|

Why is Low Resolution EO Data Still Attractive?

Dec 1st, 2014 by

Claude Rousseau, NSR

With Airbus Defence and Space announcing it will

add DMCii satellite imagery to its portfolio, and add up to 10

million km2 of data per day, one has to wonder where

the incentive is to offer more low resolution imagery. The

question is central since this market will face the frontal

assault of free data from various government programs in the

coming years.

As NSR indicated in its recently released

Satellite-Based Earth Observation, 6th

Edition report, the low-resolution EO data market will no

longer be viable in the not-too-distant future as very-high and

high-resolution imagery types take hold. So is the ADS

move to broaden its portfolio useless?

Not really, as there are still a large number of

customers that require the high-revisit and large swath products

that this type of data provides before customers no longer want

to pay for low resolution imagery. Even at 22 m

resolution, applications such as vegetation monitoring,

agriculture, change detection and forestry (to name a few) are

key targets for low resolution data.

And as with the recently announced teaming

agreement between Deimos, Dauria Aerospace, EIAST and BSEIT, who

together will offer EO satellite capacity ranging from 75 cm to

20 m from 9 spacecraft, the move makes sense as ADS can offer a

one-stop-shop for a variety of users for diverse applications

with both SAR and optical satellite data starting with sub-meter

resolution data. Furthermore, NSR estimates the agreement gives

ADS more than 70% market share in the low resolution data

market, thus deep reach in a fairly large and diverse market.

But with the advent of high-resolution imagery,

coupled with the blitz to free low resolution data via the

Sentinel program, will mean that to avoid being left out in the

cold, the operators’ strategy has to be focused on attracting

current and new users of low res data with good quality and

additional services. This will allow them to get familiar

with their products and then help the migration to medium- and

higher resolution datasets that users are still ready to pay

for.

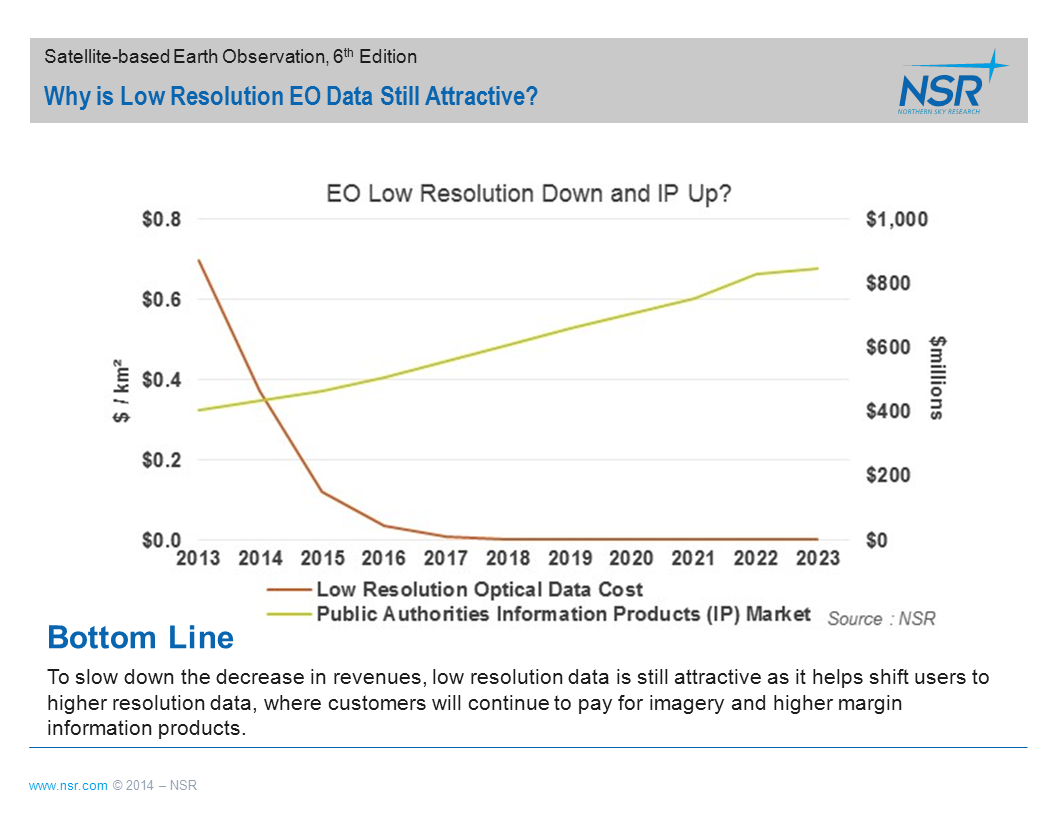

The other side of the business that operators have

certainly looked at is that low resolution data imagery is

plentiful in the Public Authorities market, a vertical that is

expected to grow to more than $1.4 B in 2023 with more than half

of revenues coming from information products (IP). Getting

specialized skills for these is the undercurrent of IP and

expertise has a price, needs strong knowledge of local

conditions to extract valuable information and is on an upward

slope. The growth in this part of the market will be even

more pronounced with higher resolution data sets.

Bottom Line

As more free low resolution EO data becomes

available, the market will continue to see negative side-effects

even for medium resolution data prices. To slow down the

decrease in revenues, low resolution data is still attractive as

it helps shift users to higher resolution data, where customers

will continue to pay for imagery and higher margin information

products.

|