Braving the Amazon—Entering the Brazilian Market

Dec 17th, 2014 by

Blaine Curcio, NSR

Of the 5 BRICS economies, the one making the most

noise in the satellite telecom sphere recently is

Brazil. Indeed, it seems as though not a month goes by

without the announcement of more capacity coming online

or another big contract signed. This has led to

questions of a capacity bubble, and whether there will

be sufficient demand to soak up the staggering amount of

capacity coming online. NSR’s BRICS Satellite

Capacity Supply & Demand study highlights a number

of potential issues and opportunities within each of the

BRICS economies, with Brazil providing some of the most

intriguing storylines.

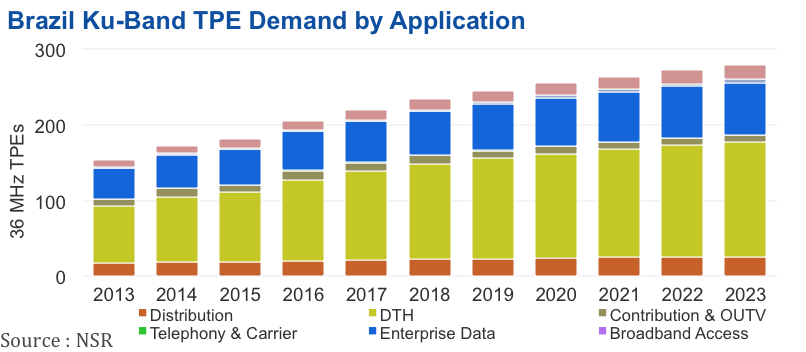

FSS Analysis

There are several factors to consider in the

Brazilian market on the traditional FSS side. The most

widely utilized frequency within Brazil, Ku-band, will

see capacity more than double from 2013 to 2023,

increasing from under 200 TPEs in 2013 to nearly 400

TPEs by 2023. This will lead to a dip in fill rates to

around 65% in 2016, before rebounding to the low-70%

range by 2023. Thus far, the capacity glut in Brazil has

not curbed the optimism of operators there—indeed, local

players such as Star One have continued to report high

fill rates despite the entry of payloads from non-local

operators, such as the launch of SES-6 in mid-2013. In

particular, the Brazilian DTH market will see

excellent demand growth due to a competitive market with

strong impetus to upgrade to more HD content.

DTH is expected to see demand double by 2023, from

around 75 TPEs to 150 TPEs

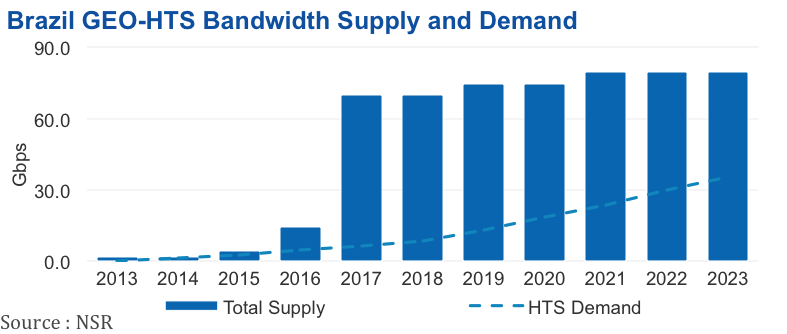

HTS Analysis

The HTS market in Brazil is currently limited to a

number of spot beams on Amazonas-3. This payload will be

dwarfed in/around 2017, with the launch of the Brazilian

governmental payload SGDC-1, a satellite with 55 Gbps of

capacity. Despite its size, the fact that it is

governmentally supported means that fill rates will not

necessarily be a great indicator of success. SGDC-1 will

be utilized for not only Gov/Mil, but also broadband

projects in second-tier cities as well as the Amazon

where demand could take off. This may lead to some

spillover demand as connectivity requirements outstrip

capacity available in a given area; however, this would

require a “wait and see” approach to take advantage of

excess demand. Most HTS demand will come from Broadband

Access, with ~30 Gbps of demand by 2023 accounting for

85% of total HTS demand. HTS fill rates are expected to

approach 40% by 2023, but again, fill rates here will be

brought down due to a governmentally-subsidized program.

How Will HTS Alter the Traditional FSS

Landscape?

NSR expects some applications within Brazil, namely

Enterprise Data, will see a degree of cannibalization by

HTS during the forecast period. While Ku-band will still

see solid growth coming from Enterprise Data to 2023,

longer-term it is expected that the bandwidth economies

of HTS will lead to a transition for things like VSAT

networking from Ku-band to HTS. This will put

some downward pressure on Enterprise Data pricing,

particularly via Ku-band, while C-band

Enterprise Data pricing is expected to remain flat.

Overall, HTS is expected to aim largely at new

markets within Brazil, but some cannibalization will

exist. The Amazon where broadband access demand

can and will likely spillover to Enterprise Data for

wireless backhaul services should lead to a transition

from FSS capacity to HTS.

Bottom Line

Of the BRICS economies, NSR expects Brazil to present

the best growth opportunities moving forward. Due to

relatively friendly governmental policy, strong growth

in video markets, and need for broadband connectivity,

NSR expects much of the excess supply to be filled in

the medium-to-long-term. However, in the short-term, a

supply glut remains a real possibility, with the

majority of new Ku-band supply in Brazil coming online

between now and 2016. Therefore, any bet on the

Brazilian market should be taken with an air of caution,

and with the assumption that it will be a long-term play

aimed at developing key customers and increasing

bandwidth requirements, rather than making a quick buck

in Latin America’s biggest economy.