition, with trucks and cars

spending the majority, if not all, of their time within a

cellular footprint.

The strengths of satellite based M2M are many, and

in most cases they are strengths that are most relevant, and

most valuable, to high-SLA type applications in remote regions,

such as offshore Oil & Gas, Transportation, and Cargo shipping.

Among other things, satellite connectivity is oftentimes more

reliable, especially in remote and underserved regions. In

developing regions, terrestrial networks are often nowhere near

as reliable as those in the North American region, or is often

non-existent in other regions. Without near 100% reliability and

availability, the value proposition derived from M2M

communications by knowing where everything is at anytime,

anywhere, begins to fall apart. Beyond that, satellite-based M2M

can offer truly global coverage, with applications such as

trans-oceanic shipping being addressable only via satellite.

Countering any perceived decline by the growth of

terrestrial M2M, satellite M2M operators are expected to focus

on these core strengths in the future, to further differentiate

themselves from the perpetually lower costs of terrestrial

networks, focusing instead on reliability and global coverage.

Additionally cellular networks are slowly moving from high,

value-based pricing, to low, cost-based pricing. Satellite

operators, rather than “racing to the

bottom” and losing out to cellular players on cost, latency and

speed, will rest assured that the satellite experience will be

near impossible to replicate terrestrially; as much as

associations such as the M2M World Alliance and Global M2M

Association are attempting to create a single, global and

seamless experience over a patchwork of independent terrestrial

networks.

Consolidation in the terrestrial M2M market shows

that operators are getting serious with competing. With Vodafone

acquiring Cobra Automotive technology for vehicle tracking and

telematics, Raco Wireless acquiring Position Logic, for B2B

location services, and back in 2012, the high profile

acquisition of Hughes Telematics by Verizon for in-car wireless

services. Along with many more acquisitions, terrestrial

operators mean business. With an increasing turn-key application

base, it’s becoming easier than ever to setup M2M services for

low cost for a wide range of verticals.

Furthermore, new up-and-coming terrestrial players

are expected to change the market dynamic, with newer operators

such as Sigfox offering low-end M2M and IoT products for as low

as $1/month. However, these products are expected to offer very

low bandwidth of 100bps on non-traditional wavelengths. Aiming

for the low-end, this could be pre-packaged into products with

multi-year prepaid deals. Due to the very low-end nature of this

new breed of providers, there is likely no threat, nor

partnership opportunities, with these low-end providers.

Nevertheless, this shows the wide base of M2M opportunities

available now and into the future.

Bottom Line:

Satellite based M2M services, far from being in

decline, will continue to offer unique advantages that other

forms of M2M communication won’t be able to match. With

constantly expanding terrestrial footprints, satellite operators

are expected to compete instead on reliability and focus on high

value applications such as the Transportation and Cargo sectors,

allowing the industry as a whole to not only survive in the face

of competition, but also continue to thrive well into the

future.