|

Big Data Moving Satellite M2M/IoT to New Heights

Dec 3rd, 2014 by

Alan Crisp, NSR

Transportation represents the lion’s share of the

satellite M2M/IoT market, with over 44% of total units and over

20% of total satellite M2M/IoT market revenues. With the mass

market of deeper analytics tools now taking hold across the

Transportation sector, its dominance affects the entire market

more than ever. To what extent will big data push the limits of

M2M via satellite? And what sort of bandwidth requirements are

we looking at?

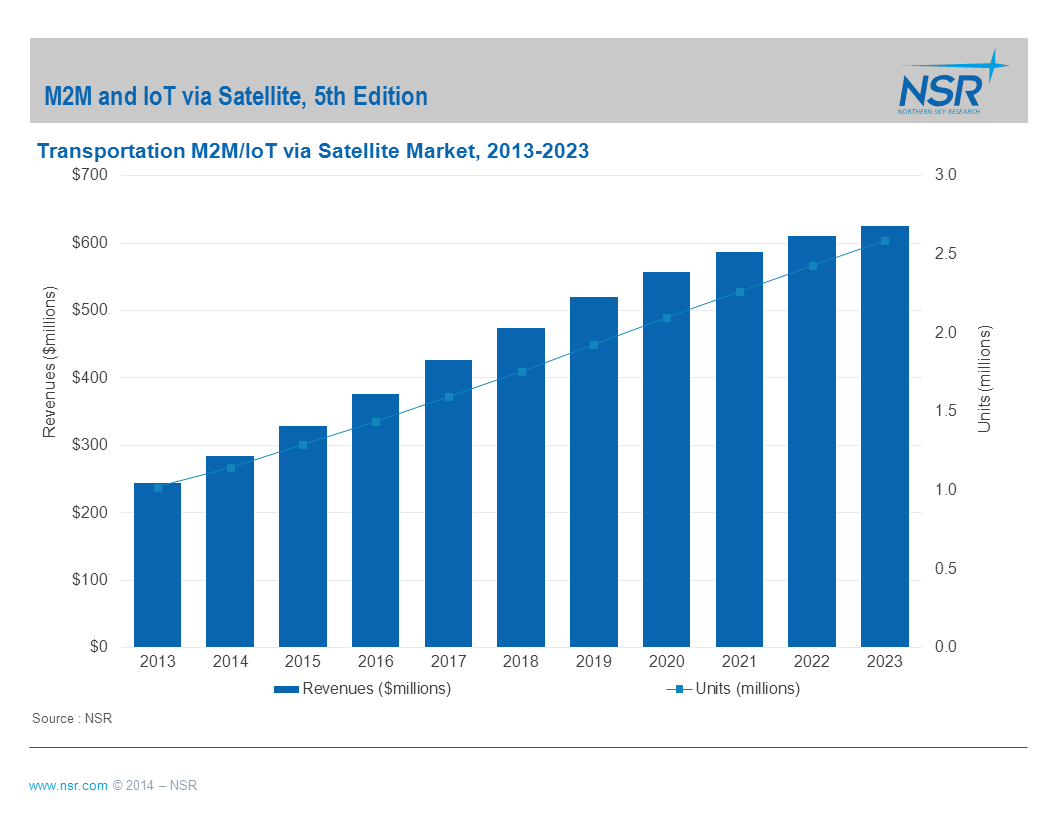

Utilizing data from NSR’s recently released

M2M and IoT via Satellite, 5th

Edition report, the Transportation sector is poised for

strong growth, growing from $245 million in annual revenues in

2013 to a forecasted $625 million by 2023, for a CAGR of 9.8%.

North America continues to dominate here – taking

up just under 61% of the market in 2013. However, this is

expected to decline to 52% by 2023 as other regions get up to

speed in this industry and fleets continue to modernise, and as

global shipping and transport continues to shift towards the

Asia-Pacific.

Growth within the M2M sector is expected to be

particularly robust in regions that lack a developed terrestrial

communications infrastructure, most notably Latin America and

Africa/Middle East regions with CAGRs of 9.9% and 8.9%,

respectively. With the Transportation and Cargo sectors in

control of high-value goods, high reliability with high-end SLAs

are compulsory for most users of M2M services.

This requirement is forecasted to rise in the

future, with the increasing use of data analytics. In the

Transportation sector there is an increasing demand for keeping

track of literally everthing that’s trackable, to discover any

insight possible to assist in optimising businesses – often

referred to as ‘big data’ or ‘deep analytics’.

Because of its nature, these requirements will

drive up bandwidth needs for M2M services, as anything and

everything will begin to be monitored, with reporting

frequencies in minutes rather than in hours. Although specific

platforms remain narrowband – and NSR believes this to remain

the case long-term – the aggregate number of connections is

pushing satellite requirements slowly higher. Packet sizes here

continue to remain in the bytes to lower kilobytes range.

Usage of deep analytics data can pay huge

dividends for end-users. In the aeronautical sector for

instance, tracking of near real-time engine telemetry to see

continuous performance of an engine using M2M via Satellite, can

assist in reducing maintenance from a fixed schedule to times

when maintenance is actually required – a ‘just-in-time’ model

in other words. These savings can be huge and are driving up M2M

units across the board.

Fleet management companies are also implementing

satellite M2M technologies for the same purpose of maintenance,

and in some cases this is combined with broadband access for

drivers’ entertainment in long-distance hauls. This is critical

to reducing employee churn, which annually can amount to over

100% of the workforce – a significant investment but also a

significant return.

What does this mean for operators? Satellite M2M

providers will need to get on board and develop, or acquire,

deep analytics application layers in order to thrive in this

sector in the future. In terms of frequency, HTS usage is still

forecast to remain minimal for the M2M sector – approximately 1%

of revenues in 2023 – next generation L-band systems such as

Iridium NEXT having the advantage for big data in the

Transportation vertical, in order to handle higher volumes of

narrowband connections.

Bottom Line

Despite M2M/IoT often being considered more of a

“niche” market for satellite operators, the sheer size of the

total addressable market moving forward means that even a small

percentage of the total leads to significant revenues. While a

number of different applications will see demand growth,

Transportation in particular does offer significant

opportunities through the consistent need for companies to

innovate and improve processes through tracking and the use of

“big data”, where higher numbers of narrowband connections will

become the new normal.

|